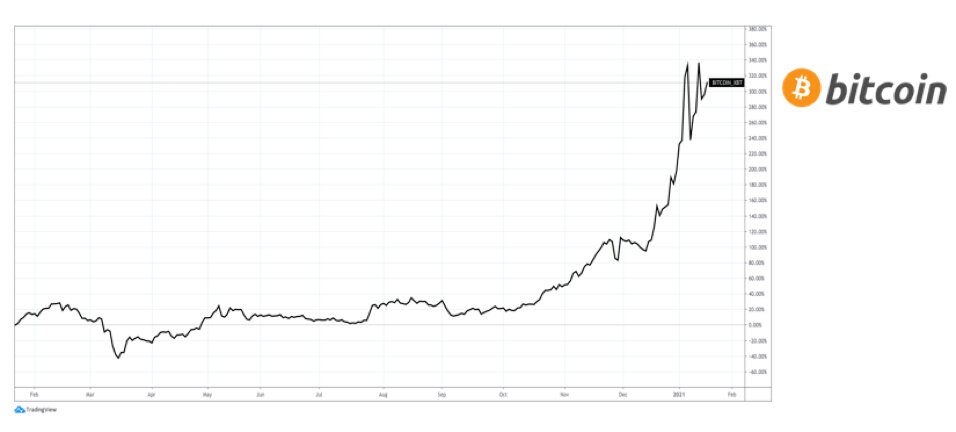

eResearch | Cryptocurrencies (“crypto”) have regained market interest as Bitcoin (“BTC”) reached an all-time-high price of $41,940 per BTC at the beginning of this year. As digital currencies experience stronger adoption, more capital is flowing into investments related to crypto.

In 2020, crypto funds received total investor inflows of $5.6 billion, a 600% increase year-over-year, according to CoinShares, a digital asset manager. Assets under management (“AUM”) for the whole sector reached $19 billion in 2020 compared with $2.6 billion in 2019.

In 2020, crypto funds received total investor inflows of $5.6 billion, a 600% increase year-over-year, according to CoinShares, a digital asset manager. Assets under management (“AUM”) for the whole sector reached $19 billion in 2020 compared with $2.6 billion in 2019.

Grayscale Investments, the world’s largest crypto fund, had nearly $5 billion of investor inflows in 2020 with AUM of $15 billion. Last year, Grayscale turned two of its products into SEC reporting funds, the Grayscale Bitcoin Trust (OTC:GBTC) and the Grayscale Ethereum Trust (OTC:ETHE).

As the adoption of cryptocurrency and blockchain technologies increases, various banks, corporations, and governments are focusing more investments in digital currencies.

Jefferies Investment Bank Buys Bitcoin and Reduces Gold Exposure

A recent article by Business Standard reported that Christopher Wood, the global head of equity strategy at Jefferies Group, a U.S. investment bank, reduced his exposure to gold for Bitcoin.

A recent article by Business Standard reported that Christopher Wood, the global head of equity strategy at Jefferies Group, a U.S. investment bank, reduced his exposure to gold for Bitcoin.

This came as a surprise as Mr. Wood previously expressed concerns for investing in Bitcoin due to risks of the cryptocurrency being hacked or being declared illegal by governments.

In his weekly note to investors called GREED & fear, Christopher said,

“The 50 per cent weight in physical gold bullion in the portfolio will be reduced for the first time in several years by five percentage points with the money invested in Bitcoin. If there is a big drawdown in bitcoin from the current level, after the historic breakout above the $20,000 level, the intention will be to add to this position.”

Mr. Wood’s US-dollar-based Pension Fund for long-only asset allocations previously held 50% of its weight in physical gold bullion. The new strategy to add Bitcoin reduced the portfolio’s holdings in gold to 45% from 50%, with the 5% reallocated towards Bitcoin investments.

Although the portfolio’s holding will diversify into other cryptocurrencies, he stated that he remains bullish for gold with expectations for the price of gold to rise if central banks continue to remain dovish due to the pandemic.

China’s Digital Yuan

China is currently in the forefront of integrating cryptocurrency into the nation’s economy by developing a Central Bank Digital Currency (“CBDC”).

China is currently in the forefront of integrating cryptocurrency into the nation’s economy by developing a Central Bank Digital Currency (“CBDC”).

Last year, China’s central bank, the People’s Bank of China (“PBOC”), announced that its digital currency for the Chinese Yuan was ready.

The digital yuan is backed by yuan deposits held by the PBOC with banks expected to convert a part of their yuan holdings into the digital yuan.

The PBOC ran its first pilot trial for the digital yuan last year by holding a lottery and handing out a total of 10 million digital yuan ($1.5 million) to residents living in the district of Shenzhen. The winners of the lottery received the digital yuan through an app with more than 3,000 participating merchants accepting payments of the cryptocurrency.

Earlier this year, the PBOC announced a second trial with a lottery of 20 million digital yuan ($3 million) for Chinese residents living in the district of Suzhou. In connection with the second trial, JD.com (HKG:9618 | NASDAQ:JD), a leading Chinese e-commerce company, became the first online platform to accept payments of the digital yuan.

The Chinese government expects the digital yuan to provide greater transparency when tracking the flow of money through its economy. In addition, the digital yuan could provide access to online transactions for the unbanked population of China.

Mogo Makes Corporate Investment in Bitcoin

Last month, Mogo (NASDAQ:MOGO | TSX:MOGO), a financial technology company with a C$17 million investment portfolio, announced plans to invest C$1.5 million into Bitcoin. The initial investment of C$1.5 million represents approximately 1.5% of Mogo’s total assets as of Q3/2020.

On the press release, Greg Feller, President and CFO of Mogo, stated,

“We are strong believers in bitcoin as an asset class and believe this investment is consistent with our goal to make bitcoin investing available to all Canadians. In addition, we believe bitcoin represents an attractive investment for our shareholders with significant long-term potential as its adoption continues to grow globally.”

The investment in Bitcoin supports Mogo’s current focus on product development for financial offerings related to investments in cryptocurrencies.

In 2018, Mogo launched MogoCrypto1, an app that facilitates the buying and selling of Bitcoin in Canada. The MogoCrypto1 app enables users to transact Bitcoin at real-time prices, 24/7 from their mobile devices.

Mogo’s stock is currently trading at C$6.19 per share, a 31% increase since announcing the investment in Bitcoin, with a market capitalization of $187 million.

Cryptocurrency Industry

A majority of corporations investing in cryptocurrencies are mainly focused on Bitcoin, which is volatile in price due to the speculation of its need and fit within the economy.

Although the price of BTC has shot up to more than $40,000, it is uncertain what the fair value of the crypto is or how high it could rise in price.

Nevertheless, as Bitcoin reaches a market share of $675 billion, it is too large to ignore for financial institutions, banks, and governments.

FIGURE 1: Bitcoin Price – 1 Year Chart

Other related eResearch articles:

- January 17, 2021: Fandom to Mint Non-Fungible Tokens for Esports Fan Rewards

- September 8, 2020: Cryptocurrency Update – Bitcoin Solutions Set to go Public, DGC Acquires Luno, and Grayscale Bitcoin Trust Receives Funds from 20 Investors