Below is an abridged version of an article by Nick Barisheff from bmg-group.com about how the current investment reality and market stress bodes well for the price of gold.

//

Many experts had been warning about over-inflated markets that were just waiting for a spark to ignite the entire system and then came the COVID-19 pandemic.

Unfortunately, while the virus itself is life threatening and will result in large demographic changes across the globe, the economic implications may be worse than the disease.

Given the situation, the only asset class that will do well in the foreseeable future is precious metals, particularly gold.

Major economies in Europe, Canada and the United States have been shut down.

- Industries such as airlines, hotels, manufacturing, entertainment, sports, schools and retail are in lockdown.

- Most of the western world is ravaged by fear, isolation, loss of employment, loss of income and the psychological effect of this massive lockdown situation.

- Employees have either been terminated or laid off indefinitely.

- The scale of this unemployment crunch and financial crisis is beyond the reach of governments’ assistance.

- Many businesses will not be able to reopen once the health issues have been controlled.

- When the health crisis subsides, the economic effects will last for years; we may, in fact, never recover.

There Are A Number Of Things We Know For Sure

While there is a great deal of uncertainty because of COVID-19, there are a number of things that we know for sure:

- Many industry sectors have no revenue.

- Governments will print enormous amounts of money in an attempt to mitigate the financial crisis.

- Most companies with no earnings will see enormous declines in share prices.

- Bonds, particularly corporate bonds, will default and become worthless.

- Even real estate is likely to suffer dramatic declines, as both commercial and residential tenants are likely to default on rent payments. This in turn will result in mortgage defaults at every level, and properties will be sold at fire sale prices.

The above conditions create a perfect storm for an increasing gold price.

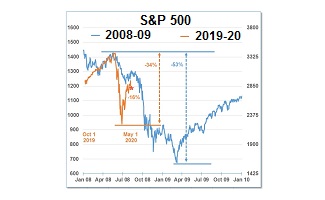

S&P 500 Sector Performance Compared To Gold YTD

Stock markets around the world have suffered the worst first quarter in history. Every sector, other than gold, has suffered losses from 12% to 50%.

CHART 1: S&P 500 Sector Performance Compared to Gold Spot Price

Unfunded Pension Liabilities Will Negatively Impact Balance Sheets

For North American public companies, the increases in unfunded pension liabilities will negatively impact balance sheets.

The unfunded liabilities will have to be amortized over five years, thereby reducing corporate profits at a time when they may be non-existent due to the COVID-19 lockdown.

This will put additional downward pressure on stock prices at a time when they are experiencing ongoing declines.

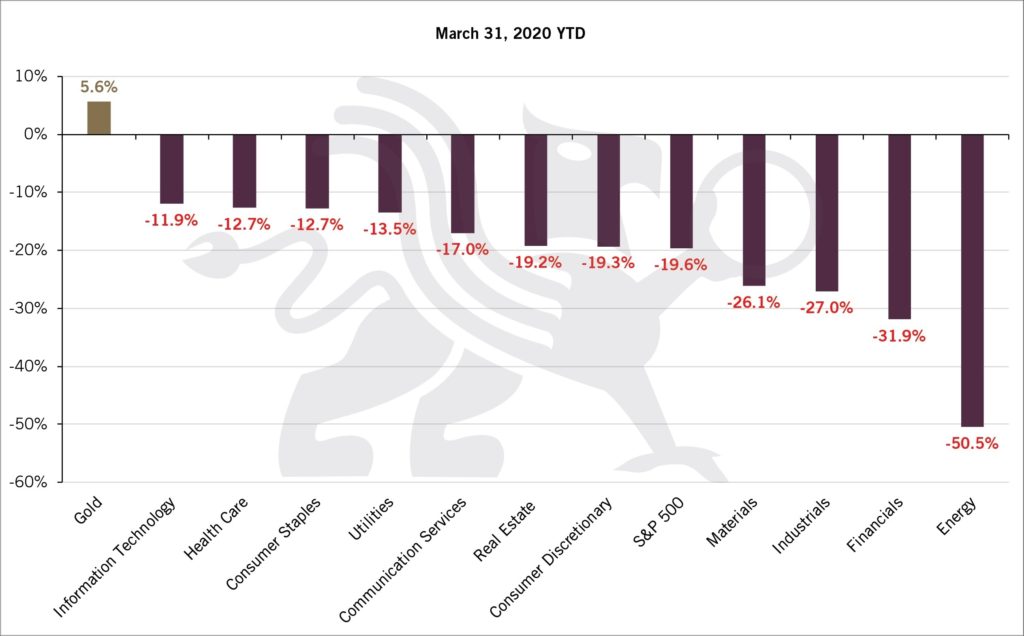

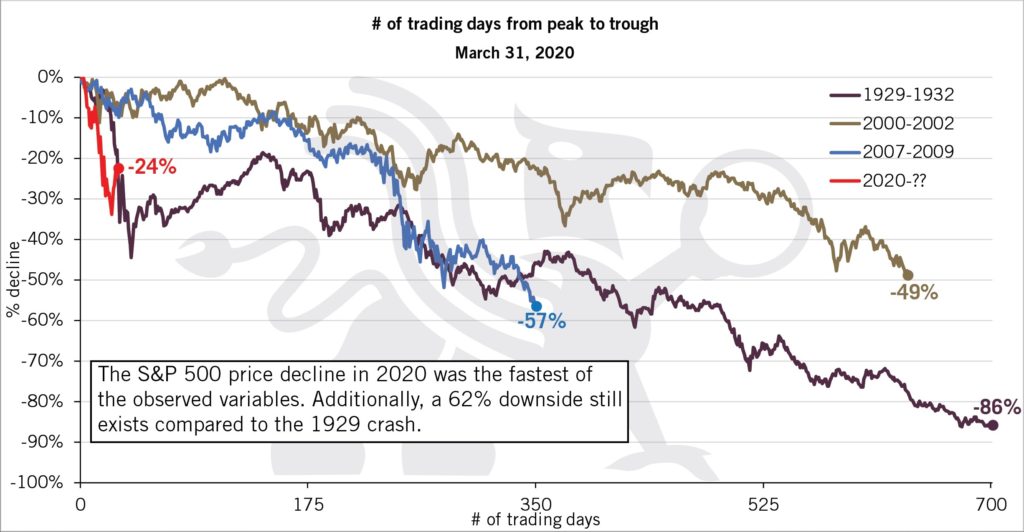

S&P 500 Historical Recession Performance

It is critical to note that there is no recovery in sight, and corporate earnings will be non-existent for the foreseeable future.

Many experts believe this crash will be worse than that of 1929, and that we have just experienced the first phase.

CHART 2: S&P 500 Historical Recession Performance

The only asset class that will do well in the foreseeable future is precious metals, particularly gold.

Gold Has Risen In ALL Currencies Since 2000

While there have been years of losses, particularly in 2013, gold has risen in all currencies since 2000 and many investors are surprised by its steady performance.

- Gold’s performance since 2000 has been an average compounded return of about 9%

- In 2019, the average increase was 17.8%.

- The YTD average for 2020 is 15.8%, which works out to an annualized return of about 63% per annum. In Canadian dollars, gold is up 15.9% YTD and it was up 5.6% in U.S. dollars in Q1 2020.

…to continue reading the full post of this abridged article, please visit Munknee.com.

//

munKNEE.com is a new affiliate of eResearch.com. To learn more about munKNEE.com, please visit their website and sign-up for their weekly newsletter.