The Atlantic (aka Appalachian) Gold Belt stretches from South Carolina to the island province of Newfoundland on the eastern coast of Canada and consists of 38 publicly listed gold exploration and mining companies. This article provides the YTD stock performances of the 4 companies already in production there.

This article is an expansion of an executive summary of the original research report (20,060 words) by Chris Thompson, Director of Equity Research at eResearch.com.

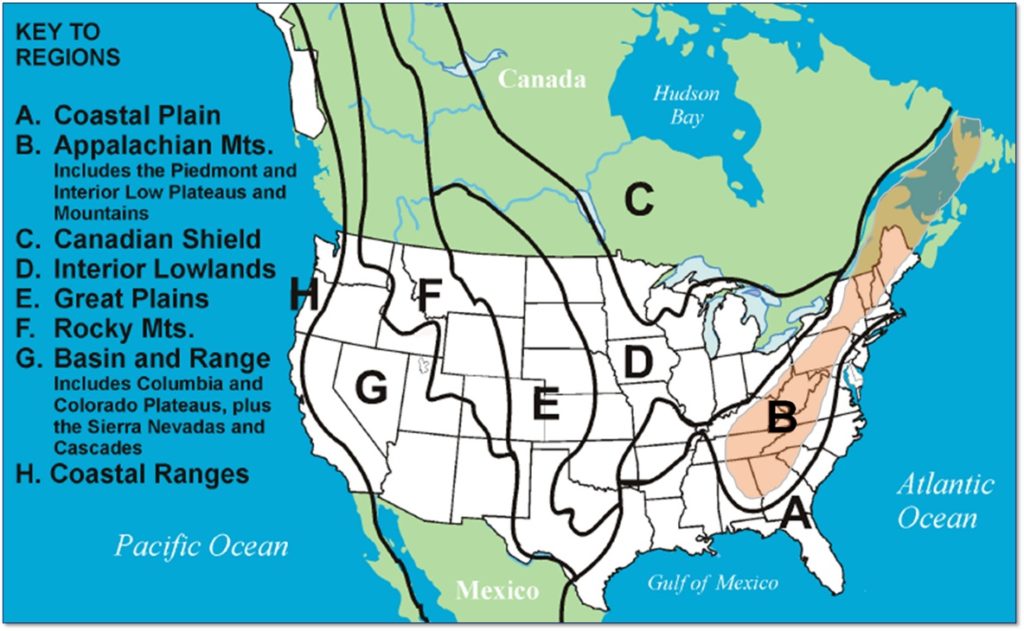

Figure 1: Appalachian Gold Belt (Highlighted in Light Red)

- 3 of the 38 companies identified (see the full list here) have made recent high-grade (“bonanza-grade”) discoveries, namely, New Found Gold (-19.9% YTD) and Sokoman (-8.6%) in Newfoundland, Canada, and Aston Bay (-50.0% YTD) in Virginia, USA.

- 4 of the 38 companies are currently mining gold, namely, Signal Gold (formerly Anaconda Mining) and Rambler Metals & Mining in Newfoundland, St. Barbara in Nova Scotia (and in Australia and Papua New Guinea), and OceanaGold in South Carolina and Nova Scotia (and in Phillippines and New Zealand).

- The remaining 31 companies are in various exploration and development phases of operation.

Below are the stock performances of the 4 producing companies YTD (as of May 27th), in descending order:

- OceanaGold (TSX:OGC): +35.0%

- Operates a gold-copper mine on Luzon Island in the Philippines; 2 mines in New Zealand; the Haile gold mine located in South Carolina, U.S. and the Atlantic Gold mining operations in Nova Scotia, Canada.

- Has a market cap of C$1.9B (go here to convert into another currency).

- Its latest quarterly financials here, reported

- a US$78.6 million in net profit (a 391% increase from Q1 2021 and

- a 61% increase in gold production year over year to 134,035 ounces.

- Company and stock overview here.

- St. Barbara (AX:SBM): -18.8%

- Operations consist of the open Touquoy pit mine in Nova Scotia, Canada; the Gwalia underground mine in Western Australia and the Simberi gold mine in New Ireland province, Papua New Guinea.

- Has a market cap of A$958M (go here to convert into another currency).

- Trades on the Australian Stock Exchange.

- Its latest quarterly financial statement here reported

- a 35% decline in gold production due to severe weather events in January and February,

- the cessation of mining of the Touquoy pit remains on schedule for the first half of FY23,

- a deferral of its planned drilling programs as part of a revised consultation process with the First Nations groups in Nova Scotia but that

- permitting efforts are progressing satisfactorily for its Beaver Dam and Fifteen Mile Stream projects.

- Company and stock overview here.

- Signal Gold (TSX:SGNL): -25.4%

- Formerly known as Anaconda Mining Inc.

- Projects include the Point Rousse Project in the Baie Verte Mining District,

Newfoundland; the Goldboro Gold project near Halifax, Nova Scotia; and the Great

Northern project is located near the community of Jackson’s Arm, Newfoundland. - Has a market cap of C$100M (go here to convert into another currency).

- Its latest quarterly financials here reported

- an 11% increase in gold production compared to Q1 2021 and

- sold 3,491 ounces of gold in Q1 2022, generating metal revenue of $8.0 million.

- Company and stock overview here.

- Rambler Metals & Mining (LSE:RMM): -38.9%

- Its principal project is the Ming copper-gold mine located in the Baie Verte Peninsula of Newfoundland and Labrador, Canada.

- Has a market cap of GBp$37M (go here to convert into another currency).

- Trades on the London Stock Exchange.

- Its FY2021 annual financial statement here reported

- revenue of US$28,176 and

- a net loss of US$(2,373)M.

- Company and stock overview here.

eResearch has published a 79-page industry report entitled “Atlantic Gold Industry Report – The Ultimate Guide to Gold Mining Companies in the Appalachian Gold Belt” which can be accessed here.

Notes: All numbers in CAD unless otherwise stated. The author of this report, and employees, consultants, and family of eResearch may own stock positions in companies mentioned in this article and may have been paid by a company mentioned in the article or research report. eResearch offers no representations or warranties that any of the information contained in this article is accurate or complete. Articles on eresearch.com are provided for general informational purposes only and do not constitute financial, investment, tax, legal, or accounting advice nor does it constitute an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this information should consult with a financial advisor. The article may contain “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements are based on the opinions and assumptions of the Company’s management as of the date made. They are inherently susceptible to uncertainty and other factors that could cause actual events/results to differ materially from these forward-looking statements. Additional risks and uncertainties, including those that the Company does not know about now or that it currently deems immaterial, may also adversely affect the Company’s business or any investment therein. Any projections given are principally intended for use as objectives and are not intended, and should not be taken, as assurances that the projected results will be obtained by the Company. The assumptions used may not prove to be accurate and a potential decline in the Company’s financial condition or results of operations may negatively impact the value of its securities. Please read eResearch’s full disclaimer.