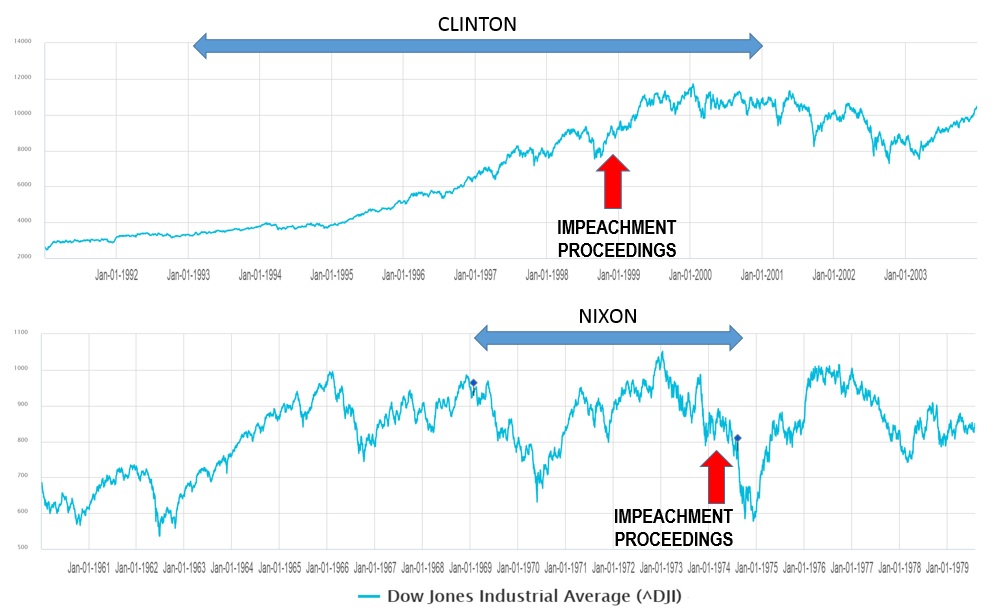

eResearch | The Big Buzz in the United States right now is the impeachment enquiry surrounding President Trump. Keith Richards of ValueTrend looked back at how the market reacted in the previous two impeachment proceedings, concerning Richard Nixon and Bill Clinton.

Richard Nixon actually did not get impeached. He resigned before that enormous political embarrassment was voted on. He knew that he was going to lose. The Nixon impeachment enquiry started in February 1974. By the time Nixon resigned in August, the stock market, as measured by the Dow Jones Industrial Average, fell around 30%.

Bill Clinton faced his impeachment enquiry beginning in October 1998. He was impeached by the House of Representatives but was exonerated by the Senate one year later. The stock market initially declined a relatively minor 1% on the day that impeachment was initiated but, one year later, when the Senate cleared him, the stock market was up 30%.

So, in one instance, the stock market fell 30% and in the other it rose 30%. Obviously, there were other extenuating circumstances at play in the market at the respective times of impeachment for Nixon and Clinton.

During Nixon’s tenure, the world’s monetary system was adjusting to the suspension of the gold standard. In fact, the U.S. economy was actually in recession. It was also recovering from the October 1973 oil crisis.

As for what was happening during Clinton’s era, the stock market was “on fire”, being in the midst of the dot.com bubble.

Thus, it seems that the stock market was more in tune with the economy and what was going on in the country rather than the actual impeachment proceedings of either President.

As for President Trump, so far the stock market has been relatively subdued as it has declined less than 1% since U.S. House of Representatives Speaker Nancy Pelosi initiated the Trump impeachment inquiry.

Consequently, investors are probably best served by focussing on the outlook for the economy rather than the Trump impeachment proceedings. The U.S.-China trade rift, the ongoing General Motors strike, unemployment trends, wage growth, GDP growth, and other economic indicators are likely more important to assessing the future direction of the stock market.

For the full ValueTrend article, please visit the ValueTrend website.