eResearch is pleased to publish an Initiation Equity Research Report on Moovly Media Inc. (TSXV:MVY | OTC:MVVYF | FSE: 0PV2).

eResearch is pleased to publish an Initiation Equity Research Report on Moovly Media Inc. (TSXV:MVY | OTC:MVVYF | FSE: 0PV2).

You can download the full 37-page report by clicking here: eR-MVY-IR-2021-03-29_FINAL2

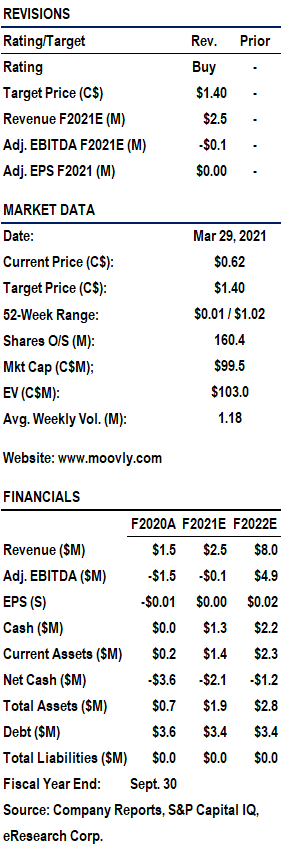

We are Initiating Coverage on Moovly with a Buy rating and one-year price target of C$1.40/share.

//

COMPANY DESCRIPTION:

Moovly Media Inc. (“Moovly” or “the Company”) is a cloud-based media platform for professional-level video production for businesses, educators and home use. The Company focuses on providing leading-edge software that allows users to easily create professional live-action, animation, motion graphics, screenshots, or whiteboard videos without being an expert in video creation. With over 3.7 million users worldwide, Moovly is a leading provider of web-based video tools for creating videos and video presentations targeting marketing, corporate communications, and storytelling.

INVESTMENT HIGHLIGHTS:

INVESTMENT HIGHLIGHTS:

- Advanced feature-rich platform for video creation. Moovly has developed one of the best-in-class, function- and media-rich, proprietary cloud-based platforms that transforms video creation and is unique in a massively growing marketplace.

- Video Automator can quickly generate thousands of customized videos. Moovly’s Video Automator allows users automate the video content-making process, and produce template-based, customized videos in high volumes and distribute them to their target audiences.

- Robust developer API enables white labeling of Moovly’s platform. Moovly’s Developer API allows developers to integrate Moovly’s video production capabilities into their own platforms, products, or services.

- Acquisition target. Moovly would fill an important gap for any company making or exploiting video content, such as video aggregators or agencies, that does not already have a leading-edge video editor.

- Experienced management with previous exit. Moovly’s founders have a deep understanding of the content creation space and a proven track record of creating significant shareholder value and leading a startup to successful exit.

FINANCIAL ANALYSIS & VALUATION:

- We estimate Moovly’s financials as:

- F2021E: Revenue $2.5 million; EBITDA -$0.1 million;

- F2022E: Revenue $8.0 million; EBITDA $4.9 million.

- We calculate an equal-weighted price per share of $1.40 from a multiple of 40x the one-year forward Revenue of $5.6 million and a DCF from a multiple of 30x the four-year forward terminal EBITDA of $14.4 million at a 12% discount rate.

- We are Initiating Coverage with a Buy rating and one-year price target of $1.40.

You can download the full 37-page report by clicking here: eR-MVY-IR-2021-03-29_FINAL2

//

INVESTMENT HIGHLIGHTS:

INVESTMENT HIGHLIGHTS: