The Fandom Sports platform encompasses free-to-play actionable predictions, a wagering marketplace (P2P), and now includes odds-line wagering.

Free-to-play is available to all users, while the wagering features are geofenced and limited to countries where permissible by Fandifi’s Curacao iGaming Wagering License that was received in August 2020.

For investors searching for an Esports-focused public company, Fandifi provides a low CapEx option with near-term revenue catalysts.

Its recently published “Gaming Industry & Peer Analysis” report highlights the Esports industry and growth, and a peer comparison shows Fandom Sports’ upside potential.

Esports Odds-line Wagering

Last week, Fandom Sports released odds-line wagering across the entire Fandifi platform that includes game titles such as Call of Duty, Counterstrike:GO, Dota 2, FIFA, King of Glory, League of Legends, Overwatch, Rainbow Six, Rocket League, StarCraft 2, StarCraft BroodWar, Valorant, Warcraft 3, and World of Warcraft.

With this feature, Fandifi utilizes its web-based machine learning betting platform to set the gambling odds and determine the favorites and underdogs. The fan can then bet on which player or team will win a game or tournament.

Fandifi’s odds-line wagering adds another feature to its platform for fan engagement as wagerers will be able to place bets even if P2P betting is unavailable. The Company will now have another revenue stream by acting as the house on the other side of the wagers.

Fandifi’s Robust Platform

Fandifi’s platform is available on web browsers, Android and iOS devices, and multiple languages are now supported, including Chinese, English, French, German, Japanese, Russian, and Spanish.

The platform provides Esports fans with the ability to watch live streams and offers a diverse range of products, from wagering to peer interaction, including:

- Odds-line and P2P wagering

- All-ages free-to-play Prediction module with an easy to use, swipe-capable interface

- Multicast streaming – watch live events while making predictions or wagers

- Authenticated messaging and sharing of predictions or wagers on social media platforms such as Facebook, Google, Pinterest, Reddit, Telegram, Twitch, Twitter, Viber, WeChat, and WhatsApp

- Esports news and social invitations for interaction, promotion, and rewards

- Users will be rewarded with points, prizes, fancoins, and Non-Fungible Tokens (“NFTs”).

Capturing Part of a Billion Dollar Market

In June, Fandifi released a “Gaming Industry Overview & Fandom Sports Peer Analysis” report.

In that report, market data provided by RnR Market Research pegged the global Esports gambling market at US$12.0 billion in 2020 and predicted it to reach US$20.5 billion by 2026, growing annually at 14.2%

The COVID-19 pandemic had a substantial positive impact on the video game industry as the pandemic forced governments to issue stay-at-home orders. Although limiting in-person Esports events, more people turned to video games and Esport online events.

Fandom Sports plans to capture this growing market by expanding its revenue streams and partnerships including advertising, product sponsorship, white-label, Esports leagues, betting commissions, and betting subscriptions.

As an example of a revenue stream, Fandifi and Elite Duels signed a mutual revenue sharing agreement under which Elite Duels will be promoting Fandifi wagering platform and Fandifi will drive traffic to Elite Duels’ Esports fantasy platform.

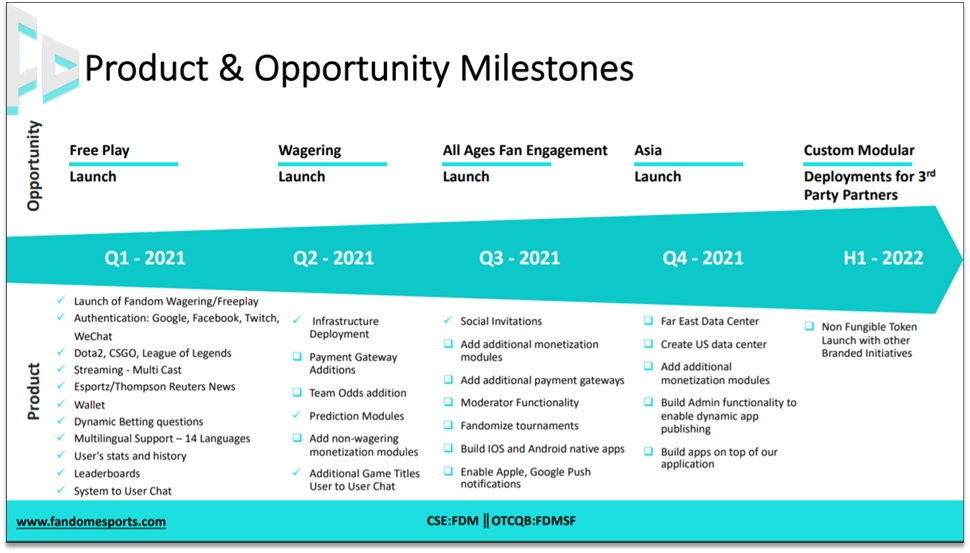

FIGURE 1: Fandom Sports’ Product & Opportunity Milestone

Hitting the Milestones for Product Rollout in 2021

Earlier this year, Fandifi launched the Free-to-Play Esports prediction platform at www.fandomeSports.gg. The platform initially allowed for real-time predictive capabilities from completed integrations with Counter Strike:GO, DOTA 2, and League of Legends but now has expanded integration to over 14 game titles.

