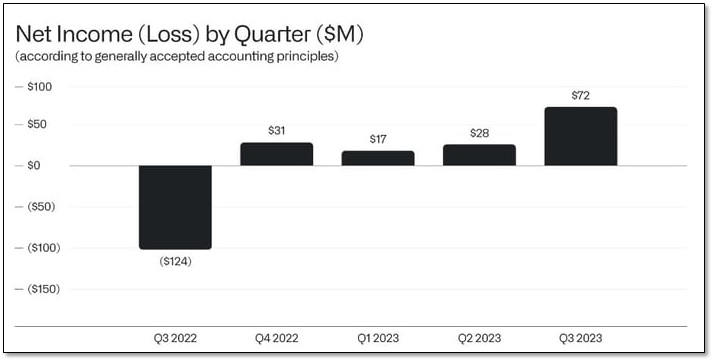

FIGURE 1: Palantir Net Income (Loss) by Quarter Q3/2022 to Q3/2023

Top Vendor in AI, Data Science & Machine Learning

The release of a new product earlier this year called Artificial Intelligence Platform has transformed Palantir’s operation with Dresner Advisory Services ranking it as the top vendor in AI, data science, and machine learning ranking it higher than Alphabet, Microsoft, C3.ai, SAP, Oracle, and Salesforce.com). See the details of Dresner’s report here and here.)

Taking the World by Storm

Over the past two decades, Palantir has meticulously developed an extensive portfolio of intellectual property and is now strategically accelerating its commercialization efforts, and taking the AI world by storm. Of late, as its Q3/2023 results attest, it has:

Focused on the addition of new clients – the company signed 20 new customers in Q3/2023 – from enhancing lead generation by hosting informative seminars where prospective customers have the opportunity to experience hands-on demonstrations of the company’s diverse software platforms.,

Focused on the addition of new clients – the company signed 20 new customers in Q3/2023 – from enhancing lead generation by hosting informative seminars where prospective customers have the opportunity to experience hands-on demonstrations of the company’s diverse software platforms.,- Launched ‘Palantir Mixed Reality,’ an advanced virtual and augmented reality software, designed for VR headsets to facilitate and enhance simulated military operations.,

- Introduced its Artificial Intelligence Platform (mentioned above), a large language model that allows its users to ask questions to the software and leads them to make the best decisions possible at the moment,

- Reduced operating expenses by 5.1%,

- Executed a media campaign, encompassing conferences, interviews, and public demonstrations, to showcase its innovative product offerings.

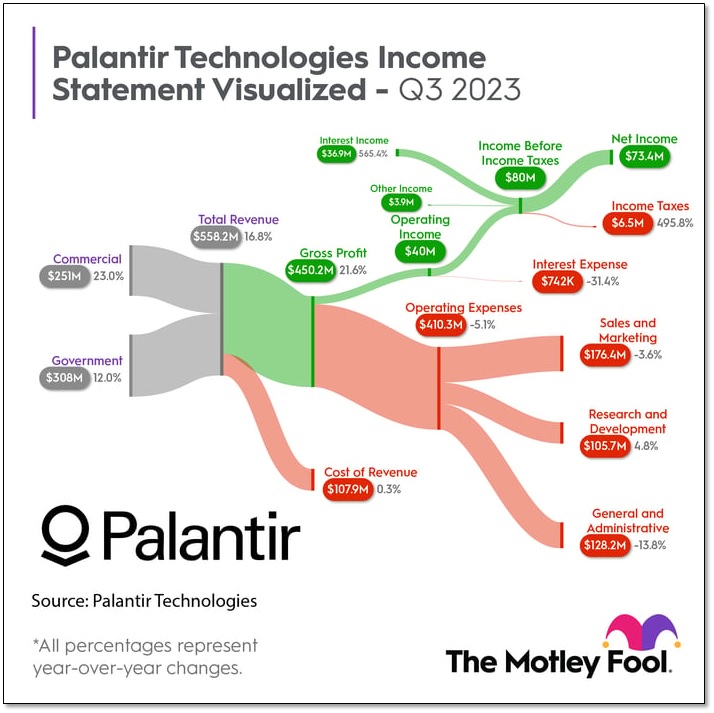

Palantir’s Q3/2023 Income Statement

FIGURE 2: Palantir’s Q3/2023 Income Statement Visualized

Total Addressable Market and Long-term Valuation Target

- Palantir pegs its total addressable market (TAM) at $120 billion and analysts expect it will grow to $230 billion by 2025 and possibly even reach $300 billion by 2030.

