eResearch | The yield curve ratios for our key interest rate metrics have been declining recently. On the back of falling interest rates, the yield curve ratios that make up our Recession Barometer have been falling. As a result, our Recession Barometer reading moved up in each of the last two weeks and now stands at 8.5X. However, there is still no threat of all the key metrics being inverted any time soon and, therefore, little likelihood of an Economic Recession occurring in the United States in the near future.

This prediction could change in a hurry if Covid-19 escalates into a full-blown global pandemic.

Key Metric: 10-Year/2-Year Yield Curve Ratio

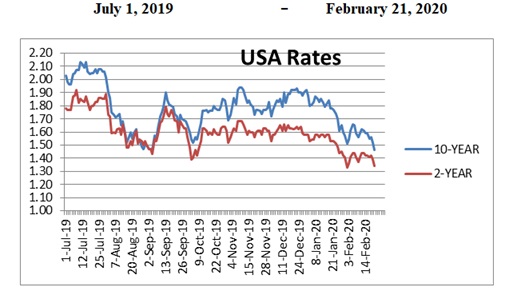

The first chart below shows the trend in 10-year and 2-year interest rates since July 1, 2019. Until the beginning of August, there was a notable gap between the two maturities. Then, they moved more closely together until the beginning of October. At that point, the gap widened considerably. After moving sideways for a while, both maturities are now declining and the gap has narrowed.

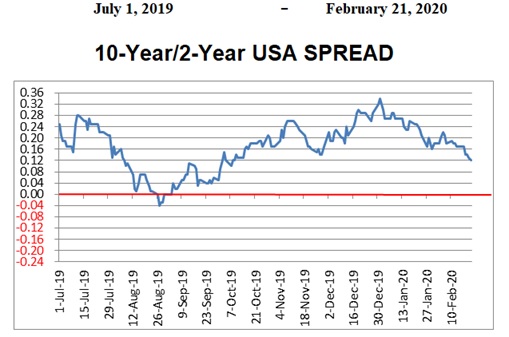

This relationship shows up better in the Spread chart that follows. The chart shows the 10-year/2-year spread since July 1, 2019. The Spread has essentially declined since February 5, and ended this past week at 0.12x. Although down from 0.30x at the end of December, it is still well above the Inversionary level of 0.00x.

Recession Watch

We are mindful that a substantial number of Spreads at the short-end of the yield curve are inverted. However, the overall Recession Barometer Reading is 8.5x, albeit rising, and the Spreads for all of our key interest rate maturities are still positive. So, there is no consensus of Inversion from the Spreads. For the moment, therefore, there is no empirical evidence to support a call for an Economic Recession in the USA in the near future.

Caveat: The coronavirus, known as Covid-19, if it turns into a global pandemic, will certainly impact global economies significantly, and most likely cause an Economic Recession in many countries of the world. It is unlikely that the United States would escape this scenario.

You can read our comprehensive report by clicking the following link: Recession Barometer – US – February 21, 2020

//