eResearch | The eResearch Recession Barometer for the U.S. continues to trend above the critical Inversion level. Our Barometer Reading is composed of three metrics; (1) the 10-year/2-year yield curve ratio; (2) an equal-weight average of 3 yield curve ratios, comprising the 20-year/10-year, the 10-year/3-month, and the 5-year/2-year maturity comparisons; and (3) an equal-weight average of 12 yield curve ratios.

In order to trigger the eResearch Count-Down to an Economic Recession in the U.S., the 10-year/2-year ratio MUST be inverted, and 2 of 3 metrics (10/2, 3-ratio, and 12 ratio) MUST be inverted, and the Combined Reading MUST be inverted.

Ratio Spreads

Currently, the 10/2 ratio sits at 0.12x and went up this past week. The 3-ratio reading is currently 0.01x, and the 12-ratio reading is at 0.02x. The Combined Reading rose last week from 0.04x to the current 0.05x, which translates into a Barometer Reading of 9.0X, which is the same as the previous week.

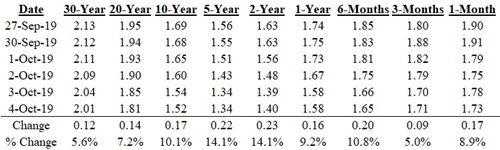

Interest Rates declined across the board in the United States last week, but particularly in the 2-year to 5-year range. The table below represents Friday, September 27 to Friday, October 4 and shows interest rates for various maturities from 30-years at the long-end down to 1-month at the short-end.

Conclusions

Our criterion for declaring Inversion is that: (1) using the Combined Spread, the Recession Barometer reading must be 10; and (2) two of the three Series must be inverted and one of these must be the 10-Year/2-Year Yield Curve.

In conclusion, although some of the key recession-watch metrics weakened this past week, the most important metric (10/2) widened. All of this in the context of the U.S. economy continuing to put out mixed signals.

You can read our comprehensive 7-page report by clicking the following link: Recession Barometer US 2019-10-04

//

Resources: