eResearch | The top six banks in the U.S. reported Q2/2020 earnings with expected Loan Loss Provisions (“LLP”) totaling almost US$35 billion, which provides an economic barometer regarding the economy’s overall financial health based on expected credit loss impacts.

This year, consumers and businesses across the world received unprecedented fiscal support from governments amid the COVID-19 pandemic, with banks offering various payment moratoriums and other forms of borrower forbearance.

However, unlike previous occurrences when high levels of borrower forbearance were offered, the current situation is vastly different due to uncertainty of the COVID-19 pandemic. Forbearance plans are usually intended for short-term relief to protect consumer creditworthiness.

Nevertheless, while U.S. banks struggled with consumer and retail banking divisions due to the COVID-19 pandemic enforcing social isolation guidelines, most banks maintained dividend payments due to strong growth in investment banking and sales & trading divisions.

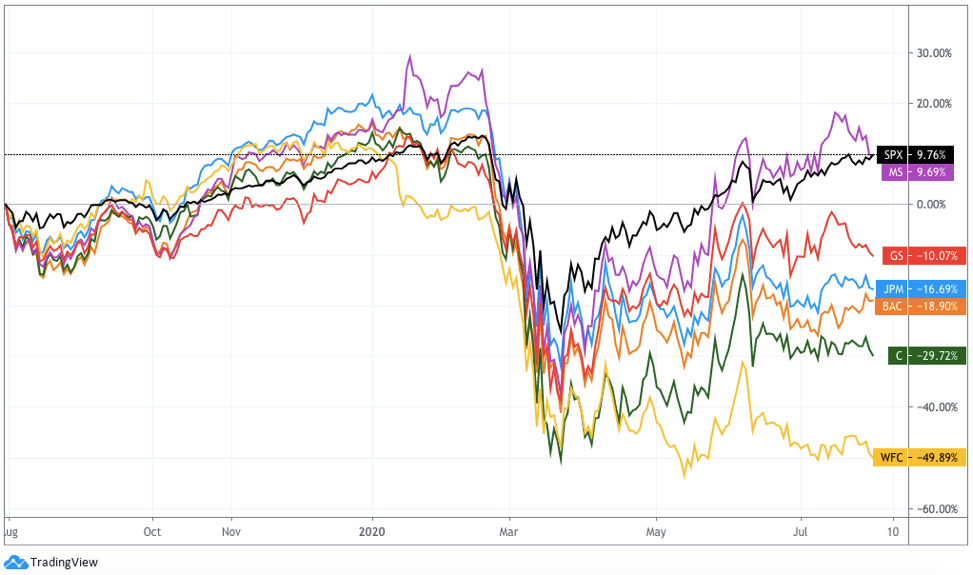

U.S. Loan Loss Provisions – Q2/2020

In Q2/2020, the top six banks in the U.S. collectively reported a total of US$34.6 billion in LLPs, a 39.5% increase compared with the prior quarter.

Last quarter, the six banks drastically increased LLPs to US$24.8 billion due to COVID-19 impacts, compared with last year, when combined LLPs of the top six banks were US$5.3 billion per quarter.

CHART 1: U.S. Bank Stocks – Provisions for Loan Losses (2019-2020)

Morgan Stanley (NYSE: MS) stood out as it reported the lowest amount of LLPs at US$239 million, with Goldman Sachs Group Inc. (NYSE: GS) reporting the second lowest amount at US$1.59 billion.

Unlike the rest of the banks who increased LLPs on average by 50% quarter-over-quarter, Morgan Stanley managed to lower its LLPs by more than 40%.

The other four banks, JPMorgan Chase & Co. (NYSE: JPM), Wells Fargo & Co. (NYSE: WFC), Citigroup Inc. (NYSE: C), and Bank of America Corp. (NYSE: BAC), together accounted for 95% of total reported LLPs.

JPMorgan reported the highest LLPs at US$10.5 billion, followed closely by Wells Fargo with US$9.5 billion. JPMorgan and Wells Fargo’s combined LLPs accounted for more than 50% of the total LLPs across the six banks.

