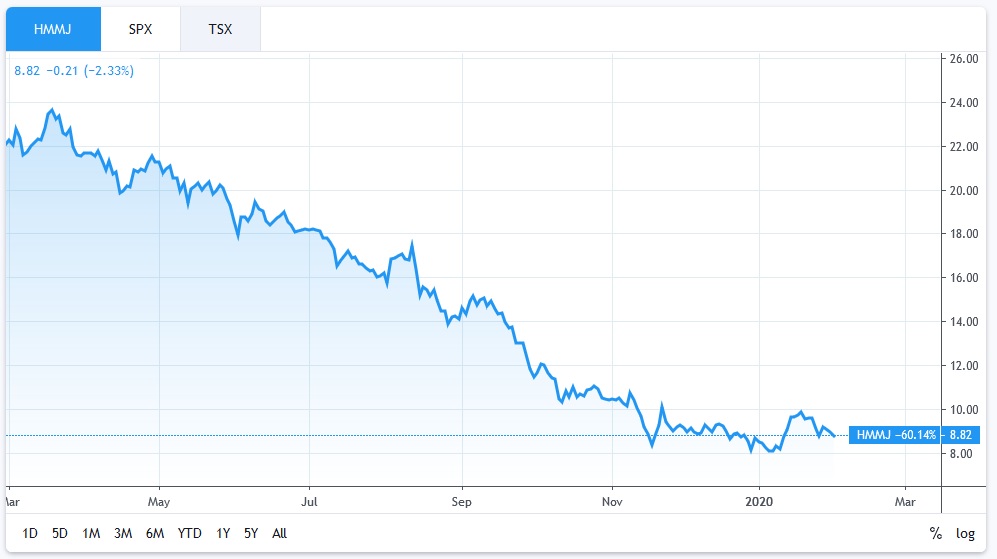

eResearch | Horizons Marijuana Life Sciences ETF (TSX: HMMJ), the first established cannabis ETF, has fallen almost 60% in share price in the past year due to several factors including (1) missed earnings from constituent companies, (2) vaping-related health concerns, and (3) miscarried government regulations.

As cannabis companies fail to meet expectations for scale and growth in revenue, the industry is losing demand and interest.

Cannabis ETFs Shut Down

Evolve Funds Group, a Canadian firm, announced the shut down of two of its cannabis focused ETFs, the Canadian focused Evolve Marijuana Fund (SEED.TO) and the U.S. focused Evolve U.S. Marijuana ETF (USMJ.NE). No further subscriptions for the two funds will be accepted after February 26, 2020.

Evolve Funds Group, a Canadian firm, announced the shut down of two of its cannabis focused ETFs, the Canadian focused Evolve Marijuana Fund (SEED.TO) and the U.S. focused Evolve U.S. Marijuana ETF (USMJ.NE). No further subscriptions for the two funds will be accepted after February 26, 2020.

The Canadian and U.S. cannabis funds had only $5.9 million and $2.3 million in assets under management, respectively, with major constituents including Canopy Growth Company (TSX: WEED), Aphria Inc. (TSX: APHA), and Tilray Inc. (NASDAQ: TLRY).

Reasons for closing of the funds include the lack of federal legalization in the U.S., vaping concerns, and the overall underperforming cannabis market.

Canopy Delays Cannabis 2.0 Products

Last month, Canopy Growth, the largest cannabis company in the world by market cap, announced a delay on its cannabis infused beverages the day after Ontario’s first day of 2.0 cannabis product sales.

Canopy Growth has yet to scale up its beverage production facility in Smith Falls, Ontario, and has yet to announce a revised timeline, but it believes the delay will not have any material impact to its fiscal 2020 revenue.

Ontario’s supply of cannabis infused edibles and beverages are all currently sold out, which brings concerns for Canopy Growth potentially missing out on revenue when there is high demand for cannabis 2.0 products.

Cannabis Company Earnings

Aprhia’s stock took a hit after missing analyst estimates on Q2/2020 earnings, with reported revenue of C$120 million and a net loss of C$9.2 million. Aphria’s CFO, Carl Merton, mentioned on the conference call that the main reason for its setback was due to a slower than expected retail store roll-out with a delay on 40 additional stores that were supposed to open.

OrganiGram (TSX: OGI), on the contrary, had better than expected revenue for its fiscal Q1/2020 earnings, with reported revenue of C$25 million and a net loss of C$863,000. Organigram announced positive news of its cannabis 2.0 product business with a successful roll-out of vapes and an order for edibles from a major province being tripled.

It has been a slow and challenging year for the cannabis market due to set backs from governments and a slow retail roll-out, but it is starting to become evident which companies are going to reach profitability by the end of 2020.

As Canada slowly rolls out cannabis 2.0 products, all eyes are now on the U.S for federal legalization to stimulate the market again.

//

Chart 1: HORIZONS MARIJUANA LIFE SCIENCES IDX ETF