We are Initiating Coverage on XORTX with a Speculative Buy rating and one-year price target of $2.30/share.

COMPANY DESCRIPTION:

XORTX Therapeutics was founded in 2013 with a goal to develop drugs that could treat a number of diseases by reducing serum acid uric which has been linked to cardiovascular and renal diseases.

Since its founding, XORTX has focused on kidney diseases with the development of new formulation for the orphan disease (polycystic kidney) with a larger scope to develop a treatment for diabetic patients with chronic kidney disease (“CKD”).

Since its founding, XORTX has focused on kidney diseases with the development of new formulation for the orphan disease (polycystic kidney) with a larger scope to develop a treatment for diabetic patients with chronic kidney disease (“CKD”).

XORTX does not have any approved drugs, but has two potential late stage drugs in development, each with a proprietary combination using Oxypurinol as the starting ingredient.

INVESTMENT HIGHLIGHTS:

- Stock Price Upside Potential

- With a $14 million market cap and multiple compelling value-creation opportunities in its pipeline, we expect this small cap biopharmaceutical company to become an attractive investment for investors and for commercial partners.

- Two Programs Using Pre-Existing FDA Approved Drugs but Enhanced with its Proprietary Drug Delivery Technology

- The original drug approved >50 years ago for the treatment of gout has been restricted to other disease because of its toxicity and lack of benefits in ~30% of patients. With this new and improved drug formulation, the two drugs being developed by XORTX could now be therapeutically beneficial for disease indications with potential for orphan drug indication using the 505(b)(2) regulatory path.

- Phase 3 Asset (XRx-008): Treatment for Polycystic Kidney Disease (“PKD”)

- We believe the new formulation of xanthine oxidase inhibitors developed by XORTX could become a significant treatment option for patients with PKD. This program is ready to file with the FDA and initiate a pivotal Phase 3 clinical trial in the next 12 months.

- Phase 3 Asset (XRx-101): Treatment for COVID-19

- XORTX has also developed another formulation for the treatment of acute kidney injury for hospitalized COVID-19 patients being treated in an intensive care unit. XORTX has started discussions with the FDA for initiating a pivotal Phase 3 clinical trial in the next 12 months.

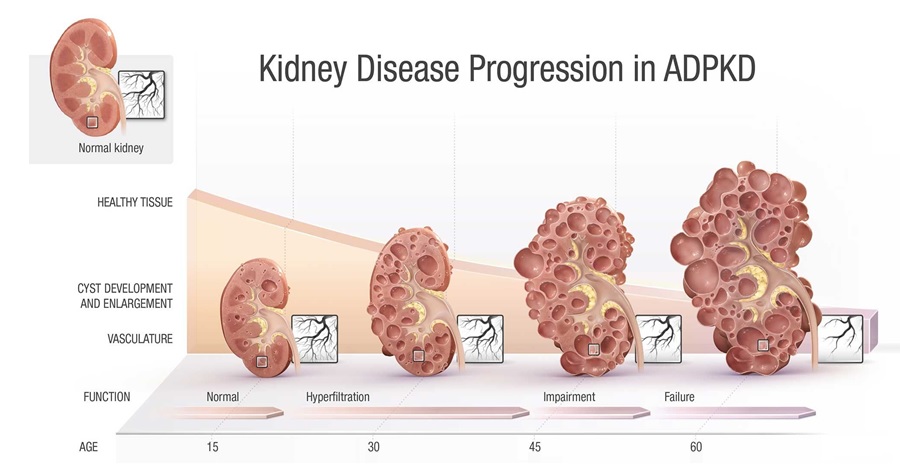

Figure 1: Kidney Disease Progression in Autosomal Dominant Polycystic Kidney Disease (ADPKD)

FINANCIAL ANALYSIS & VALUATION:

- Valuation: Our price target of US$2.30 is based on a DCF through 2030 with a discount rate of 20% consistent with smaller biotech companies.

- We estimate peak royalty revenues for XORTX in 2028 could exceed C$200 million.

- Our target price is extremely conservative even when compared to a long list of biotech companies at a similar stage of development in kidney, liver or orphan diseases.

- Initiating coverage on XORTX with a Speculative Buy rating and a US$2.30 price target, representing a significant upside from current levels.

//

You can download the full 33-page report by clicking here: eR-XRX-IR-2020_08_17-FINAL

//

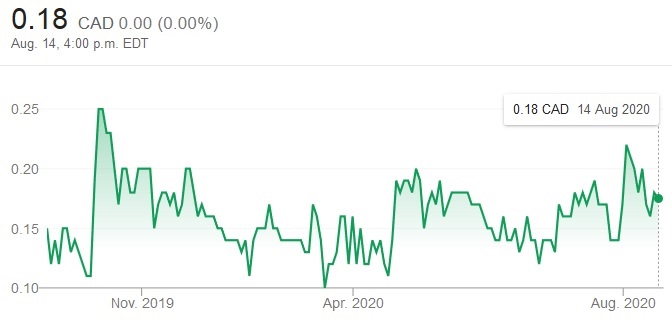

CHART 1: XORTX 1-Year Stock Chart