The Company also entered into the Non-Fungible Token (NFT) space and minted its first “Fancoin” NFT in March.

In June, Fandifi deployed odd-line wagering, P2P wagering, and actionable predictions features after setting up its payment gateways and private cloud infrastructure with its own data center and first two remote nodes. A Far East data center is planned for the fourth quarter this year.

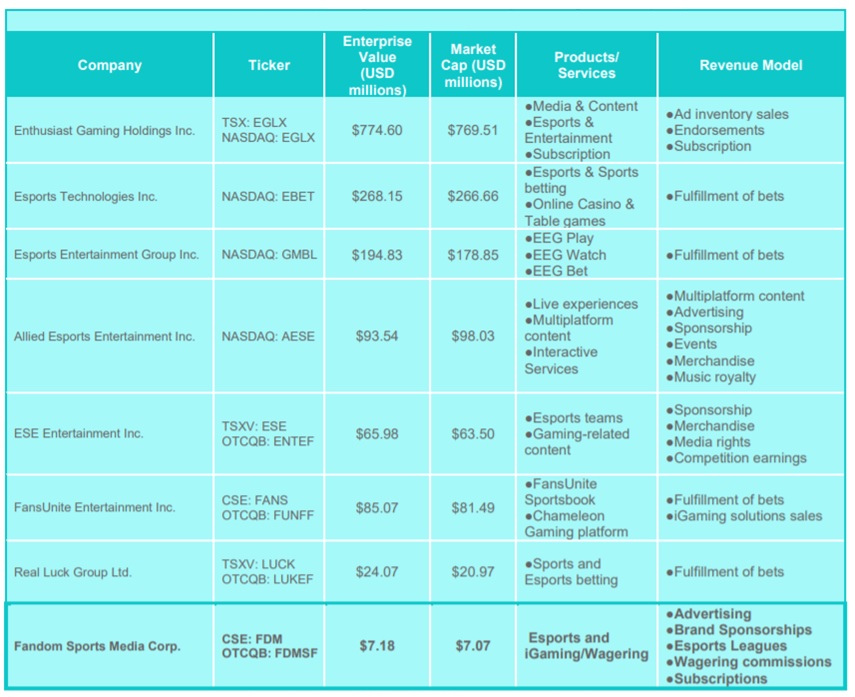

Public Comps – Room to Grow for Fandom Sports

Also conveyed in Fandifi’s June industry report was a peer comparison with some publicly-traded competitors including Enthusiast Gaming (TSX: EGLX, NASDAQ-GS: EGLX), Esports Technologies (NASDAQ-GS: EBET), Esports Entertainment Group (NASDAQ: GMBL), ESE Entertainment (TSXV: ESE, OTCQB: ENTEF), Allied Esports Entertainment (NASDAQ: AESE), FansUnite Entertainment (CSE: FANS, OTCQB: FUNFF), and Real Luck Group (TSXV: LUCK, OTCQB: LUKEF).

As illustrated in Figure 2, Fandom Sports has a specific focus on Esports and iGaming wagering with a diverse revenue model but trades at a fraction of the market cap of its peers.

As the Fandifi platform is fully launched by the end of the year and revenue starts to be recorded, the stock could see a re-rating to be more in-line with its industry peers.

Fully Funded for 2021

Fandifi closed a C$5.1 million financing in April when it issued 21.1 million units at C$0.24 per unit that included a common share and one common share purchase warrant at an exercise price of C$0.36 for a period of 2 years.

With the recent financing, the Company is fully funded for 2021 and plans for the proceeds include enhancing the technology and business development with a focus on North America and Asia.

Fandifi currently trades around C$0.28, up almost 70% year-to-date, but still with a Market Cap of less than C$23 million.

FIGURE 2: Fandifi’s Public Peers

Notes: All numbers in USD unless otherwise stated. The author of this report, and employees, consultants, and family of eResearch may own stock positions in companies mentioned in this article and may have been paid by a company mentioned in the article or research report. eResearch offers no representations or warranties that any of the information contained in this article is accurate or complete. Articles on eresearch.com are provided for general informational purposes only and do not constitute financial, investment, tax, legal, or accounting advice nor does it constitute an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this information should consult with a financial advisor. The article may contain “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements are based on the opinions and assumptions of the Company’s management as of the date made. They are inherently susceptible to uncertainty and other factors that could cause actual events/results to differ materially from these forward-looking statements. Additional risks and uncertainties, including those that the Company does not know about now or that it currently deems immaterial, may also adversely affect the Company’s business or any investment therein. Any projections given are principally intended for use as objectives and are not intended, and should not be taken, as assurances that the projected results will be obtained by the Company. The assumptions used may not prove to be accurate and a potential decline in the Company’s financial condition or results of operations may negatively impact the value of its securities. Please read eResearch’s full disclaimer.