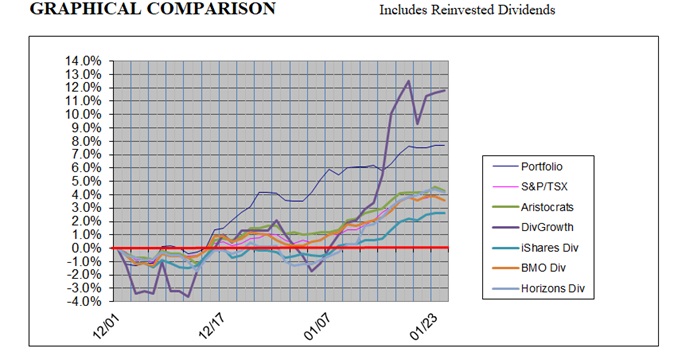

eResearch | The Dividend-Income Portfolio has gained 7.7% since Inception on December 1 last year. It has out-performed all but one of its comparables to date. Half of the stocks in the portfolio have risen above their initial two Price Targets, so it time to review and re-evaluate these situations.

The Portfolio

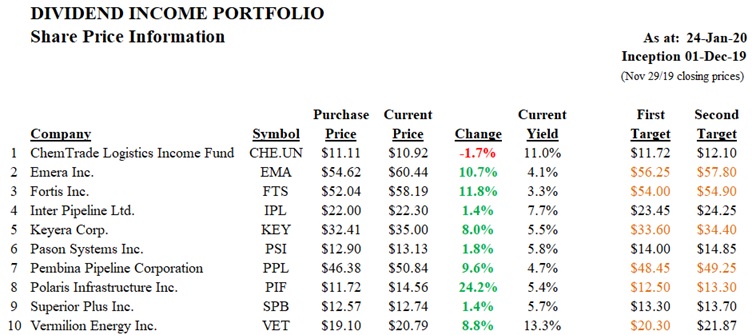

The 10 stocks that comprise the Dividend-Income Portfolio are shown below. There have been no changes since Inception on December 1 last year. Quite a few of the stocks have exceeded both of their Target Prices.

Comparables

We have included 5 ETFs as comparables and the S&P/TSX Composite Index to serve as benchmarks for the portfolio’s performance. The following graphic depicts how well the portfolio has done to date, and compared to the “Comps”.

Comprehensive Report

You can read our entire report here: Dividend Portfolio_January 24, 2020

//