eResearch| The easing of pandemic restrictions has enabled mCloud Technologies Corp. (TSXV: MCLD |OTCQB: MCLDF) to access customer sites and accelerated onboarding and international expansion.

mCloud is a CleanTech leader and provides physical asset management solutions combining the Internet-of-Things (IoT), cloud computing, artificial intelligence (AI), and analytics. The Company helps businesses minimize energy waste, increase energy production, and get the most out of their critical energy infrastructure.

In May, the Company announced it went live connecting its first AssetCare™ solutions to the customer buildings associated with three utility program partnerships the Company originally announced in April. mCloud estimates these utility partnerships will make its solutions available to approximately one million commercial buildings in the US and Canada.

In May, the Company announced it went live connecting its first AssetCare™ solutions to the customer buildings associated with three utility program partnerships the Company originally announced in April. mCloud estimates these utility partnerships will make its solutions available to approximately one million commercial buildings in the US and Canada.

The three utilities were BC Hydro, which is the provincial utility in British Columbia, the Bay Area Regional Energy Network (BayREN) in California, and Con Edison in New York.

mCloud partnered with BC Hydro to offer a direct incentive to commercial customers in order to make their buildings grid-responsive.

mCloud partnered with BC Hydro to offer a direct incentive to commercial customers in order to make their buildings grid-responsive.

BayREN and Con Edison, in two of the highest peak demand regions of the US, partnered with mCloud to deliver energy savings to their customers.

The first customers associated with three utility program partnerships include two prominent car dealership properties in New York State. The Company expects to quickly roll out the next round of buildings that include new restaurants, manufacturing, and retail spaces.

AssetCare™

AssetCare™ is mCloud’s asset management platform, designed for the most demanding industries, that combines remote technology and computer learning to ensure physical assets continuously operate at peak performance.

With AssetCare™, a company can have virtually every aspect of asset management, from operations to optimization and maintenance, under one umbrella, enabling them to get the most out of their assets. According to mCloud, AssetCare™ is the only unified platform for end-to-end asset management in the cloud.

mCloud’s AssetCare™ HVAC and Indoor Air Quality (IAQ) solutions utilize the Company’s full suite of AI and IoT-powered capabilities to provide businesses with meaningful energy efficiency improvements that could reach 25%.

AssetCare™ allows for continuous monitoring and active management of a building’s ventilation and air purification systems to ensure improved indoor air quality and the safety of occupants at all times. Moreover, they help companies to ensure their buildings are compliant with state-mandated health and safety regulations.

North American Customer Onboarding

The easing of COVID pandemic restrictions has improved access to customer sites, and the pace of customer onboarding for mCloud is expected to accelerate in the US and Canada.

The easing of COVID pandemic restrictions has improved access to customer sites, and the pace of customer onboarding for mCloud is expected to accelerate in the US and Canada.

In June, mCloud announced that it delivered AI grid-adaptive energy savings to 20 additional buildings through its three utility partners.

The Company added grid-adaptive demand management to its AssetCare™ for Buildings solution and used AI in the cloud to actively manage the electric demand of a building to drive continuous savings in direct response to signals from local utility companies.

Southeastern US Expansion

Also in June, mCloud announced that, in partnership with Fidus Global, LLC, it is connecting the first building in a portfolio of buildings operated by the State of Arkansas.

In the wake of COVID-19, Arkansas is looking to improve indoor air safety across various state-owned properties, such as offices, schools, and other government-run facilities.

In the wake of COVID-19, Arkansas is looking to improve indoor air safety across various state-owned properties, such as offices, schools, and other government-run facilities.

Both mCloud and Fidus Global target customers in the southeastern regions of the United States, including Arkansas and Florida. In partnership with Fidus Global, mCloud plans to target 5,000 buildings across the country with an initial focus on southeastern regions of the United States, including Arkansas and Florida.

International Expansion

In July 2021, mCloud announced it had partnered with URBSOFT to bring AssetCare™ to the oil and gas, refining, and petrochemical operators alongside retail and real estate markets in the Middle East. The move has paved the path for AssetCare™ to support the digitalization and ESG objectives of Saudi Vision 2030, the Kingdom of Saudi Arabia’s national economic action plan.

