eResearch | Our Recession Barometer is designed to forecast an Economic Recession when certain yield curve metrics become inverted. All of our indicators in the last two weeks declined, that is, moved away from an Inversionary reading, and moved away from the possibility of an Economic Recession occurring. However, given the unprecedented global economic chaos being caused by the COVID-19 crisis, economic pundits now unanimously predict negative GDP growth in Q1/2020, substantial negative GDP growth in Q2/2020, and likely a third quarter of negative GDP growth in Q3/2020. It takes two consecutive quarters of negative GDP growth to trigger an Economic Recession.

With an Economic Recession now firmly on the horizon, the stock market has received a hammering. Substantial recovery is unlikely to occur until the market consolidates with a base and there are signs that the coronavirus negative impact is dissipating.

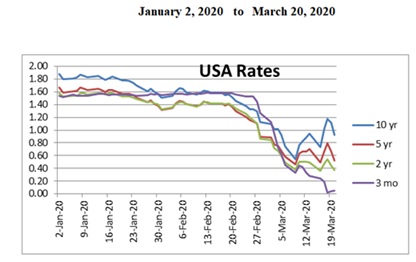

Volatile Interest Rates

We featured the following chart two weeks ago. It has been turned upside down. The yields have separated AND they are now in their correct relationship, with the longer dated maturities trending higher.

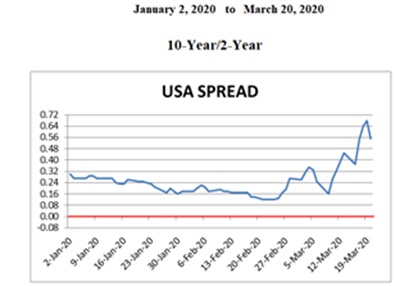

Key Metric: The 10-Year/2-Year Yield Curve Ratio

Same thing: a separation. That means a widening of the Spread, which is our next chart.

We consider the 10Y/2Y metric to be the most important of our recession-watch indicators. The fact that the Spread has moved considerably away from an Inversion reading is perplexing given all the dire warnings recently about the United States going into a recession shortly because of the impact of the COVID-19 crisis.

Recession Watch

In our last report, we said:

“Caveat: The coronavirus, known as Covid-19, if it turns into a global pandemic, will certainly impact global economies significantly, and most likely cause an Economic Recession in many countries of the world. It is unlikely that the United States would escape this scenario.”

This now seems to be reality.

You can read our comprehensive report by clicking the following link: Recession Barometer – US – March 20 2020

//