U.S. Banks

JPMorgan

In Q2/2020, JPMorgan reported US$10.5 billion in LLPs, a 26% increase quarter-over-quarter, mainly consisting of US$4.6 billion in reserves for wholesale credit and US$4.4 billion in reserves for consumer credit, predominantly in cards.

In Q2/2020, JPMorgan reported US$10.5 billion in LLPs, a 26% increase quarter-over-quarter, mainly consisting of US$4.6 billion in reserves for wholesale credit and US$4.4 billion in reserves for consumer credit, predominantly in cards.

However, JPMorgan’s Corporate & Investment banking division reported an impressive growth in revenue to US$16.4 billion, a 66% increase year-over-year, which mainly consisted of Investment banking revenues of US$3.40 billion, Fixed income trading revenues of US$7.34 billion, and Equity trading revenues of US$2.38 billion.

In the earnings call, Jamie Dimon, CEO of JPMorgan, stated that the bank had another US$20 billion in loan loss reserves ready, if needed in a worst case scenario.

Last month, JPMorgan passed the Federal Reserve’s annual stress test and announced no expected changes to dividend payments. JPMorgan is expected to continue paying dividends of US$0.90/share per quarter.

JPMorgan Q2/2020 Financial Highlights

- Net revenue of US$33 billion, a 15% increase year-over-year.

- Net Income of US$4.69 billion, a 51% decrease year-over-year.

- Balance sheet includes Deposits with banks of US$473 billion, Debt and equity instruments of US$451 billion, Available-for-sale securities of US$486 billion, Net loans of US$979 billion, Net investment securities of US$559 billion, Deposits of US$1.93 trillion, and Long-term debt of US$317 billion.

- ROE of 7% compared with 16% the prior year.

- CET1 capital ratio of 12.4%.

Wells Fargo

In Q2/2020, Wells Fargo reported US$9.53 billion in LLPs, a 138% increase quarter-over-quarter, the highest relative increase among the top six banks. The LLPs mainly consisted of US$6 billion from its Wholesale banking division and US$3.38 billion from its Community banking division.

In Q2/2020, Wells Fargo reported US$9.53 billion in LLPs, a 138% increase quarter-over-quarter, the highest relative increase among the top six banks. The LLPs mainly consisted of US$6 billion from its Wholesale banking division and US$3.38 billion from its Community banking division.

Wells Fargo reported a Net loss of US$2.38 billion, which led to a cut in quarterly dividends to US$0.10/share from US$0.51/share. Wells Fargo was the first of the major U.S. banks to reduce dividends since the 2009 financial crisis.

Last month, eResearch published an article which explained why Wells Fargo was at the greatest risk for a dividend cut.

In the earning call, Charles Scharf, CEO of Well Fargo, stated the bank took a US$400 million hit in expenses related to decisions made regarding the pandemic, including safety improvements for employees and work facilities. To better manage current and future risks, Wells Fargo plans to have five lines of chief risk officers for specific high-risk teams such as the Consumer lending group.

Wells Fargo Q2/2020 Financial Highlights

- Net revenue of US$17.8 billion, a 17.6% decrease year-over-year.

- Net loss of US$2.38 billion, compared with a Net income of US$6.21 billion the prior year.

- Balance sheet includes Loans of US$935 billion, Deposits of US$1.41 trillion, and Debt securities of US$473 billion.

- ROE of negative 6.6% compared with 13.3% the prior year.

- CET1 capital ratio of 10.9%.

Citigroup

In Q2/2020 Citigroup reported US$7.69 billion in LLPs, a 19.4% increase quarter-over-quarter, which included US$4 billion in reserves for the Consumer banking division and US$3.69 billion in reserves for the Corporate banking division.

In Q2/2020 Citigroup reported US$7.69 billion in LLPs, a 19.4% increase quarter-over-quarter, which included US$4 billion in reserves for the Consumer banking division and US$3.69 billion in reserves for the Corporate banking division.

