eResearch| After an eight-year absence, Dole plc (NYSE: DOLE) returned to the public market and made its debut (again) on the New York Stock Exchange. Unfortunately, on the first day of trading, shares of Dole slid by 9%.

Although the initial public offering price was $16 per share, a value which was already on the lower end of Dole’s expected $16-$17 range, the shares opened at $15 per share, fixing the Company’s implied market value of approximately $1.5 billion. The stock is currently trading at $16.09. David Murdock, the Chairman of Dole, last took the company private in 2013 for $1.3 billion.

Although the initial public offering price was $16 per share, a value which was already on the lower end of Dole’s expected $16-$17 range, the shares opened at $15 per share, fixing the Company’s implied market value of approximately $1.5 billion. The stock is currently trading at $16.09. David Murdock, the Chairman of Dole, last took the company private in 2013 for $1.3 billion.

The IPO Marks the Completion of Dole’s Merger with Total Produce

The IPO marked the completion of Dole Food’s merger with Total Produce, a deal that began in 2018 when the latter took a 45% stake in Dole for $300 million. With this merger, the newly formed company, Dole plc became the largest fresh producer in the world.

The two entities had plans to unify themselves under common ownership and enable full operational integration and value creation across their business network through operational and market synergies.

The IPO of 25 million shares, priced at $16 per share, raised $400 million in gross proceeds, which were used to cover the cost of the merger as well as to pay down debt.

