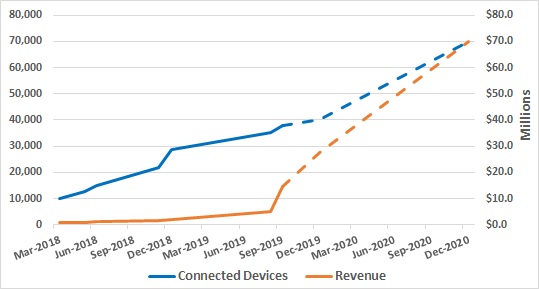

mCloud released its Q3/2019 financials and, with partial-period revenue from the Autopro acquisition that closed in mid-July, revenue increased over 200% quarter-over-quarter to C$9.2 million.

Year-to-date revenue of C$14.4 million, up from C$1.9 million year-over-year, also benefited from the acquisition’s revenue stream.

In Q4/2019, mCloud expects to have revenue in the C$13-15 million range, incorporation organic and inorganic growth.

mCloud

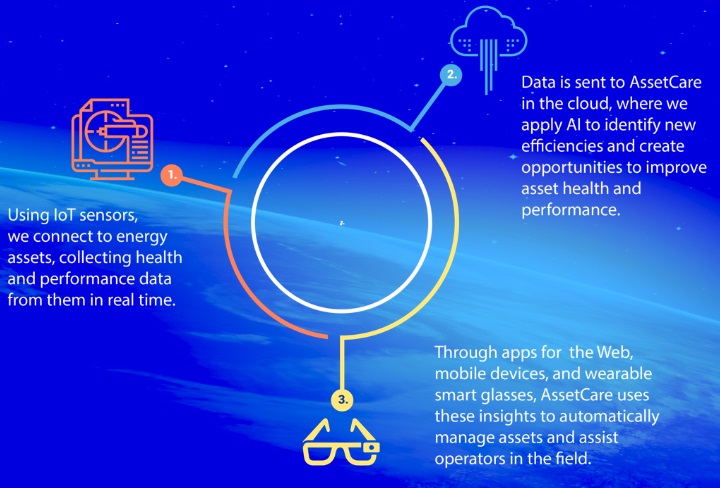

mCloud provides a software-as-a-service (SaaS) solution, AssetCare™, to manage, monitor and optimize physical assets that are connected on the internet or wirelessly.

mCloud’s solutions utilize the Internet-of-Things (“IoT”) technologies as well as Artificial Intelligence and Analytics, integrating real-time and historical data, to manage and optimize the performance of equipment such as HVAC (heating, ventilation, and air conditioning) systems, telecommunications equipment, wind turbines, and Oil & Gas equipment.

mCloud’s clients include casinos, shopping centres, smart buildings, office towers, refineries, and wind farms.

Figure 1: How the AssetCare Platform Works

At the start of 2019, mCloud closed the purchase of royalty agreement with Agnity Global that solidified its IoT asset management platform and expansion into Europe’s telecom space.

In July 2019, mCloud acquired Fulcrum Automation and Autopro Automation, which was expected to add C$35 million in revenue and C$5.5 million in EBITDA annually.

Autopro Automation is a professional engineering and integration company that specialized in the design and implementation of industrial automation solutions.

mCloud gauges growth by the number of connected assets under management. In June 2018, the company had 15,000 connected assets, expects at least 40,000 connected asset by the end of 2019, and almost doubling to 70,000 connected assets by the end of 2020.

With this growth in connected assets, mCloud expects revenue in the range of C$70.0-$80.0 million in 2020.

Chart 1: Connected Devices and Revenue

mCloud is in the process of up-listing the stock from the TSX-V to the TSX and also preparing for a listing on the NASDAQ stock exchange.

//

mCloud Technologies (TSXV:MCLD)

- mcloudcorp.com

- Headquartered in Vancouver, Canada, mCloud Technologies provides asset management, Software-as-a-Service (SaaS) solutions combining analytics, artificial intelligence (AI), cloud computing, and the Internet-of-Things (IoT). Its AssetCare platform offers asset management solutions to three segments, including smart buildings, wind energy, and oil and gas.

- mCloud Technologies is currently trading at $0.47 with a market cap of $72.9 million.

Chart 2: MCLD 1-Year Stock Chart; Up 36.8% while TSX up only 13.0%