However, Citigroup experienced strength in its Institutional clients group, which reported revenues of US$12.1 billion, a 21% increase year-over-year, accounting for more than 50% of total revenues. A significant portion of the growth stemmed from Fixed income trading sales, which reported revenues of US$5.59 billion, a 68% increase year-over-year.

In the earnings call, Mark Mason, CFO of Citigroup, stated that the bank took actions to lower risk in the current environment by putting a pause on proactive marketing expenditures and applying a more stringent guideline for credit line increases.

Last month, Citigroup passed the Federal Reserve’s annual stress test and announced no expected changes to dividend payments. Citigroup is expected to continue paying dividends of US$0.51/share per quarter.

Citigroup Q2/2020 Financial Highlights

- Net revenue of US$19.8 billion, a 5% increase year-over-year.

- Net Income of US$1.32 billion, a 73% decrease year-over-year.

- Balance sheet includes Deposits with banks of US$287 billion, Securities of US$283 billion, Trading account assets of US$362 billion, Investments of US$433 billion, and Loans of US$685 billion.

- ROE of 2.4% compared with 10.1% the prior year.

- CET1 capital ratio of 11.5%

Bank of America

In Q2/2020, Bank of America reported LLPs of US$5.12 billion, a 7.48% increase quarter-over-quarter, which included provisions of US$2.61 billion for the Consumer banking division and US$2.50 billion for the Commercial banking division.

In Q2/2020, Bank of America reported LLPs of US$5.12 billion, a 7.48% increase quarter-over-quarter, which included provisions of US$2.61 billion for the Consumer banking division and US$2.50 billion for the Commercial banking division.

However, Bank of America experienced strong growth in its Sales and trading division, which increased revenue by 28% to US$4.2 billion, and its Investment banking division, which increased revenue by 57% to US$2.2 billion.

In light of the COVID-19 pandemic, Bank of America provided support by delivering US$25 billion in funding to small business owners and 1.8 million payment deferrals across credit card, auto, mortgage, home equity, and small business loans.

Last month, Bank of America passed the Federal Reserve’s annual stress test and announced no expected changes to dividend payments. Bank of America is expected to continue paying dividends of US$0.18/share per quarter.

Bank of America Q2/2020 Financial Highlights

- Net revenue of US$22.3 billion, a 3% decrease year-over-year.

- Net Income of US$3.53 billion, a 52% decrease year-over-year.

- Balance sheet includes Cash and cash equivalents of US$289 billion, Federal funds sales and securities of US$451 billion, Trading account assets of US$226 billion, Debt securities of US$472 billion, Loans of US$999 billion, Deposits of US$1.72 trillion, and Long-term debt of US$262 billion.

- ROE of 5.4% compared with 11.6% the prior year.

- CET1 capital ratio of 11.6%

Goldman Sachs

In Q2/2020, Goldman Sachs reported LLPs of US$1.59 billion, a 70% increase quarter-over-quarter, which included US$819 million for the Investment banking division, US$183 million for the Global markets division, US$271 million for the Asset management division, and US$317 million for the Consumer & wealth management division

In Q2/2020, Goldman Sachs reported LLPs of US$1.59 billion, a 70% increase quarter-over-quarter, which included US$819 million for the Investment banking division, US$183 million for the Global markets division, US$271 million for the Asset management division, and US$317 million for the Consumer & wealth management division

Goldman Sachs experienced strong top line growth through its Global markets and Investment banking divisions. The Investment banking division’s underwriting arm reported revenues of US$2.05 billion, a 107% increase year-over-year, while its Global markets division’s Fixed income, Currency and Commodities arm reported revenues of US$4.24 billion, a 149% increase year-over-year.

In the earnings call, David Solomon, CEO of Goldman Sachs, said “In the United States we are seeing early indications of economic improvement, including the better than expected 18% rebound in retail sales and notable improvement in unemployment in June to approximately 11%. As markets assess the impact of the virus in the second quarter and its potential economic consequence, we experienced a rise in the valuation of risk assets”.

