eResearch | The following commentary is taken from BNN Bloomberg Market Call in which Keith Richards of ValueTrend provides two scenarios for the market outlook that could occur after the recent market down-turn.

MARKET OUTLOOK

There are two potential scenarios here:

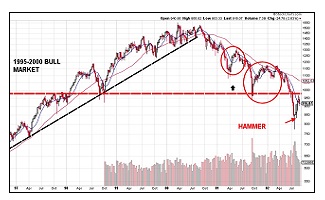

- If we see a bullish reversal pattern, backed by a Bear-o-meter “buy” signal (which we will be reading on Monday), we will invest the 12 per cent cash and sell some of the gold/silver holdings held in the platform. There’s strong potential that this market is in a washout phase. For those interested in what a reversal pattern looks like, we put in a diagram of some of the “candlestick” patterns that we look for on our blog today. In particular, the hammer, doji and engulfing patterns strongly coincide with market reversals.

- If the S&P 500 remains below 3,000 points for too long, it would suggest the potential for further downside. Our discipline is to sell upon a break of the 200-day simple moving average (SMA) and a break of technical support if it lasts for more than a few days. This strategy sometimes whipsaws us, but it worked wonders for us in the 2008-2009 crash, where markets fell 50 per cent and didn’t recover until mid-2013 (the ValueTrend Equity Platform fell only 17 per cent and recovered fully near the end of 2009). It also worked well for us in the 2011 selloff, where markets fell 20 per cent, while the VTEP fell only 7 per cent and recovered quickly from that small pullback. If the S&P 500 level remains below 3,000 as of Wednesday of next week, we will leg a bit more cash out. We will do this one step at a time. If the market is in a bear (debatable), it will have counter-trend rallies. We leg-out into rallies in a bear market.

At this juncture, our “bet” is that we will see a reversal pattern shortly. The signs of market capitulation are high and nine out of 10 times, this leads into a market bottom. But our discipline trumps an opinion. You may rest assured knowing that we raised cash and bought precious metals a month ago, ahead of the crowd. Clearly, this won’t eliminate market risk, but it puts our clients well ahead of the buy/hold gang.

You may also rest assured in knowing that when we redeploy that cash into stocks, it will be in accordance to rules that have saved our clients from much of the market volatility in the past. In either case, we view this market as opportunistic. After all, these situations change. Those with a plan tend to profit from such developments. For what it is worth, we hear that Warren Buffett has been buying this week. He is not a market timer, but he is a pretty smart guy.

//