eResearch is pleased to publish a 46-page Update Equity Research Report on Silver Bullet Mines Corp. (TSXV: SBMI | OTC: SBMCF).

We are maintaining a Speculative Buy Rating on SBMI but reducing the one-year Price Target to $0.20 from $0.80, and introducing a two-year Price Target of $0.35.

You can download our 46-page Equity Research Report by clicking on the following link: eResearch-SBMI-UR-2024_11_08-FINAL

Company Overview

Silver Bullet Mines Corp. (“SBMI” or “the Company”) is a Canadian-based silver and copper exploration and development company. The Company’s primary asset is the Black Diamond (BD) Property, located near Globe, Arizona, which includes five past-producing, high-grade silver mines, including the Buckeye Silver Mine.

SBMI commenced production at the Buckeye Silver Mine (“Buckeye Mine”) in mid-2022, but mining operations are currently paused pending the resolution of safety issues. While awaiting the restart of mining at Buckeye, the Company plans to generate revenue by processing third-party mineralized material at its mill in Globe, Arizona.

SBMI is also advancing its Washington Mine in Idaho, a historical silver and gold mine that is being prepared for production. Additionally, the Company is exploring copper-gold porphyry targets on the BD Property, leveraging the region’s mining history and proximity to significant copper deposits.

REPORT HIGHLIGHTS

Investment Thesis & Upcoming Catalysts:

- Revenue Generation through Third-Party Processing:

- SBMI’s mill near Globe, Arizona, is actively processing third-party mineralized material, providing an alternative revenue stream during mine shutdowns.

- Near-Term Cash Flow Potential:

- SBMI is positioned to resume mining at the Buckeye Mine, where high-grade silver in Zone1 is anticipated to significantly enhance cash flow once operations restart.

- Recent Strategic Financing:

- SBMI’s recent $1.1 million financing strengthens its balance sheet, thereby supporting ongoing work and operational resilience.

- District-Scale Exploration Potential

- The BD Property, located in Arizona’s prolific Silver Belt, offers exploration potential with multiple historical mines, including Buckeye and McMorris, as well as promising copper-gold targets.

- Strong Management and Board

- Recent additions to the board bring expertise in mining and safety, which is critical given the operational and regulatory challenges.

- Mining-Friendly Jurisdictions

- Arizona and Idaho are recognized for their mining history and supportive regulatory environment, which favour SBMI’s

- Upcoming Catalysts

- Completion of Buckeye Mine Safety Work: Expected completion of regulatory safety work at the Buckeye Mine, thus enabling high-grade silver mining to resume.

- Restart of the Washington Mine: SBMI is advancing the Washington Mine in Idaho, which is expected to provide a second revenue stream.

- Further Third-Party Processing Agreements: Continued third-party material processing, boosting revenue flow until full-scale mining resumes.

Financial Analysis & Valuation:

- We are maintaining a Speculative Buy Rating on SBMI but reducing the one-year Price Target to $0.20 from $0.80, and introducing a two-year Price Target of $0.35.

- The one-year Price Target of $0.20 is based on SBMI processing 30,000 tons of third-party mineralized material over the next 12 months with a grade of 8 oz/t, 90% recovery rate, and booking net revenue of US$15 per ounce. Silver production would be approximately 240,000 ounces.

- The two-year Price Target of $0.35 is based on SBMI processing the third-party mineralized material in 12 months and then processing higher-grade mineralized material from the Buckeye Mine. For a base case, we assumed 80% utilization of the mill, 264 production days per year, all-in operating costs of US$20/ounce, a grade of 20 oz/t, and a silver price of US$30/ounce. Silver production would be approximately 583,020 ounces.

We are maintaining a Speculative Buy Rating on SBMI but reducing the one-year Price Target to $0.20 from $0.80, and introducing a two-year Price Target of $0.35.

You can download our 46-page Equity Research Report by clicking on the following link: eResearch-SBMI-UR-2024_11_08-FINAL

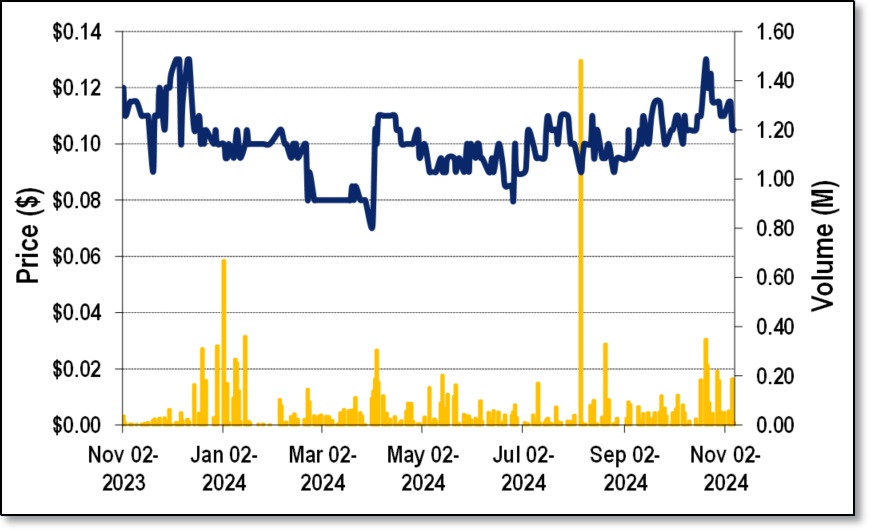

FIGURE 1: One-Year Stock Chart

Other content about SBMI on eResearch.com

- Video (February 3, 2024): InvestorIntel Video – Tracy Weslosky Interviews Chris Thompson about eResearch Launching Coverage on Silver Bullet Mines

- Initiation Report (December 7, 2021): Silver Bullet Mines (TSXV:SBMI)

- Video (March 1, 2021): Panel Discussion on Silver with Chris Thompson, Peter Clausi and Peter Krauth

Notes: All numbers in CAD unless otherwise stated. The author of this report, and employees, consultants, and family of eResearch may own stock positions in companies mentioned in this article and may have been paid by a company mentioned in the article or research report. eResearch offers no representations or warranties that any of the information contained in this article is accurate or complete. Articles on eresearch.com are provided for general informational purposes only and do not constitute financial, investment, tax, legal, or accounting advice nor does it constitute an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this information should consult with a financial advisor. The article may contain “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements are based on the opinions and assumptions of the Company’s management as of the date made. They are inherently susceptible to uncertainty and other factors that could cause actual events/results to differ materially from these forward-looking statements. Additional risks and uncertainties, including those that the Company does not know about now or that it currently deems immaterial, may also adversely affect the Company’s business or any investment therein. Any projections given are principally intended for use as objectives and are not intended, and should not be taken, as assurances that the projected results will be obtained by the Company. The assumptions used may not prove to be accurate and a potential decline in the Company’s financial condition or results of operations may negatively impact the value of its securities. Please read eResearch’s full disclaimer.