eResearch | Renforth Resources (CSE:RFR | OTC:RFHRF | FSE:9RR) continues to release results from its 15,569-metre (m) drill program aimed at growing its current, near-surface, NI 43-101 resource of 281,800 gold ounces at 1.77 grams per tonne (g/t) at its Parbec Gold Project in the Abitibi region of Quebec, a world-class mining region.

Renforth is a Canadian-focused gold & base metal exploration company that is both asset and cash-rich with a collection of four projects within the Abitibi Greenstone Belt and over C$6 million in cash and securities.

The Parbec Gold project is Renforth’s principal asset and it sits on the Cadillac Break, near Malartic, Quebec, and adjacent to the Canadian Malartic Mine.

Recent Drill Results

This week, Renforth released assays from PAR-21-133, a 279m hole that was drilled to twin the historical hole PAR-88-44 (drilled in 1988).

PAR-21-133 intersected 12.5m of 6.9 g/t gold, with a sub-interval of 0.35m grading 118.7 g/t gold.

The recently completed 15,569m drill program focused on infill drilling, extending the resource at depth and along strike, and twinning some previous drill results from 1986 to 1993 in order to incorporate those results into the new resource estimate at Parbec scheduled for completion in Summer 2021.

The timing of the updated resource estimate will be dependent on the receipt of assays from the lab and there are currently 16 drill holes with assays pending.

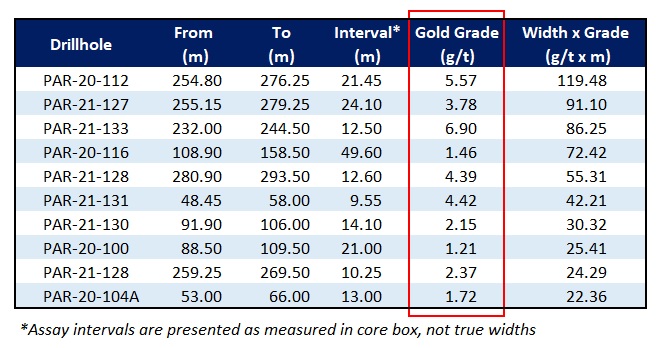

In addition, the Company also released the Top Ten Intervals (Figure 1) from the 2020/21 drill program at Parbec.

Of importance is that 70% of the Top 10 gold grades exceed the existing resource gold grade of 1.77 g/t and the long intervals bode well for an increase in the current resource.

From the recent drill programs, Renforth believes that it can at least double the current NI 43-101 resource of 281,800 gold ounces.

FIGURE 1: Parbec Top Ten Intervals from the 2020/21 Drill Program

29-page Initiation Report Available for Download – Target Price of C$0.25

In April, we published a 29-page Initiation Report on Renforth that is available to download for free at www.eresearch.com.

With Renforth’s current focus on growing the resource at Parbec, management has expressed an interest in selling Renforth and the Parbec project in the next 12-18 months, and then spinning out the remaining assets into a new company.

Renforth has deal-making experience as it recently executed an asset sale to Radisson Mining (TSXV:RDS). Last August, Renforth sold its 100% stake in the New Alger gold property to Radisson. Under the deal terms, Renforth received $0.5 million in cash, 12 million Radisson shares (approximately C$4.2 million), and a C$1.5 million cash contingent payment.

As calculated in our report we valued Renforth by the sum of its parts, including the potential sale value of Parbec, the value of its other projects (Surimeau, Malartic West, and Nixon-Bartleman), as well as its cash and securities holdings.

The result of the calculation is a Market Cap of C$78.9 million or $0.25/share based on the fully diluted share count of 321.1 million.

