eResearch | The Dividend-Income Portfolio suffered a 2.3% set-back on Friday after reaching an all-time high the previous day. This caused three stocks to tip over into negative territory. The winners in the Portfolio are all up by double digits.

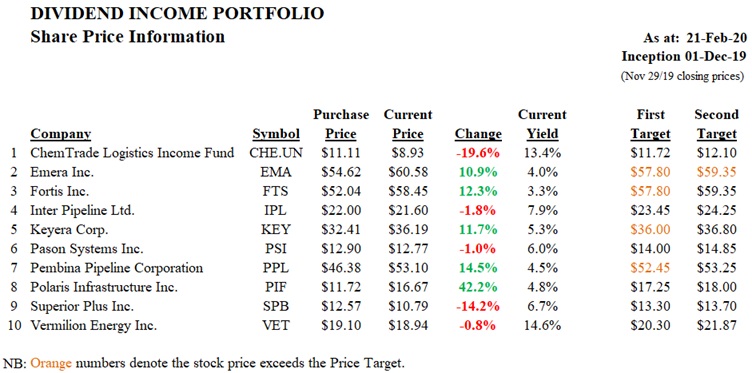

The Portfolio

The 10 stocks that comprise the Portfolio are shown below. There have been no changes since Inception on December 1 last year. ChemTrade Logistics is clearly the under-performer, affected by the rail/highway blockade. Superior Plus claimed the same problem for its propane distribution business. These stocks should show some recovery when the blockade ends.

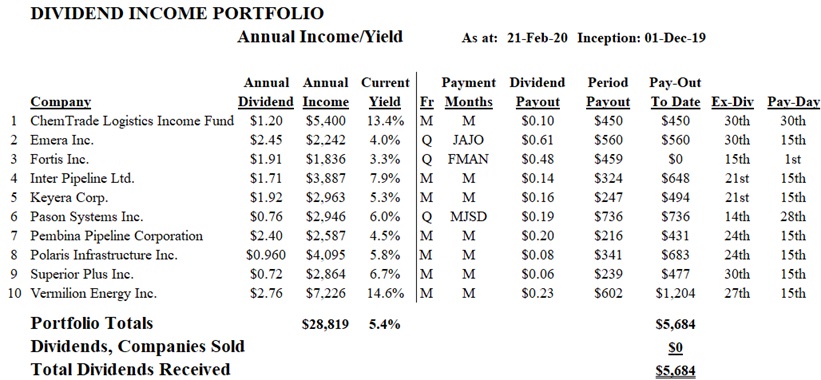

Dividend Income

The next table shows the relevant information concerning the dividend income generated by the Portfolio. The overall Portfolio is generating a yield of 5.4%.

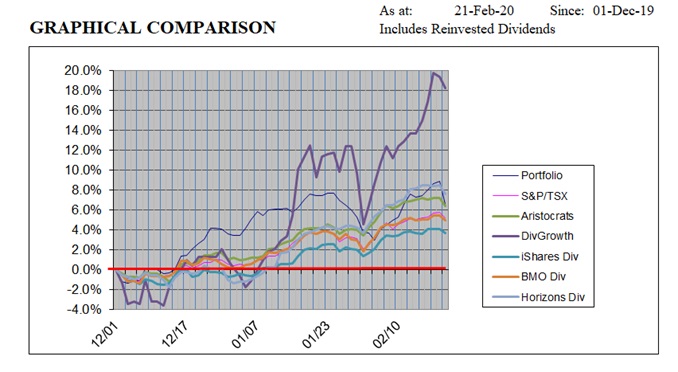

Comparables

We have included 5 ETFs as comparables and the S&P/TSX Composite Index to serve as benchmarks for our Portfolio’s performance. The following graphic depicts how well our Portfolio has done to date, and compared to the “Comps”. The Dividend Growth Split Corp. is the run-away winner. The Portfolio is third best behind the Horizons Canadian Dividend ETF.

Comprehensive Report

You can read our entire report here: Dividend-Income Portfolio – February 21, 2020

//