Below is an article written by Lorimer Wilson of munKNEE.com. munKNEE.com is a new affiliate of eResearch.com.

Cash is king in high growth, cash-burning industries like cannabis, and those without it won’t be around for long. This article:

- Identifies 8 companies that have already filed for bankruptcy;

- Provides a table showing liquidity by company so you can see how many years of cash are left for each; and,

- Provides details of convertible debentures coming due in the next few months which will necessitate new re-financing or bankruptcy by the affected cannabis companies.

The First of Many Bankruptcies

Now that financing has dried up for all but a handful of large cannabis companies in Canada, we think bankruptcies will become more prevalent in the future. Against the backdrop of a troubled cannabis market, a number of other marijuana firms have received creditor protection this year. Included on the list are names such as:

- Wayland Group Corp. (OTCQB: MRRCF) in December

- Invictus MD Strategies (TSXV: GENE.H) in February,

- CannTrust Holdings in March,

- James E. Wagner Cultivation (TSXV: JWCA.H) in April,

- Green Growth Brands (CSE: GGB ; OTC Pink: GGBXF) in May and

- Beleave (CSE: BE) said Friday (June 5) that it plans to apply for an order for creditor protection from the Ontario Superior Court of Justice under the Companies’ Creditors Arrangement Act (CCAA).

- Pyxus International (OTC: PYXSQ) has seen its shares suspended from trading and delisted from the New York Stock Exchange as of today as a result of the company seeking Chapter 11 bankruptcy protection

- Lift & Co. Corp. (TSXV: LIFT) announced today that it has made a voluntary assignment for the benefit of its creditors under section 49 of the Bankruptcy and Insolvency Act (Canada) and that all of its directors and officers have resigned. This follows the failure to reach an agreement with the holders of the Corporation’s secured convertible debentures.

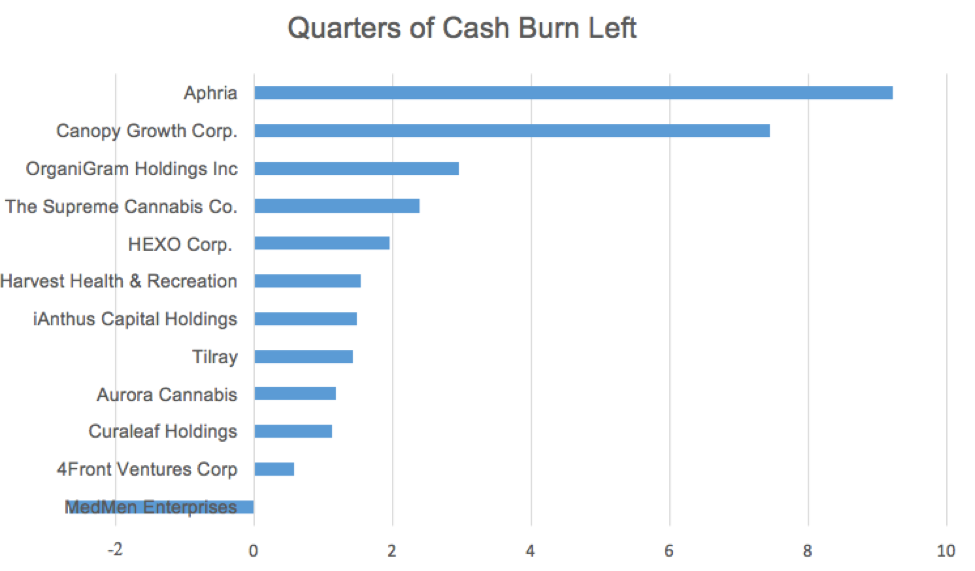

CHART 1: Quarters of Cash Left for 12 Cannabis Companies with the Highest Debt Levels (as of April 2020)

Note: Cannabis Companies with Highest Debt and Negative Cash Flows from Operations

Many Convertible Bonds Coming Due

Exacerbating the cash flow problems with many of the above companies is the fact that they have convertible debentures, issued in 2018 on two-year terms, that are about to come due.

Convertible bonds, notes, or debentures are a form of debt that gives the holder of the debt instrument a regular interest payment (called a “coupon”), either for a fixed amount of time, or until the stock trades above a target price that triggers a conversion event. This is the preferred outcome.

- In a bear market as we have at the current time, however, the conversion of the share price is far less likely within the prescribed time period and, therefore, the company will have to roll over the debt into a new financing, which could happen via:

- Straight equity or a new round of convertibles (and rolling over into a new round of convertibles or equity would result in a super dilution event),

- Or, standard bank financing (the ultimate objective).

To highlight how dire the current situation is, click here for a list of several issuers that are currently in precarious situations as a result of their current debt load and their likely inability to pay off the debt under current cash reserves.

Recommended Course of Action

The bankruptcy announcements serve as a stern warning to investors. If the current market condition for cannabis stocks persists into 2020, we think financial risks will cause more firms to collapse and, therefore, it is extremely important to:

- Avoid players with weak balance sheets; and,

- Avoid assuming that cash flow could improve drastically in the near future.

Only firms with a visible path to profitability and self-funding should be considered.

//

To view the original article and more from munKNEE.com, please visit: https://www.munknee.com/pot-stock-bankruptcy-watch-2-down-many-more-to-come/

//