The Parbec Gold Project – Next Door to Canada’s Largest Open Pit Gold Mine

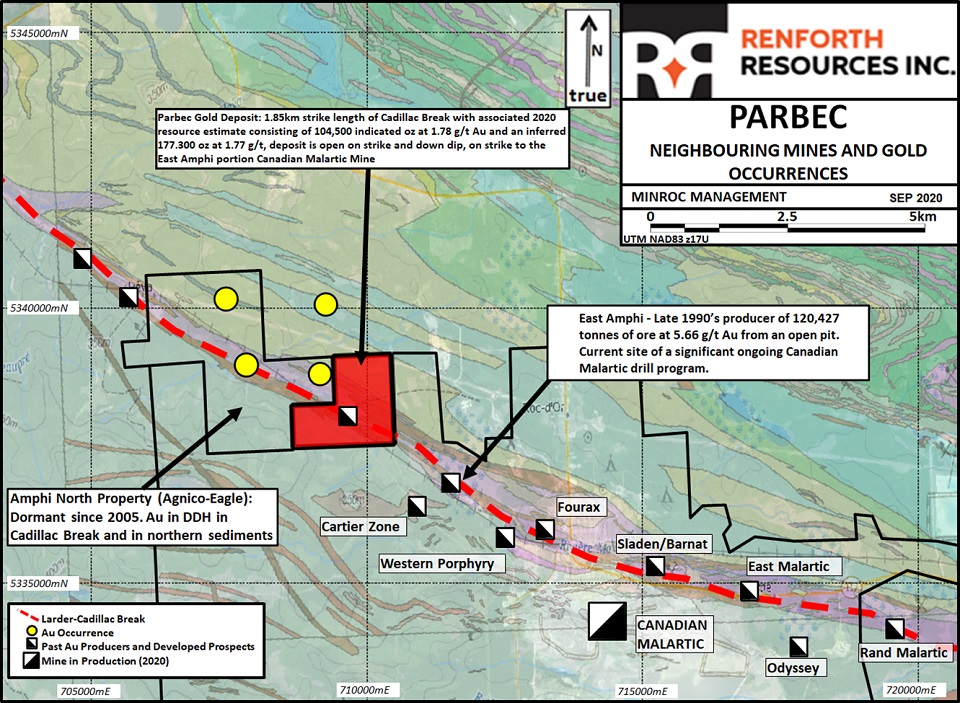

The Parbec Gold Project covers 2.29 square kilometres (565.9 acres) and is located approximately 25 km west of Val-d’Or and 80 km east of Rouyn-Noranda.

The property has 5 identified mineralized zones which run along the Cadillac Break on the property, from northwest to southeast. From historic geophysical work and various drill programs, it implies that the geology and mineralization exhibit continuity along strike and at depth between the various zones.

The project is adjacent to and along strike with the Canadian Malartic property that hosts the Canadian Malartic Mine (CMM).

The CMM is Canada’s largest gold mine and produced over 568,000 ounces of gold in 2020 and is operated by Agnico Eagle (TSX:AEM | NYSE:AEM) and Yamana Gold (TSX:YRI | NYSE:AUY).

In 2019, Renforth’s drilling proved that mineralization at Parbec was continuous for 1.85 km along the Cadillac Break, right up to the border with the East Amphi property that hosted both an open pit and underground mines, and forms the north-western border of the CMM property.

At East Amphi, McWatters Mining mined over 120,000 tonnes of ore in 1998 and 1999 from an open pit with an average diluted gold grade of 5.66 g/t.

Then Richmont Mines brought an underground mine into commercial production in 2006 at East Amphi. Over the short mine life, Richmont extracted over 300,000 tonnes of ore, at an average gold grade of 3.4 g/t and a recovery rate of 97.6%.

With gold resources still left underground, Richmont sold the East Amphi project to Osisko Exploration in 2007 and it now forms part of the Canadian Malartic property.

Richmont eventually was acquired by Alamos Gold Inc. (TSX:AGI) in 2017 for C$910 million.

FIGURE 2: Parbec Gold Project (in Red) – Neighbouring Mines and Gold Projects

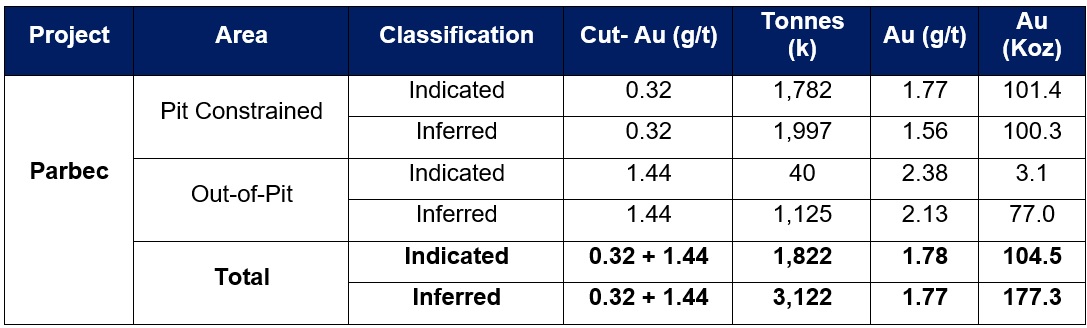

Understanding the Historical and Current Resource Estimates at Parbec

In 2015, Renforth optioned the Parbec Gold property (now 100% owned) and worked on updating the historical resource.

