eResearch | The surge in the price of oil yesterday has spawned a raft of commentaries about what investors should consider with this unexpected turn of geopolitical events. An Investing Daily article has some sage and insightful words for investors to ponder.

It is well known that Saudi Arabia is the world’s largest oil exporter. It used to be the world’s largest oil producer, but the unprecedented wide-scale development of the U.S. shale industry has usurped that title in favour of the United States.

The U.S. oil industry (and also that of Russia, also one of the world’s largest oil producers) is spread throughout the country. In Saudi Arabia, the situation is different as it is a small-sized country and its oil assets are not spread widely geographically. This makes it vulnerable to attack, which has now occurred.

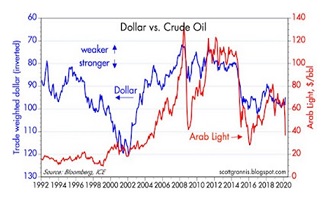

Robert Rapier, the article’s author, postulates that, without the massive U.S. shale boom, international oil prices would probably never declined below US$100/barrel. He further ponders how much higher the price of oil could be now if the U.S. shale boom had never happened and then factoring in the attack last week-end that removed almost 6 million barrels a day of oil from the international markets. Obviously, the price would be much higher!

Looking ahead, there are several possibilities for what impact on society this attack has brought. For one, if Saudi Arabia is not able to get its production back on line in a reasonable time, then prices at the gas pump are likely to spike considerably higher.

Second, the consequences of this attack and its illustration of just how vulnerable the Middle East countries are to a well-planned terrorist attack are likely to cause a permanent “premium” to be attached to the oil price in world markets.

Third, permanently higher oil prices will no doubt have a big impact on the U.S. economy. There is already an abundance of fears that the U.S. could go into recession and higher oil prices could be a big part of making that prediction come true. Higher pump prices would impact consumer spending, which has been the hub of the U.S. economy recently.

Fourth, investors are likely to seek safe havens for their money. Maybe gold. Maybe Treasuries.

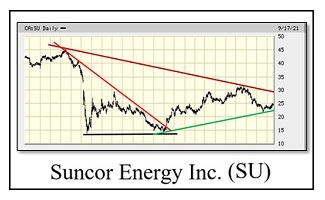

For investment considerations, the oil producers and the oil refiners could expect increased focus in the near-term.

To read the entire Investing Daily article, click HERE