Guidance for 2021

During its last earnings call, mCloud reported that it anticipates reaching 70,000 connected devices by late summer or early fall and thus hitting a cash flow positive milestone for the Company.

mCloud announced that it will report the financial results for the second quarter ended June 30, 2021, on August 16, 2021, after the market is closed. Analysts are expecting $9.31 million in quarterly revenue and a loss of 23 cents in adjusted earnings per share, according to the consensus analyst estimate from S&P Capital IQ.

First-quarter results were extremely positive with AssetCare™ revenues reaching C$7.3 million as compared to C$3.1 million in the first quarter of 2020, an increase of around 139% year-over-year.

Recurring revenues for the period were C$6.2 million as compared to C$5.5 million and C$1.0 million in the fourth quarter and first quarter of 2020, respectively, with an increase of 13% quarter-over-quarter and an impressive 524% year-over-year.

Total revenues in the first quarter of 2021 were C$8.4 million compared to C$6.6 million for the same period in 2020, an increase of 28% year-over-year, despite a substantial decline in Engineering Services revenue, which was a result of ongoing pandemic restrictions.

Russ McMeekin, President and CEO, mCloud stated, “mCloud continued to grow its AssetCare business in the first quarter of 2021, despite the challenges that persisted throughout the quarter due to pandemic restrictions. Our pipeline and backlog remain very strong as we await the expected lifting of these restrictions worldwide beginning in June.”

New Operating Line and Debt Conversion Improves Capital Position

In May, mCloud announced it secured a C$5 million operating line of credit with ATB Financial that was used to repay a C$1.75 million credit facility with HSBC Bank Canada and to help the Company expand internationally into target markets including the Middle East and Southeast Asia.

In addition, mCloud announced in July that it has entered into conversion agreements with debt holders of more than 99.2% of the outstanding principal amount of its 8% convertible unsecured subordinated debentures. To extinguish the $8.8 million of principal and $0.3 million of interest, the Company plans to issue 6.3 million shares, converted at prices that range from $1.14 to $1.68, and 6.3 million warrants with a strike price of $2.29 and a term of 36 months.

The debt conversion will allow mCloud to preserve cash, and improve its balance sheet and cash flow.

The Company also raised C$0.42 million in an equity offering that is directed towards advancing its Alberta-led ESG and oil and gas decarbonization agenda.

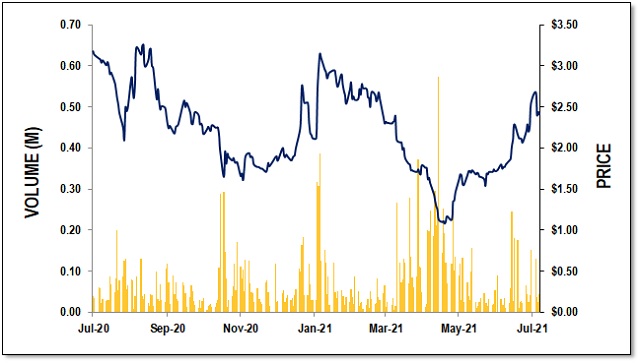

mCloud closed yesterday at C$2.44, with a Market Cap of C$84.0 million. It is currently covered by two analysts with a consensus Target Price of C$5.00 and 2021 Revenue estimate of C$45.4 million.

FIGURE 1: mCloud 1-Year Stock Chart

Notes: All numbers in USD unless otherwise stated. The author of this report, and employees, consultants, and family of eResearch may own stock positions in companies mentioned in this article and may have been paid by a company mentioned in the article or research report. eResearch offers no representations or warranties that any of the information contained in this article is accurate or complete. Articles on eresearch.com are provided for general informational purposes only and do not constitute financial, investment, tax, legal, or accounting advice nor does it constitute an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this information should consult with a financial advisor. The article may contain “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements are based on the opinions and assumptions of the Company’s management as of the date made. They are inherently susceptible to uncertainty and other factors that could cause actual events/results to differ materially from these forward-looking statements. Additional risks and uncertainties, including those that the Company does not know about now or that it currently deems immaterial, may also adversely affect the Company’s business or any investment therein. Any projections given are principally intended for use as objectives and are not intended, and should not be taken, as assurances that the projected results will be obtained by the Company. The assumptions used may not prove to be accurate and a potential decline in the Company’s financial condition or results of operations may negatively impact the value of its securities. Please read eResearch’s full disclaimer.