Last month, Goldman Sachs passed the Federal Reserve’s annual stress test and announced no expected changes to dividend payments. Goldman Sachs is expected to continue paying dividends of US$1.25/share per quarter.

Goldman Sachs Q2/2020 Financial Highlights

- Net revenue of US$13.3 billion, a 41% increase year-over-year.

- Net Income of US$2.42 billion, unchanged year-over-year.

- Balance sheet includes Cash and cash equivalents of US$132 billion, Collateralized agreements of US$274 billion, Trading assets of US$398 billion, Loans of US$117 billion, Deposits of US$268 billion, and Long-term debt of US$223 billion.

- ROE of 8.4% compared with 11.1% the prior year.

- CET1 capital ratio of 13.6%

Morgan Stanley

In Q2/2020, Morgan Stanley reported LLPs of US$239 million, a 41% decrease quarter-over-quarter, which included US$121 million for the Corporate banking division, US$34 million for the Secured lending facilities division, US$23 million for the Wealth management division, and US$89 million for the Commercial banking division.

In Q2/2020, Morgan Stanley reported LLPs of US$239 million, a 41% decrease quarter-over-quarter, which included US$121 million for the Corporate banking division, US$34 million for the Secured lending facilities division, US$23 million for the Wealth management division, and US$89 million for the Commercial banking division.

Morgan Stanley experienced significant growth in its Institutional securities division, which reported revenues of US$7.98 billion, a 56% increase year-over-year, accounting for more than 50% of total revenues.

James Patrick Gorman, CEO of Morgan Stanley, said “We continue to support our employees and communities through these challenging times through financial, equipment, medical and other means of support. We remain focused on opportunities to work smarter and more efficiently. We have learned a lot about our organization and its cost structure through this period, and we will leverage that learning to continue to optimize how and where we work and how we use our technology”.

Last month, Morgan Stanley passed the Federal Reserve’s annual stress test and announced no expected changes to dividend payments. Morgan Stanley is expected to continue paying dividends of US$0.35/share per quarter

Morgan Stanley Q2/2020 Financial Highlights

- Net revenue of US$13.4 billion, a 31% increase year-over-year

- Net Income of US$3.19 billion, a 45% increase year-over-year.

- Balance sheet includes Deposits of US$237 billion, Loans of US$151 billion, Liquidity resources of US$301 billion, and Long-term debt of US$202 billion.

- ROE of 15.7% compared with 11.2% the prior year.

- CET1 capital ratio of 16.5%.

2021 Forecasts and Estimates

According to S&P Global, in the U.S. and Canada, total LLPs is expected to reach US$366 billion between the beginning of 2020 and the end of 2021, compared with a total of US$63 billion in LLPs last year.

Across the 88 banking systems S&P Global covers throughout the world, total LLPs is expected to reach US$1.3 trillion globally this year, double the US$603 billion reported last year. Next year, assuming a strong economic recovery, total LLPs is expected to decrease to US$825 billion.

Moving forward, the banks’ asset qualities are expected to be volatile as economies across the world tread carefully in an uncertain environment. Only time will tell if U.S. banks put aside enough for defaults and forbearances.

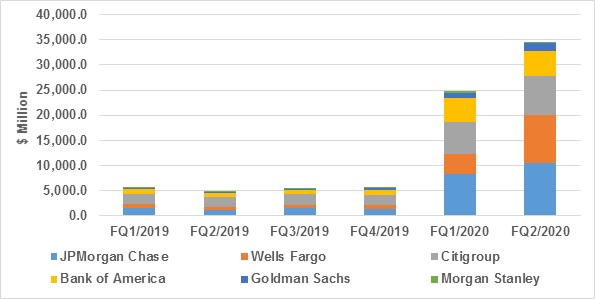

CHART 2: S&P 500 (black) vs Bank of America (orange), Citigroup (green), Goldman Sachs (red), JPMorgan Chase (blue), Morgan Stanley (purple), and Wells Fargo (yellow) – LTM Stock Performance