The Company released an initial resource estimate in 2016 and an updated resource in 2018 that produced a historical and now non-compliant Indicated & Inferred resource of over 694,000 gold ounces at 2.4 g/t, with a cut-off grade of 0.50 g/t.

However, in 2019, the Ontario Securities Commission (OSC) found the existing 2016 and 2018 technical reports filed on SEDAR for the Parbec property did not meet the continuous disclosure requirements outlined in the NI 43-101 Standards of Disclosure for Mineral Projects, specifically a determination that additional twinning was required in order to use the historical drill results.

In May 2020, Renforth published an updated, NI 43-101 compliant (Figure 3), resource for Parbec for a total resource (Indicated and Inferred) of 281,800 ounces of gold at an average grade of 1.77 g/t gold. This resource excludes all of the historical holes drilled between 1986 and 1993.

With the recently completed additional twinning of the holes drilled between 1986 and 1993, Renforth should be able to incorporate those drill results that were excluded in the 2020 resource update and we expect the new resource could increase back to the level of the 2018 resource estimate.

FIGURE 3: NI 43-101 Compliant Parbec Mineral Resource Estimate (May 2020)

Open-Pittable Deposit Attractive to Potential Buyers

As a near-surface resource, Renforth believes the Parbec project would be an attractive asset to any gold producer (CMM, Wesdome (TSX:WDO), or Eldorado Gold (TSX:ELD)) in the area that is looking to add or replace depleting ounces.

Figure 4 shows the plethora of active mines in the area. From a proximity and production standpoint, the most obvious buyer is CMM. However, mergers & acquisitions activity in the Abitibi area is strong, highlighted by these deals over the past 2 years.

In January 2020, Kirkland Lake Gold (TSX:KL) acquired Detour Gold Corporation (TSX:DGC) for C$4.9 billion. The deal valued Detour at C$27.50 a share, a 24% premium based on the prior day’s close.

In May 2020, Wallbridge Mining Company (TSX:WM) completed the acquisition of Balmoral Resources (TSX:BAR) for C$110 million in an all-stock deal that valued Balmoral at C$0.62 and represented a 46% premium to the 20-day volume-weighted average price (VWAP).

At the start of the year, Yamana Gold completed its transaction with Monarch Gold (TSX: MQR) for the Wasamac & Camflo properties and the Camflo mill for a total consideration of C$200 million in a combination of cash, Yamana shares, and shares a newly-formed company that holds Monarch’s other mineral properties. The transaction represented a premium of 43% to the 20-day VWAP of Monarch’s stock.

Finally, Eldorado Gold (TSX:EGO) closed the acquisition of QMX Gold Corp. (TSXV:QMX) in April for C$132 million in a combination of cash and Eldorado shares. The total consideration represented a 39.5% premium to the closing price of QMX shares on the day before the deal was announced.

Each one of these deals shows a healthy premium that should reflect well for Renforth as it continues to build “gold ounces in the ground”.

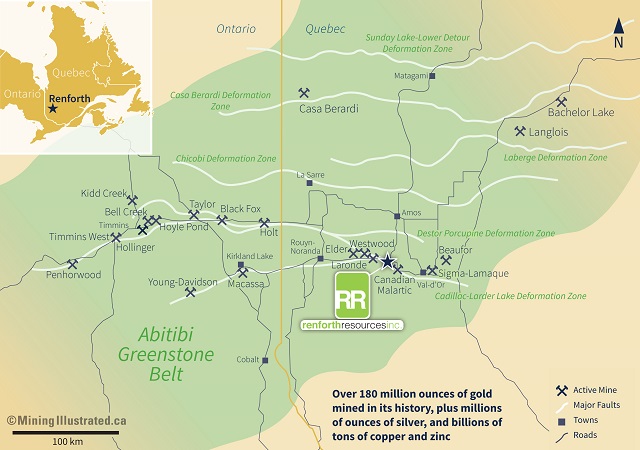

Figure 4: Active Mines in the Abitibi Greenstone Belt

Renforth Focused on the Abitibi and not a “One-Trick Pony”