- Were Palantir to obtain a conservative 5% of that market, Palantir’s revenues would reach $15 billion by 2030.

An Optimistic Forecast

When it comes to leaders in AI, Adam Spatacco of the Motley Fool believes that:

- “a first-mover advantage is critical and, while Big Tech enterprises…all have deep pockets and have already demonstrated a willingness to invest aggressively, Palantir’s moves should not be overlooked.

- Generative AI and its various applications is a core part of Palantir’s DNA…[and], as interest in AI begins to ratchet up and IT budgets allocate more capital toward large language models and other AI-powered tools, Palantir looks well-positioned to dominate.

- Over the next couple of years, investors will witness exponential growth in Palantir’s customer base, which should lead to more meaningful top-line acceleration and profit expansion as customers increasingly rely on Palantir’s full-spectrum AI ecosystem.

- The stock hovers at a valuation multiple right in the middle of its peers so it’s hard to pass up this bargain and, [as such,] presents an incredible opportunity.” Source

An Analysis of the Optimistic Outlook

Palantir Technologies has:

- A Price-to-Sales Ratio (PSR) of 19.6 which is extremely high (404% higher than the sector mean of 2.6) following its 210% surge YTD, (its stock price has increased at a faster pace than its sales over the past three years indicating that the company has been able to justify its expensive valuation to date).

- A forward Price-to-Earnings (PE) ratio which is also extremely high at 80.6 (or 204% higher than the sector mean of 22.1) BUT

- Its Price – to – Earnings Growth (PEG) ratio, on the other hand, is a very impressive 1.1 which is 37.3% below the sector mean of 1.8 suggesting that, while Palantir’s forward P/E and P/S ratios are extremely high, the Company expects earnings growth will be exceptionally high over the next year enabling the aforementioned ratios to come into line as time plays out. A case in point is that:

Palantir:

- Increased its Q3 revenue by 17% year-over-year to $558 million,

- Expects its Q4 revenue to come in at $601 million at the midpoint, which would be a jump of 18% from the prior-year period,

- Has raised its full-year revenue guidance to $2.22 billion, which represents an increase of 16% in 2023 and

- Could be poised for accelerated growth, driven by the rapidly increasing adoption of its Artificial Intelligence Platform:

- Wall Street analysts believe Palantir’s revenue will grow at a 19% rate in 2024 and

- Morgan Stanley expects revenue growth of 20% annually over the next five years,

- Grew its commercial revenue by 23% year-over-year last quarter to $251 million and its U.S.-specific commercial revenue increased at an even faster pace of 33%,

- Saw a sequential jump of 65% in the number of commercial deals it closed last quarter, and the company’s total customer count has risen by 34% compared to the previous year, indicating a sustained and strong demand for its offerings.

The above insights into the business all explain why Palantir is anticipated to grow at a faster pace going forward, which should lead to solid stock upside as well.

Conclusion

If Palantir achieves its projected sales growth, reaching $2.22 billion in the next year, and sustains its current price-to-sales ratio, the company may deliver even stronger stock price gains in the months ahead as its revenue growth to date has been exceeding expectations.

FIGURE 3: Palantir’s 1-Year Stock Chart

Notes: All numbers are in USD unless otherwise stated. The author of this report, and employees, consultants, and family of eResearch may own stock positions in companies mentioned in this article and may have been paid by a company mentioned in the article or research report. eResearch offers no representations or warranties that any of the information contained in this article is accurate or complete. Articles on eresearch.com are provided for general informational purposes only and do not constitute financial, investment, tax, legal, or accounting advice nor does it constitute an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this information should consult with a financial advisor. The article may contain “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements are based on the opinions and assumptions of the Company’s management as of the date made. They are inherently susceptible to uncertainty and other factors that could cause actual events/results to differ materially from these forward-looking statements. Additional risks and uncertainties, including those that the Company does not know about now or that it currently deems immaterial, may also adversely affect the Company’s business or any investment therein. Any projections given are principally intended for use as objectives and are not intended, and should not be taken, as assurances that the projected results will be obtained by the Company. The assumptions used may not prove to be accurate and a potential decline in the Company’s financial condition or results of operations may negatively impact the value of its securities. Please read eResearch’s full disclaimer.