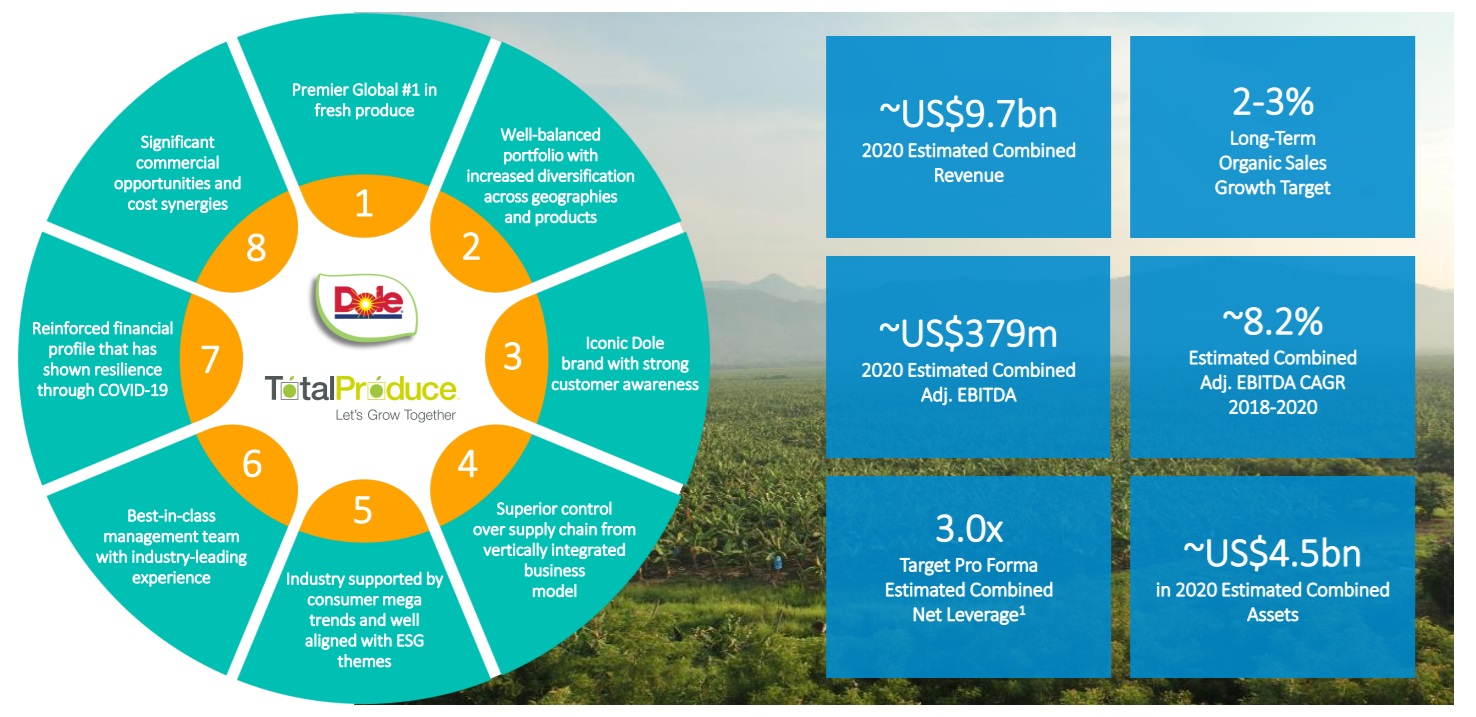

Dole and Total Produce’s Combined Annual Revenue for 2020 stood at $9.7 Billion

For the fiscal year ended December 31, 2020, Dole Food and Total Produce generated a combined annual revenue of $9.7 billion. Dole Food was responsible for $4.67 billion, an increase of 3.5% compared to what the company earned in 2019. Total Produce generated a revenue of $5.05 billion, recording a 3.6% gain from 2019.

Dole plc’s Adjusted EBITDA and total assets for this period were $379 million and $4.5 billion, respectively. Net income attributable to stakeholders stood at $80.1 million.

Dole plc’s Enterprise Value at IPO, after the equity capital raise, is estimated at $2.9 billion, which values the Company, using 2020 consolidated financials, at an implied EV/Revenue of 0.3x and an implied EV/EBITDA of 7.7x.

FIGURE 1: Dole and Total Produce Combination

Drought in California Won’t Have Any Material Impact on Business: Rory Byrne

A severe drought witnessed by California, which has led to unfavorable growing conditions in the state, dramatically reduced both crop size and crop quality. However, Rory Byrne, CEO of Dole, believes that the current situation in California won’t have an impact on Dole’s business. The company owns more than 109,000 acres of land across the globe.

Fresh Food Market to Grow by 337.76 Million Tons by 2024

The COVID-19 pandemic has forced people to reconsider their eating habits and look for healthy living options. There is a major shift in consumer behavior that has caused an increase in demand for organic fresh food products in the market, which can be seen by the growing sales of perceived immunity-boosting products, such as lemons, garlic, ginger, etc.

According to a post-pandemic report by Technavio, the global fresh food market size is expected to grow by 337.76 million tons from 2020-2024, at a compound annual growth rate (CAGR) of 3%.

Large companies in the industry, such as Dole, BRF SA (BOVESPA: BRFS3), Cargill, and others are eyeing to capitalize on this market opportunity to grow their business. Though there are identified challenges that could hamper the growth of the industry, such as harmful practices of over-fertilization, the market is prospected to expand at a rapid pace during the forecasted period.

Because fresh food is a fragmented market, vendors are deploying various strategies to compete and increase their market share, while maintaining their positions in the slow-growing segments as well.

Poor eating habits have been considered a major risk factor for the spread of the coronavirus. Consumers have become relatively more cautious in terms of food choices as they want to know the origins of the food they are eating and its safety.

Taking into account the growing awareness among consumers that fresh food is a much healthier option than processed food, it can be said that the positive impact on fresh food sales is likely to continue even in the near future.

The “New” Dole plc

With the combination of Total Produce and Dole Food Company, Dole plc becomes the world’s largest fresh producer.

With the combination of Total Produce and Dole Food Company, Dole plc becomes the world’s largest fresh producer.

The company has its presence in more than 30 countries with an integrated supply chain that extends over 250 facilities including packing houses, distribution centers, cold storage, and manufacturing facilities.

Already a global leader in fruits like bananas and pineapples, the company plans to expand its product line in categories, such as organic produce, avocados, and berries.

Notes: All numbers in USD unless otherwise stated. The author of this report, and employees, consultants, and family of eResearch may own stock positions in companies mentioned in this article and may have been paid by a company mentioned in the article or research report. eResearch offers no representations or warranties that any of the information contained in this article is accurate or complete. Articles on eresearch.com are provided for general informational purposes only and do not constitute financial, investment, tax, legal, or accounting advice nor does it constitute an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this information should consult with a financial advisor. The article may contain “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements are based on the opinions and assumptions of the Company’s management as of the date made. They are inherently susceptible to uncertainty and other factors that could cause actual events/results to differ materially from these forward-looking statements. Additional risks and uncertainties, including those that the Company does not know about now or that it currently deems immaterial, may also adversely affect the Company’s business or any investment therein. Any projections given are principally intended for use as objectives and are not intended, and should not be taken, as assurances that the projected results will be obtained by the Company. The assumptions used may not prove to be accurate and a potential decline in the Company’s financial condition or results of operations may negatively impact the value of its securities. Please read eResearch’s full disclaimer.