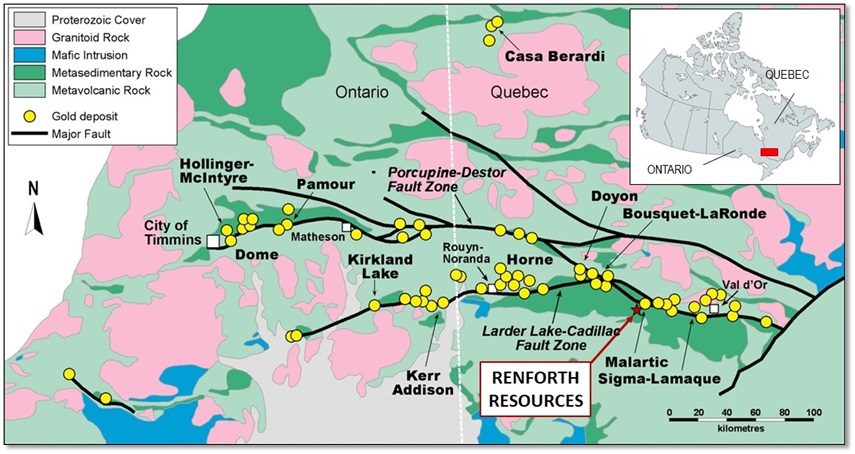

Renforth is in the right region for finding economic mineralization as mining activity in the Abitibi Greenstone Gold Belt is reported to have produced over 180 million ounces of gold in its history, plus millions of ounces of silver and billions of tons of copper and zinc.

The belt spans from Wawa in eastern Ontario to the east of Val-d’Or, Quebec (Figure 5).

Mineral deposits are commonly located along or near the fault zones. The two most prolific and well-known fault zones (also called “breaks” or deformation zones) are the Destor-Porcupine in Ontario and the Cadillac-Larder Lake in Quebec.

Renforth’s projects in Quebec are all near Malartic, Quebec, and on or near the Cadillac-Larder Lake Fault Zone. The Nixon-Bartleman Gold project in Ontario straddles the Destor-Porcupine Fault Zone.

Renforth’s Surimeau project is of interest to the battery metals enthusiasts for its potential to host a large-scale sulphide nickel & platinum-group elements (PGE) system as well as indications of a copper-zinc Volcanogenic Massive Sulfide (VMS) system.

The Company’s other two projects include the Malartic West copper and silver project in Quebec and the Nixon-Bartleman Gold project, near Timmins, Ontario.

Figure 5: Fault Zones (Black Lines), Gold Deposits (Gold Dots), and Major Towns (White Squares) in the Abitibi Greenstone Belt

Fully Funded For 2021

Renforth is cash-rich after selling its New Alger Gold Property to Radisson Mining Resources Inc. (TSXV:RDS) for cash and Radisson Mining shares, and then raised $3.2 million in an equity financing.

With its recent financing and asset sale, Renforth has $1.1 million in cash and approximately $3.6 million in Radisson Mining shares. The Company is fully funded for its 2021 exploration and drilling programs at Parbec and Surimeau.

Final Thoughts

The upcoming catalysts for the Renforth include:

- At Parbec, final drill results from the completed 15,569-metre drill program and the new resource estimate scheduled for release in June or July;

- Assay results from the 3456m, 15-hole program at Surimeau, Renforth’s battery metal project in the Abitibi, that was completed in April; and,

- A new 1,000m drill and field prospecting program at Surimeau.

At Parbec, after twinning some of the holes drilled between 1986 and 1993, Renforth should be able to incorporate those drill results that were excluded in the 2020 resource update.

We expect the existing resource could increase back to the level of the previous, historical resource estimate that was released in 2018 before the regulators required Renforth to exclude all of the historical drillings.

Renforth is currently trading at C$0.09 with a market cap below C$25 million but with gold in the ground at Parbec and unaccounted value at Surimeau, Malartic West, and Nixon-Bartleman, we believe the potential for a re-rating once the updated resource is released.

Link to eResearch’s 29-page Initiation Report on Renforth.

Notes: All numbers in USD unless otherwise stated. The author of this report, and employees, consultants, and family of eResearch may own stock positions in companies mentioned in this article and may have been paid by a company mentioned in the article or research report. eResearch offers no representations or warranties that any of the information contained in this article is accurate or complete. Articles on eresearch.com are provided for general informational purposes only and do not constitute financial, investment, tax, legal, or accounting advice nor does it constitute an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this information should consult with a financial advisor. The article may contain “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements are based on the opinions and assumptions of the Company’s management as of the date made. They are inherently susceptible to uncertainty and other factors that could cause actual events/results to differ materially from these forward-looking statements. Additional risks and uncertainties, including those that the Company does not know about now or that it currently deems immaterial, may also adversely affect the Company’s business or any investment therein. Any projections given are principally intended for use as objectives and are not intended, and should not be taken, as assurances that the projected results will be obtained by the Company. The assumptions used may not prove to be accurate and a potential decline in the Company’s financial condition or results of operations may negatively impact the value of its securities. Please read eResearch’s full disclaimer.