eResearch| Bitcoin (“BTC”), one of the leading cryptocurrencies (“crypto”), now has a market cap of $1.1 trillion.

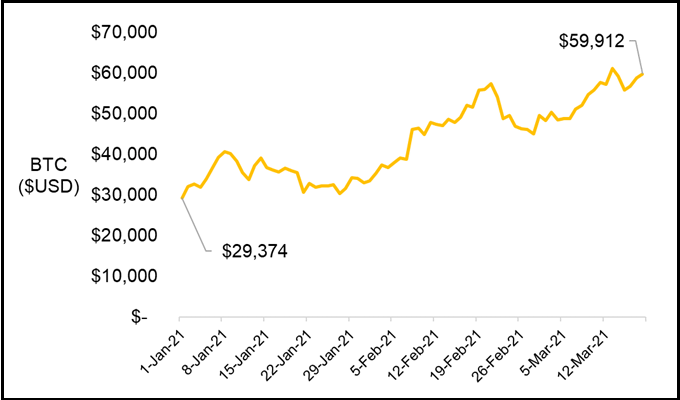

BTC has increased 101% so far this year. The price change is a story of increased demand and inelastic supply.

Originally intended to be a medium for financial exchange, the current market worry, government stimulus, and ever-growing popularity make BTC look like an attractive investment.

Investor dollars are pouring into new Bitcoin ETFs that are now trading on the Toronto Stock Exchange (TSX: X).

Demand is also coming from firms such as Tesla (NASDAQ: TSLA) that are now hoarding a large stash in anticipation of accepting payment in BTC.

All of this surging popularity juxtaposes the fact that BTC has a limited supply. Statista estimates that 18.63 million BTCs of the total 21 million limit are currently in circulation. Each remaining BTC will be more difficult to mine.

IMAGE 1: BTC Price (US$)

Bitcoin ETF

It is relatively simple for techno-capable people to trade BTC. There are several exchanges, and even some common investing platforms offer users purchasing options.

It is relatively simple for techno-capable people to trade BTC. There are several exchanges, and even some common investing platforms offer users purchasing options.

However, it is not easily accessible for all types of investors. The exchanges are sometimes not regulated entities so transferring cash can be an uncomfortable experience.

Welcome BTC ETFs.

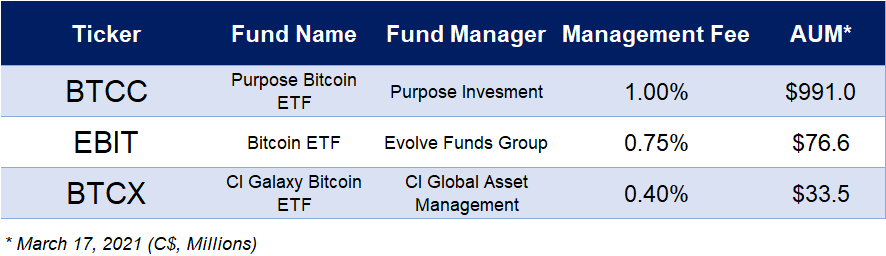

Approved and launched this year, three BTC ETFs are trading on the TSX.

The first approved ETF is Purpose Bitcoin ETF (TSX: BTCC) managed by Purpose Investments. Projected to have $1B in AUM by the end of the week, some analysts speculate that it could become the most popular fund on the TSX within a few months.

Evolve ETF launched the Bitcoin ETF (TSX: EBIT) and CI Global Asset Management (TSX: CIX | NYSE: CIXX) introduced the CI Galaxy Bitcoin ETF (TSX: BTCX). Both of these options have lower management fees.

The ETFS all come in a USD and CAD variations.

TABLE 1: Comparison of BTC ETFs

Tesla

Tesla announced plans to accepts Bitcoin as a payment option. As part of this strategy, Tesla bought $1.5 billion of BTC, a significant portion of the available supply.

Tesla announced plans to accepts Bitcoin as a payment option. As part of this strategy, Tesla bought $1.5 billion of BTC, a significant portion of the available supply.

Master of Coin (formerly CFO) Zach Kirkhorn likely believes that a stockpile of bitcoin will help Tesla to weather BTC volatility storms and nefarious price manipulation.

Tesla, headquartered in Palo Alto, California, is an American electric vehicle manufacturer. Tesla also sells solar panel solutions and home batteries. Tesla is noted for an impressive share price performance, strikingly high multiples, as well as its “electric” leader, the Technoking Elon Musk.

With more retailers and manufacturers using BTC as a medium of exchange, it is beginning to look more and more like an actual fiat currency.