eResearch | We will be starting anew as of January 1 with a fresh portfolio of stocks in our Top Ten Portfolio. The Portfolio was only able to generate a gain of 5.5% in Q4-2019 but the S&P/TSX Composite Index did not do much better, only increasing by 6.0%. Until the recent military escalation in the Middle East, the investment community was fairly bullish for the stock market in 2020. Now, the market is not so sure, and if the political tensions increase appreciably, we could see the long-awaited sell-off.

21.0% Gain For 2019

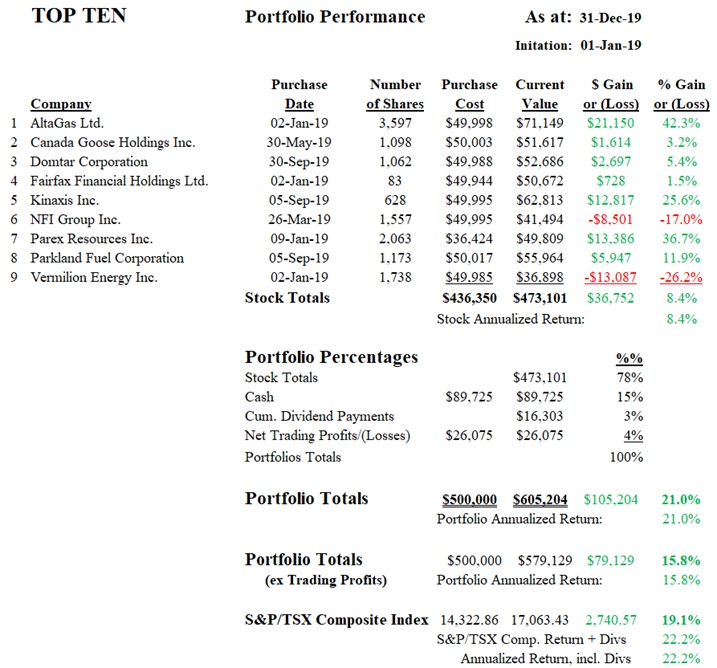

Our initial investment was $500,000 so, at $605,204, the Portfolio is ahead by 21.0%, which includes dividends received, trading profits, and investable funds (cash).

Market Outlook

The very recent sabre-rattling in the Middle East, if it escalates appreciably, could lead to a market pull-back. After an extended stock market rally throughout much of 2019, it could also result in a prolonged slump. Certainly the market does not go up interminably. In terms of a possible sell-off if and when it occurs, based on current metrics, it is likely to be shallow and short-lived, unless some kind of war engulfs the Middle East and then it could be much more pronounced. Certainly a pull-back of 5%-7% would be welcome if it opens up attractive buying opportunities.

Worst and Best Performers

Of the 9 stocks present in the Portfolio at year-end, 7 were positive and 2 were “under water”. The best performers were AltaGas (+42.3%) and Parex Resources (+36.7%). The two losers were Vermilion Energy (-26.2%) and NFI Group (-17.0%).

The year-end portfolio is presented below:

You can read our comprehensive year-end report here: Top Ten Portfolio – 2019 Year End Report

//