eResearch | This week, mCloud Technologies Corp. (TSXV: MCLD | OTCQB: MCLDF) announced the appointment of Arnel Santos as Executive Vice President with the additional role of President, Americas and responsibilities for the Company’s regional business in North America.

mCloud is a provider of asset management solutions combining the Internet-of-Things (IoT), cloud computing, artificial intelligence (AI), and analytics. The Company, a CleanTech leader, helps businesses reduce energy waste, maximize energy production, and get the most out of critical energy infrastructure.

Mr. Santos, a seasoned oil executive and based in Calgary, Alberta, Canada, joins the Company as it relocates its global headquarters to Calgary and advances its Environmental, Social, and Corporate Governance (ESG) agenda.

mCloud reported that he has a “celebrated career” as one of Alberta’s top energy executives leading digital strategy, technology innovation, and ESG affairs both provincially and globally. Currently, he is also an Executive Committee Member of the Chemistry Industry Association of Canada.

Most recently, he worked for NOVA Chemicals (private) since 2016 as Senior Vice President, Operations and Innovation. NOVA Chemicals is a multibillion-dollar chemical and plastic resin manufacturer, with a head office in Calgary and a U.S. commercial center in Moon Township, Pennsylvania.

Prior to that role, he spent over 24 years at Royal Dutch Shell PLC (NYSE: RDS.A | LSE: RDSA ), holding a variety of positions, including Regional Vice President, Manufacturing, South-Eastern Asia for Shell Eastern Petroleum Limited in Singapore and General Manager Shell Scotford Upgrader in Fort Saskatchewan, Alberta.

Alberta-led ESG Initiatives

In February, mCloud announced it signed a Memorandum of Understanding (MOU) with Invest Alberta Corporation (IAC) that enables the Company to leverage its technology to help energy companies reduce carbon emissions to take action on ESG issues.

The MOU included plans for mCloud to relocate its global corporate headquarters to Calgary.

Last month, mCloud announced a $14.5 million capital raise as it grows its energy-related business in Alberta, the Middle East and Southeast Asia.

The Company explained that the financing would be used to advance its Alberta-led ESG digital initiatives and oil and gas decarbonization solutions, including the commercialization of its new AssetCare fugitive gas and leak detection solution.

Building a Global Team

Mr. Santos is just the latest executive to join mCloud as the company grows its talent pool to meet the demand for its solutions in Alberta, the Middle East, and Southeast Asia.

Russ McMeekin, mCloud President and CEO, commented,

“We are incredibly privileged to have Arnel join mCloud’s executive team, especially as someone who commands respect as a distinguished oil and gas thought leader in Alberta and abroad. He is a deeply passionate champion for the importance of digitalization and ESG across the industry and has the ear of key business and government leaders on the topics of technology and innovation.”

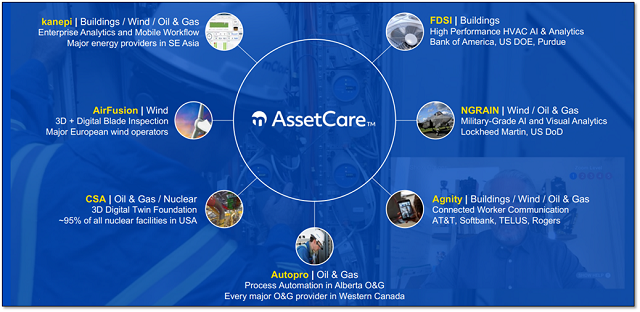

FIGURE 1: mCloud’s AssetCare

Guidance for 2021

Financial results in 2021 should be driven by growth in mCloud’s AssetCare solutions. AssetCare is an asset management platform that combines IoT, AI, and the Cloud to ensure assets, such as connected buildings, processing plants, or wind turbines, continuously operate at peak performance.

Many heavy industry sites, oil & gas companies, and processing companies are looking for ways to continue operations when they cannot get people on the ground.

Due to COVID-19 issues, mCloud has a substantial backlog of new AssetCare implementations that it expects to monetize as travel restrictions ease. The Company estimated that it has C$175 million of a combination of pipeline and backlog, mostly contracted over a 3-year period and divided primarily between building solutions (40%) and oil & gas solutions (40%).

With this backlog and a strong sales pipeline, mCloud expects to double AssetCare revenues in 2021, which comprised 76% of revenue in 2020 and could raise its total revenue to at least C$45 million in 2021.

Uplisting to the NASDAQ and TSX

The Company also reported that it has been working diligently to uplist to the TSX and to the NASDAQ.

mCloud closed yesterday at C$1.64 with a Market Cap of C$56.4 million. It is currently covered by two analysts with a consensus Target Price of C$5.00 and 2021 Revenue estimate of C$50.7 million.

To learn more about mCloud…

Read our other articles about the Company:

- mCloud Reports 47% Yearly Revenue Increase and Closes $14.5M Financing

- Adelaide Capital’s CleanTech conference where mCloud presented – Canadian CleanTech Companies Speak about the Current Market.

- mCloud Released 2019 & Q1/2020 Financial Results with a 922% Revenue Gain in 2019

Or see mClould’s recent presentation at the virtual Planet MicroCap Showcase on April 20-22, 2021:

Notes: All numbers in USD unless otherwise stated. The author of this report, and employees, consultants, and family of eResearch may own stock positions in companies mentioned in this article and may have been paid by a company mentioned in the article or research report. eResearch offers no representations or warranties that any of the information contained in this article is accurate or complete. Articles on eresearch.com are provided for general informational purposes only and do not constitute financial, investment, tax, legal, or accounting advice nor does it constitute an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this information should consult with a financial advisor. The article may contain “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements are based on the opinions and assumptions of the Company’s management as of the date made. They are inherently susceptible to uncertainty and other factors that could cause actual events/results to differ materially from these forward-looking statements. Additional risks and uncertainties, including those that the Company does not know about now or that it currently deems immaterial, may also adversely affect the Company’s business or any investment therein. Any projections given are principally intended for use as objectives and are not intended, and should not be taken, as assurances that the projected results will be obtained by the Company. The assumptions used may not prove to be accurate and a potential decline in the Company’s financial condition or results of operations may negatively impact the value of its securities. Please read eResearch’s full disclaimer.