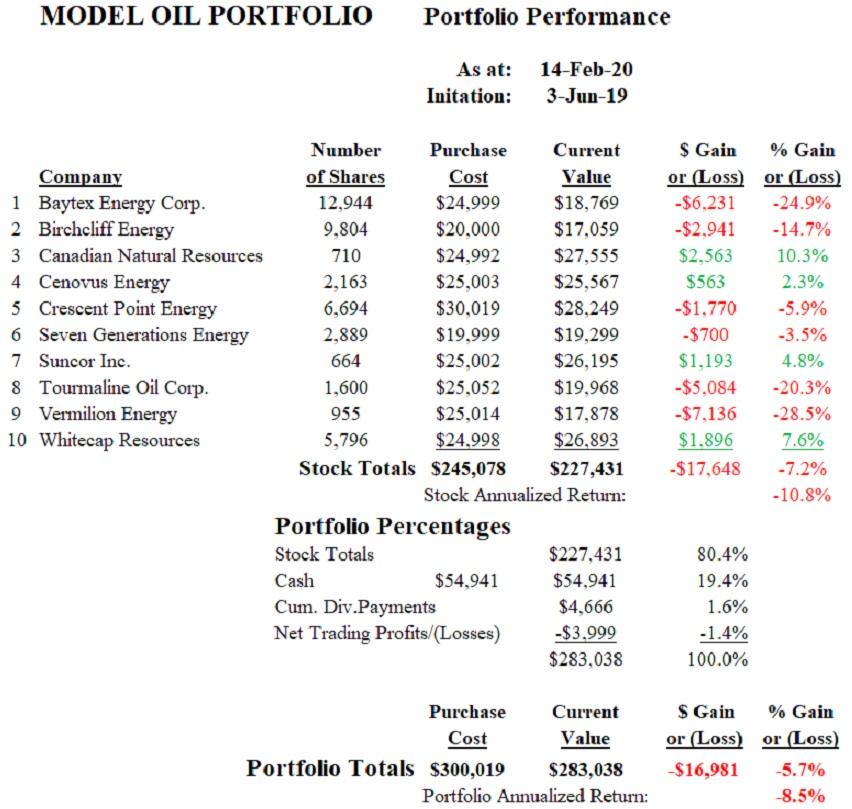

eResearch | The Energy Sector fared a little better over the last two weeks. However, our Model Oil Portfolio dropped 0.9% and is now down 5.7% since inception on June 2, 2019 while, for 2020, it is off 14.6%. Many of the benchmarks we use are also struggling. The fear is that the coronavirus could spread globally and instigate a significant slow-down in a variety of economic areas.

Portfolio Composition

Portfolio 2019 Performance

Our Model Oil Portfolio was initiated on June 3, 2019 with capital of $500,000. The value of the stock component at inception was $300,019. At the end of December 2019, or seven months later, the Portfolio was worth $326,659, including dividends received and trading profits. This represents a gain of 8.9% and compares to a gain of 1.8% for the S&P/TSX Energy Index, a gain of 13.6% for the price of crude oil, and a gain of 6.3% for the S&P/TSX Composite Index.

Portfolio 2020 Performance

At the beginning of 2020, the Model Oil Portfolio stood at $326,659. A month and a half later, it is at $283,038, a decrease of 14.6%. For comparison, the S&P/TSX Energy Index is down 10.8%, the price of crude oil is off 16.7%, but the S&P/TSX Composite Index is up 4.9%.

Winners and Losers

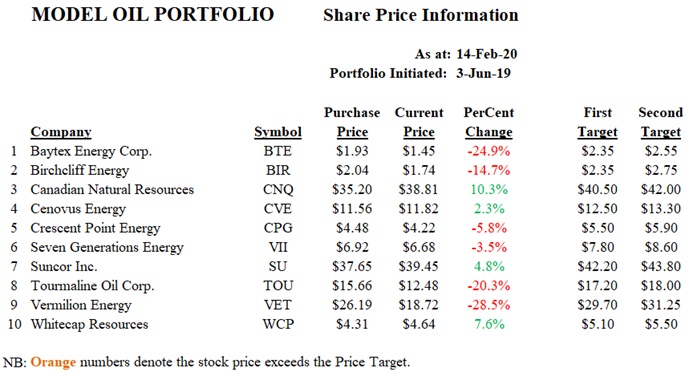

Of the 10 stocks in the Portfolio, there are 4 that are showing a profit so that 6 are “under water”.

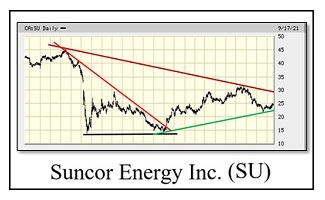

Our 4 positive-performing stocks since inception are Canadian Natural Resources (up 10.3%), Whitecap Resources (up 7.6%), Suncor Inc. (up 4.8%), and Cenovus Energy (up 2.3%).

Our primary laggards are the same as two weeks ago: Vermilion Energy (down 28.5%), Baytex Energy (down 24.9%), and Tourmaline Energy (down 20.3%).

Cash Position

The current cash component, which includes dividends received and trading profits/losses, is $55,608, which is 19.6% of the total portfolio value.

//