eResearch is pleased to publish an Initiation Report on Blue Star Gold Corp. (TSXV:BAU | OTC:BAUFF | FSE:5WP0).

eResearch is pleased to publish an Initiation Report on Blue Star Gold Corp. (TSXV:BAU | OTC:BAUFF | FSE:5WP0).

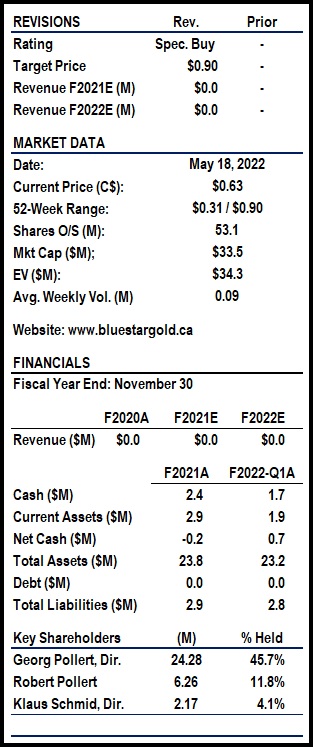

We are Initiating Coverage with a Speculative Buy rating and one-year price target of $0.90.

You can download our 52-page Equity Research Report that covers an in-depth analysis of the company and a detailed overview of its exploration projects in Nunavut, by clicking on the following link: eResearch-BlueStarGold-BAU-2022-05-18-FINAL

Company Overview

Company Overview

Blue Star is a Vancouver-based mineral exploration and development company that explores for gold in Nunavut, Canada.

The Company has acquired 100% interests in the Ulu Gold, Hood River, and Roma projects in Nunavut, covering 267 km2 (over 65,900 acres) in the High Lake Greenstone Belt (“HLGB”).

The Ulu Gold and Hood River properties are adjacent to each other, and the Roma project is located 48 km due north of the Ulu Gold Project.

The Ulu Gold Project contains an NI 43-101 resource (M&I and Inferred) of 831,000 gold (Au) ounces (oz.).

Investment Thesis and Upcoming Catalysts

- District-scale Exploration Opportunity:

- Blue Star holds interests in several high-grade gold and prospective exploration projects in Canada with drill-ready targets including the Ulu Gold Property, Hood River Property, and Roma Project.

- The Company is the largest title holder on the High Lake Greenstone Belt (“HLGB”) with over 26,674 ha in three highly prospective and underexplored areas.

- Greenstone belts are highly prolific and synonymous with high-grade gold production and often contain ore deposits of gold, silver, copper, lead, and zinc.

- Canada is a mining-friendly jurisdiction with a transparent regulatory regime.

- Existing Resource to Build Upon:

- The Ulu Gold Project contains an NI 43-101 resource of 831,000 Au oz. and the existing resource is still open along strike and depth.

- Existing Infrastructure Lowers Start-up Expenses

- There are almost 1,700m of underground development as the Ulu deposit has a decline and cross cuts from a small bulk sample.

- The Ulu Gold Property also includes an inventory of capital equipment, a mining camp, a maintenance shop, and a 1,200-metre airstrip.

- Value Creation Opportunity

- Due to the quality of assets and resource growth potential of the mining properties, the Company has a significant value creation opportunity.

- According to the technical reports, the existing resource at the Ulu Gold Property has the potential for expansion as the Flood Zone is still open at depth, the Gnu Zone is still open along strike and at depth, and the other peripheral gold showings or zones can be further explored.

- The 2021 exploration program delivered promising initial results that warranted further exploration. Key results included, 52.7 g/t Au over 2.0 metres (m), 19.1 g/t Au over 4.91m, 6.9 g/t Au over 7.00m, and 13.0 g/t Au over 2.64m.

- In addition, a newly discovered vein system in the Gnu area on the Ulu Property, 750m northeast of the Flood Zone, returned 20.8 g/t Au over 8.15m.

- Regional Exploration:

- Besides the existing resource, the projects have several drill-ready targets and other peripheral gold showings or zones that can be further explored.

- Strong Management Team:

- Blue Star has an experienced team of professionals with a successful exploration history and an engaged Board of Directors to advance the projects.

- Cash in the Bank:

- As of February 28, 2022, Blue Star had $1.66 million in cash on its Balance Sheet.

- In addition, the Company has illustrated its ability to raise funds from the capital markets when required.

Financial Analysis & Valuation

- We are basing our one-year target price on a multiple of 65x EV/oz. and we are using an adjusted resource.

- Our adjusted resource for the valuation is based on the following formula: 75% of the Measured & Indicated (“M&I”) and 50% of the Inferred resource. The adjusted resource for valuation is 566,750 Au oz.

- We also assume there will be additional financings over the next year and the share count in one year will be 54.5 million shares.

We are Initiating Coverage with a Speculative Buy rating and one-year price target of $0.90.

You can download the full 52-page report by clicking here: eResearch-BlueStarGold-BAU-2022-05-18-FINAL

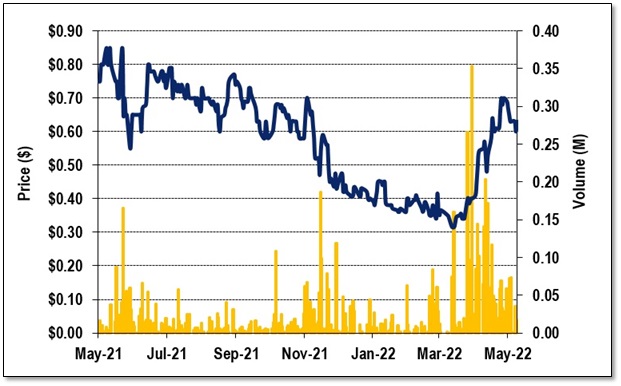

FIGURE 1: BAU 1-Year Stock Chart

Notes: All numbers in CAD unless otherwise stated. The author of this report, and employees, consultants, and family of eResearch may own stock positions in companies mentioned in this article and may have been paid by a company mentioned in the article or research report. eResearch offers no representations or warranties that any of the information contained in this article is accurate or complete. Articles on eresearch.com are provided for general informational purposes only and do not constitute financial, investment, tax, legal, or accounting advice nor does it constitute an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this information should consult with a financial advisor. The article may contain “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements are based on the opinions and assumptions of the Company’s management as of the date made. They are inherently susceptible to uncertainty and other factors that could cause actual events/results to differ materially from these forward-looking statements. Additional risks and uncertainties, including those that the Company does not know about now or that it currently deems immaterial, may also adversely affect the Company’s business or any investment therein. Any projections given are principally intended for use as objectives and are not intended, and should not be taken, as assurances that the projected results will be obtained by the Company. The assumptions used may not prove to be accurate and a potential decline in the Company’s financial condition or results of operations may negatively impact the value of its securities. Please read eResearch’s full disclaimer.