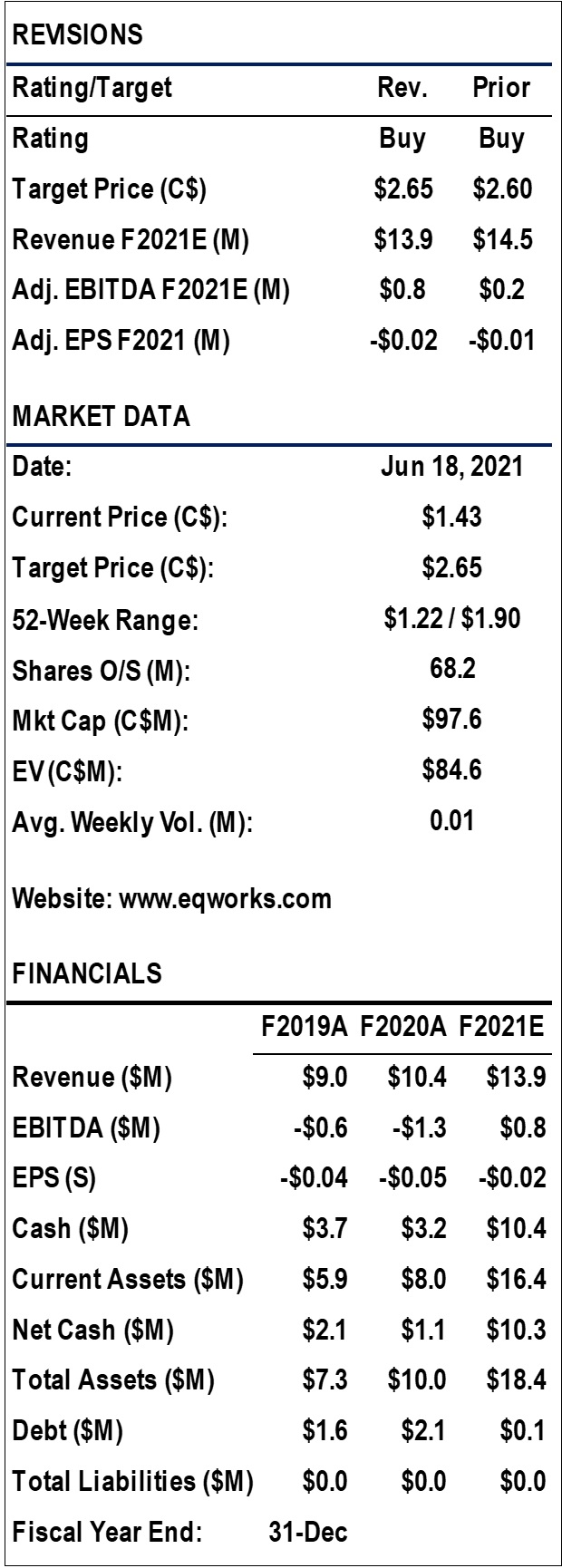

We are maintaining our Buy rating and increasing our one-year price target to $2.65.

You can download our 14-page Update Equity Research Report by clicking on the following link: eR-EQ-UR-Q1-2021_06_18_FINAL

Company Description:

Company Description:

EQ Inc. (“EQ” or “the Company”) enables businesses to understand, predict, and influence customer behaviour. Using unique and third-party data sets, advanced analytics, artificial intelligence, and machine learning, EQ creates actionable intelligence for businesses to attract, retain, and grow customers. The Company’s proprietary SaaS platform mines insights from location and geospatial data, enabling businesses to close the loop between digital and real-world consumer actions. EQ is one of the largest providers of location-based data in Canada with over 1 petabyte of data.

Quarterly Highlights:

Quarterly Highlights:

- Data Revenue Increased by 12% Y/Y but Down 51% Q/Q

- EQ’s data solutions revenue, recently its fastest-growing segment, increased 12% year-over-year to $0.48 million in Q1/2021 but decreased 51% from Q4/2020.

- Due to seasonality & COVID-19 impacts, overall revenue for Q1/2021 was $1.75 million, down from $2.20 million in Q1/2020 but slightly higher than our estimate of $1.70 million.

- EQ Expects Q2/2021 Revenue at Least 60% Higher Q/Q

- In mid-May, EQ commented that it expects Q2/2021 revenue to be at least 60% higher than Q1/2021 revenue as revenue increased month-over-month through the first quarter.

- Recent Client Deal Announcement Supports Stronger H2/2021

- In January, the Company reported that it signed commitments of more than $4 million for data-driven marketing projects.

- In June, EQ announced that it signed a data services contract with one of Canada’s largest integrated media companies and also signed a $1.8 million agreement with an unnamed Media Agency.

- Strong Balance Sheet After Q1/2021 Financing

- As of March 31, EQ’s cash balance was $13.4 million.

Financial Analysis & Valuation:

- We slightly reduced our 2021 revenue estimate due to the continued impact of COVID-19 on advertising spending but left 2022E revenue unchanged.

- 2021E: Revenue $14.5 million; EBITDA $0.8 million;

- 2022E: Revenue $23.2 million; EBITDA $3.0 million.

- We estimate an equal-weighted price target of $2.65 based on a DCF valuation ($2.54/share) and Revenue Multiple valuation ($2.78/share).

We are maintaining our Buy rating and increasing our one-year price target to $2.65.

You can download our 14-page Update Equity Research Report by clicking on the following link: eR-EQ-UR-Q1-2021_06_18_FINAL

Notes: All numbers in USD unless otherwise stated. The author of this report, and employees, consultants, and family of eResearch may own stock positions in companies mentioned in this article and may have been paid by a company mentioned in the article or research report. eResearch offers no representations or warranties that any of the information contained in this article is accurate or complete. Articles on eresearch.com are provided for general informational purposes only and do not constitute financial, investment, tax, legal, or accounting advice nor does it constitute an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this information should consult with a financial advisor. The article may contain “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements are based on the opinions and assumptions of the Company’s management as of the date made. They are inherently susceptible to uncertainty and other factors that could cause actual events/results to differ materially from these forward-looking statements. Additional risks and uncertainties, including those that the Company does not know about now or that it currently deems immaterial, may also adversely affect the Company’s business or any investment therein. Any projections given are principally intended for use as objectives and are not intended, and should not be taken, as assurances that the projected results will be obtained by the Company. The assumptions used may not prove to be accurate and a potential decline in the Company’s financial condition or results of operations may negatively impact the value of its securities. Please read eResearch’s full disclaimer.