In the United States, the world’s still-dominant economy showed economic growth of 6.5% in Q2/2021 over a restrained Q2/2020 when hospitality, leisure, and service industries were severely impacted, and unemployment soared to over 10%. The ensuing economic recovery has lowered this rate to around 5.7%. However, labour shortages are still impacting employment levels, and supply shortages are continuing to restrain economic recovery in certain industries (e.g., computer chips).

The Delta variant case-load is rising in the USA and this will have an increasingly negative effect on the country’s economic recovery. Since the Delta variant is also now increasing in many countries around the globe, any chance for a swift and sustained global economic recovery now appears moot. A global economic slow-down, even if short-lived, will likely have a direct negative effect on global stock markets in the short term.

Rising inflation is also a concern, even as global central bankers insist it is only temporary. Our Opinion is that inflation will continue to rise, maybe not at the recent high rate, but rise just the same and, if so, this will force these central bankers to change their tune and their strategies/policies.

In last month’s report, we commented as follows. We reinforce this commentary now!

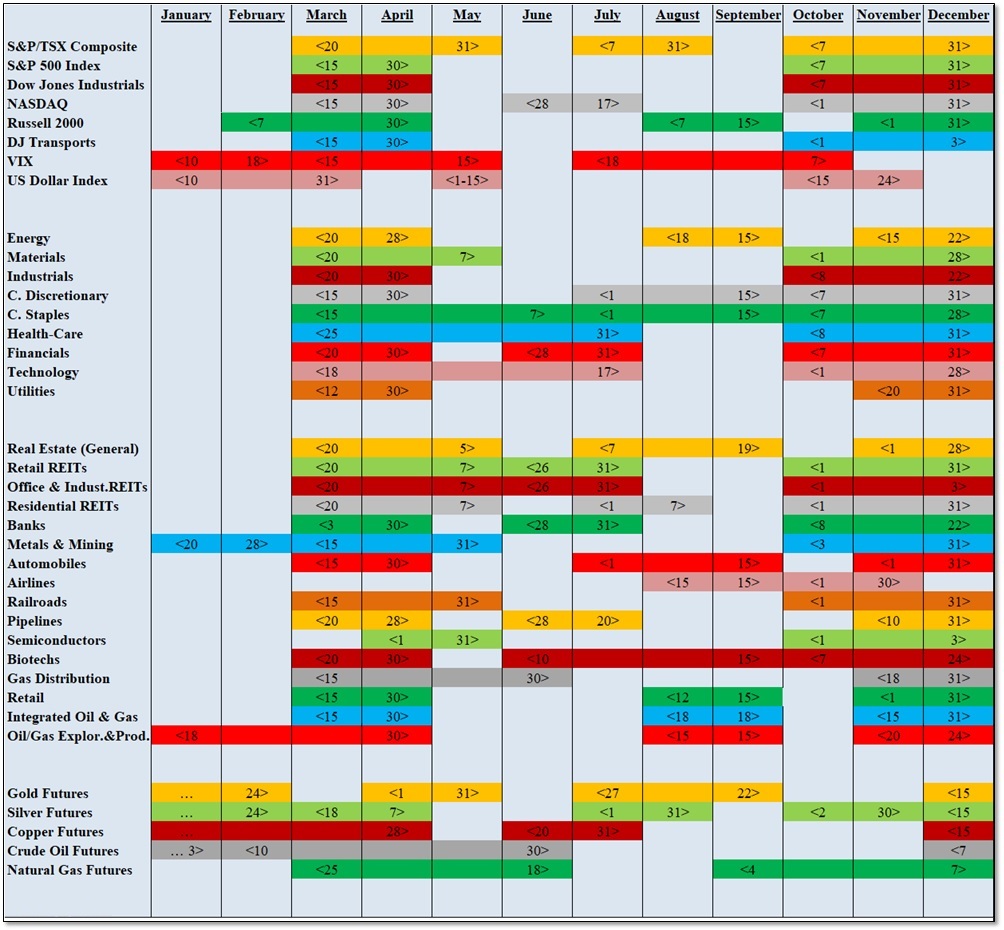

COMMENT: We have been saying for some time that we are expecting a summer pull-back. If a consolidation or pull-back does occur over the summer months, then investors should review which indexes and sectors of the market are best placed to out-perform the others. Here is where our monthly Seasonality Trends reports would be very useful.

Changes for August

The SIX market index/sectors that exhibit new seasonal strength in August include the Russell 2000, Airlines, Retail, Energy, Integrated Oil & Gas, and Oil & Gas Exploration & Production.

The THREE index/sectors that leave their period of seasonality strength behind this month are: S&P/TSX Composite Index, Residential REITs, and Silver Futures.

The EIGHT index/sectors that left at the end of July are: the NASDAQ Composite Index; Financials; Technology; Retail REITs; Office & Industrial REITs; Banks; Pipelines; and Copper Futures.

Seasonal Trends for the Market Segments in August

The following table shows which indexes/sectors gain or lose seasonal strength during the month of August. There are 6 additions this month, shown in GREEN under FROM, and 3 expiries this month, shown in RED under UNTIL

NOTE: A full seasonality list of indexes and sectors is provided at the end of this report.

FIGURE 1: Current Seasonal Positive Strength for the Market Segments

Importance of Seasonality Trends

Seasonality refers to particular time-frames when stocks/sectors/indexes are subjected to and influenced by recurring tendencies that produce patterns that are apparent in the investment valuation process. A seasonality study preferably uses at least 10 years of data.

Seasonality Trends Chart

The Seasonality Trends chart below was updated in June 2021. The chart shows the periods of seasonal strength for 38 (formerly 28) market segments (sectors/indexes). Each bar indicates a buy and a sell date based upon the optimal holding period for each market sector/index.

The ten new industry sectors are (1) Retail REITs, (2) Office & Industrial REITs, (3) Residential REITs, (4) Pipelines, (5) Semiconductors, (6) Integrated Oil & Gas, (7) Crude Oil Futures, (8) Automobiles, (9) Airlines, and (10) Railroads.

The Seasonality trends chart is an ever-changing 14-year average of the indexes and sub-indexes that we track. The information in the chart is courtesy of www.equityclock.com.

FIGURE 2: Seasonality Trends Chart (Updated June 2021)

Notes: All numbers in USD unless otherwise stated. The author of this report, and employees, consultants, and family of eResearch may own stock positions in companies mentioned in this article and may have been paid by a company mentioned in the article or research report. eResearch offers no representations or warranties that any of the information contained in this article is accurate or complete. Articles on eresearch.com are provided for general informational purposes only and do not constitute financial, investment, tax, legal, or accounting advice nor does it constitute an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this information should consult with a financial advisor. The article may contain “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements are based on the opinions and assumptions of the Company’s management as of the date made. They are inherently susceptible to uncertainty and other factors that could cause actual events/results to differ materially from these forward-looking statements. Additional risks and uncertainties, including those that the Company does not know about now or that it currently deems immaterial, may also adversely affect the Company’s business or any investment therein. Any projections given are principally intended for use as objectives and are not intended, and should not be taken, as assurances that the projected results will be obtained by the Company. The assumptions used may not prove to be accurate and a potential decline in the Company’s financial condition or results of operations may negatively impact the value of its securities. Please read eResearch’s full disclaimer.