eResearch | Spruce Point Capital Management, a New-York-based firm focused on shorting company stocks, issued a negative report on Canadian Tire Corporation, Limited (TSX:CTC.A) that sees a potential downside of 50%.

To read the article and download their report, please click here: https://www.sprucepointcap.com/canadian-tire-corporation-ltd/

Spruce Point has made short calls on other companies such as Cintas Corp. (Nasdaq:CTAS) and Hill-Rom Holdings, Inc. (NYSE:HRC)

In the report, Spruce Point argues that Canadian Tire:

- Is not well positioned in an e-commerce and mobile world

- Does not offer free shipping, like some of its competitors

- Is not price competitive

- Is lagging in its social media

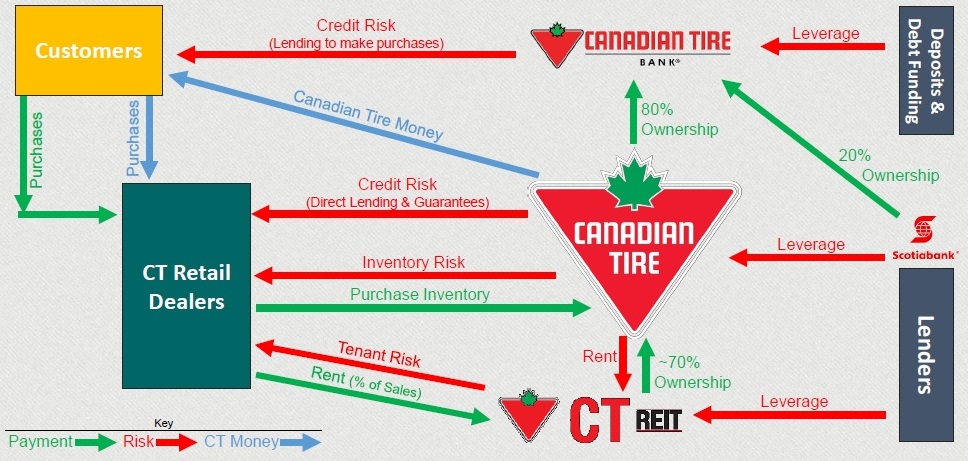

- Has a complicated organization structure

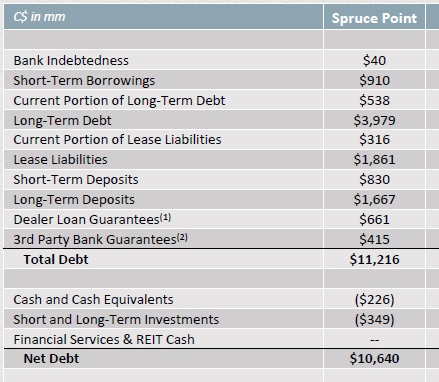

- Has a large debt load

Figure 1: Canadian Tire Corporate Organization Chart

During Canadian Tire’s November 7 earnings conference call, the Company announced:

- A goal of saving C$200 million by 2022 through operational efficiencies

- The intent to repurchase C$350 million of shares by the end of 2020

- An increase to their dividend by 9.6% per share

As the recent quarterly revenue was C$3.35 billion, down from C$3.37 a year ago, Spruce Point thinks the Company has been misdirecting funds towards share repurchases and increasing dividends, and should be paying down the debt.

Figure 2: Canadian Tire – Total Debt and Net Debt

Spruce Point is not the first short seller to short the Toronto-based retailer. In August 2019, Steve Eisman disclosed his short position in an interview with BNN Bloomberg, concerned about Canadian Tire’s credit card business.

Steven Eisman, is a Senior Portfolio Manager with Neuberger Berman, and was made famous in Michael Lewis’ book and film “The Big Short” as the investor that made billions shorting Collateralized Debt Obligations (CDOs), and profiting after the collapse of the U.S. housing bubble in 2007–2008.

///

Canadian Tire (TSX:CTC.A)

- corp.canadiantire.ca

- Headquartered in Toronto, Canada, Canadian Tire provides a range of retail goods and services in Canada. The Company operates through three segments: Retail, CT REIT, and Financial Services. The Retail segment retails general merchandise, apparel, footwear, sporting equipment, and gasoline. The CT REIT segment operates as a closed-end real estate investment trust that holds a portfolio of properties comprising Canadian Tire stores. The Financial Services segment provides financial and other ancillary products and services, including credit cards and in-store financing.

- Canadian Tire is currently trading at C$142.96 with a market cap of C$8,806.4 million.

Figure 3: Canadian Tire – 1-Year Stock Chart

///