eResearch is pleased to publish an Update Report on Kuuhubb Inc. (TSXV:KUU). The report covers the Company’s Fiscal Q2/2020 Financial Results. You can download the full 12-page report by clicking here: eR-KUU-UR-2020_03_10-SENT

COMPANY DESCRIPTION:

Kuuhubb Inc. (“Kuuhubb” or “the Company”) focuses on digital entertainment and casual eSports targeting the female demographic. The Company creates and acquires games and applications for female audiences with a focus on relaxation, expression, and entertainment. Kuuhubb’s main apps are Recolor, a digital colouring book application, and My Hospital, a simulation game application. Currently in soft launch are two Match-3 apps with story-based formats, Tiles & Tales and Dance Talent, and, in development, is a new casual eSports Match-3 Battle Royale game.

FQ2/2020 FINANCIAL RESULTS:

- Revenue for the 3 months, ended December 31, 2019, was $1.97 million compared to revenue of $3.07 million for the 3 months ended December 31, 2018. Revenue for the quarter was slightly higher than our estimate of $1.90 million.

- Revenue was primarily generated from sales of the Recolor App, in-application sale of virtual goods from the My Hospital game, and in-application advertising.

- According to the Company, revenue from the Recolor App stabilized during the quarter with a successful new product update in November 2019, but revenue from the My Hospital game decreased in the quarter due to a dispute with Cherrypick Games, the apps creator and support developer.

- Overall expenses were $2.3 million in FQ2/2020, below our estimate of $2.5 million, mainly due to lower spending on Sales & Marketing.

- During the three months ended December 31, 2019, Kuuhubb incurred a net loss of $1.4 million compared to a net loss $2.1 million in the same quarter a year ago.

- Cash flows from operating activities for the three months ended December 31, 2019, was positive, for the first time in a year, at $95,222, compared to $136,492 in same period during the prior fiscal year.

FINANCIAL ESTIMATES & VALUATION:

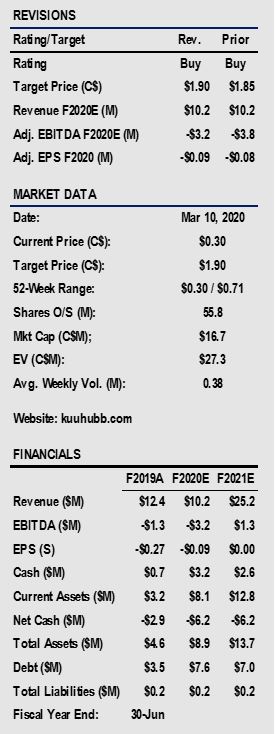

- For the next 3 Fiscal years, ending June 30, we estimate Kuuhubb’s revenue as follows:

- F2020: Revenue $10.2 million; EBITDA -$3.2 million;

- F2021: Revenue $25.2 million; EBITDA $1.3 million;

- F2022: Revenue $59.3 million; EBITDA $8.9 million.

- We estimate an equal-weighted price per share target of C$1.90, blending a target price based on a DCF valuation (C$3.01/share) and a Revenue Multiple valuation (C$0.81/share).

- Currently trading at 1.3x C2020 EV/Revenue compared with the Large Cap gaming comps trading at 3.4x C2020 EV/Revenue and the Nordic gaming comps at 2.8x C2020 EV/Revenue.

We are maintaining a Buy rating and increasing the one-year price target to C$1.90/share from C$1.85/share.

//

You can download the full 12-page report by clicking here: eR-KUU-UR-2020_03_10-SENT