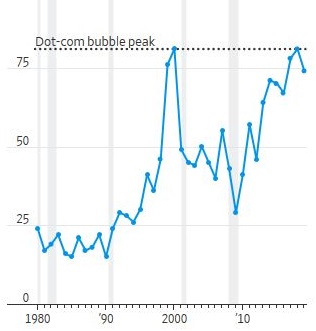

According to an article in the Wall Street Journal, 40% of listed companies in the U.S. have negative net incomes over a one-year period. This percentage is the highest level since the late 1990’s during the Dot-Com era.

The data also shows that for equity IPO’s greater than US$5/share, over 75% are losing money.

Unprofitable companies are IPO’ing and raising cash at a rate not seen since the late 1990’s, before the Tech Bubble burst.

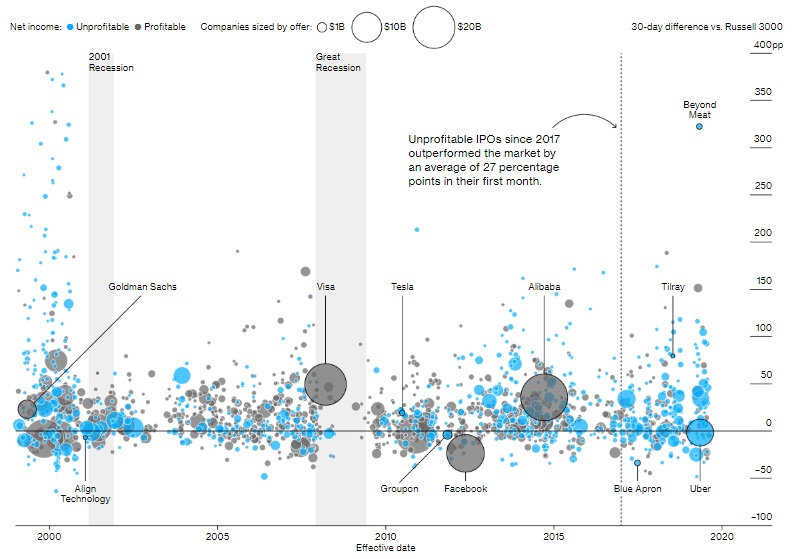

Lyft, Peloton, Pinterest and Uber Technologies are all part of the IPO class of 2019 raising almost US$10 billion and, together, have already raised the most cash of any year since 2000.

According to data from Bloomberg, while still not as bad as during the period before the Dot-Com bubble burst, unprofitable company IPOs have grown since the financial crisis in 2009 and many have outperformed the market in their first few months after the IPO.

Tesla is the poster-child of the “loss” maker and even though it posted a profit in the last quarter, during the last 12 months the company lost over US$800 million, and has not had a profitable year since it IPO’d in 2010.

According to the data, 42% of the companies losing money are health-care (biotech) companies and 17% are tech companies.

//