Written by: Jay Yi, MBA; Edited by: Chris Thompson, CFA, MBA, P.Eng

eResearch | On September 15, 2019, in an effort to join the hot European property market, BlackRock, Inc. (NYSE: BLK), the world’s largest asset manager with US$6.8 trillion in assets under management, announced acquisition of Dream Global Real Estate Investment Trust, a Canadian Real Estate Investment Trusts (REIT) focused on European property, primarily in Germany and the Netherlands, for C$3.3 billion. Dream Global also brings along C$2.9 billion in debt which brings the deal’s total worth to C$6.2 billion.

eResearch | On September 15, 2019, in an effort to join the hot European property market, BlackRock, Inc. (NYSE: BLK), the world’s largest asset manager with US$6.8 trillion in assets under management, announced acquisition of Dream Global Real Estate Investment Trust, a Canadian Real Estate Investment Trusts (REIT) focused on European property, primarily in Germany and the Netherlands, for C$3.3 billion. Dream Global also brings along C$2.9 billion in debt which brings the deal’s total worth to C$6.2 billion.

Dream Global REIT (TSX: DRG.UN; FSE; DRG)

- Trading at C$16.58 per share with a market capitalization of C$3.2 billion.

- C$5.9 billion gross asset value with 72% of assets in Germany, 23% in Netherlands, 3% in Austria, and 2% in Belgium.

- Assets are 94% office buildings and 6% industrial properties.

- Credit rating of Baa2, 5.7% distribution yield, 4.8% cap rate, and 77% payout ratio.

- Leverage of 39%, unencumbered assets of 28%, and average debt term of 4.6 years

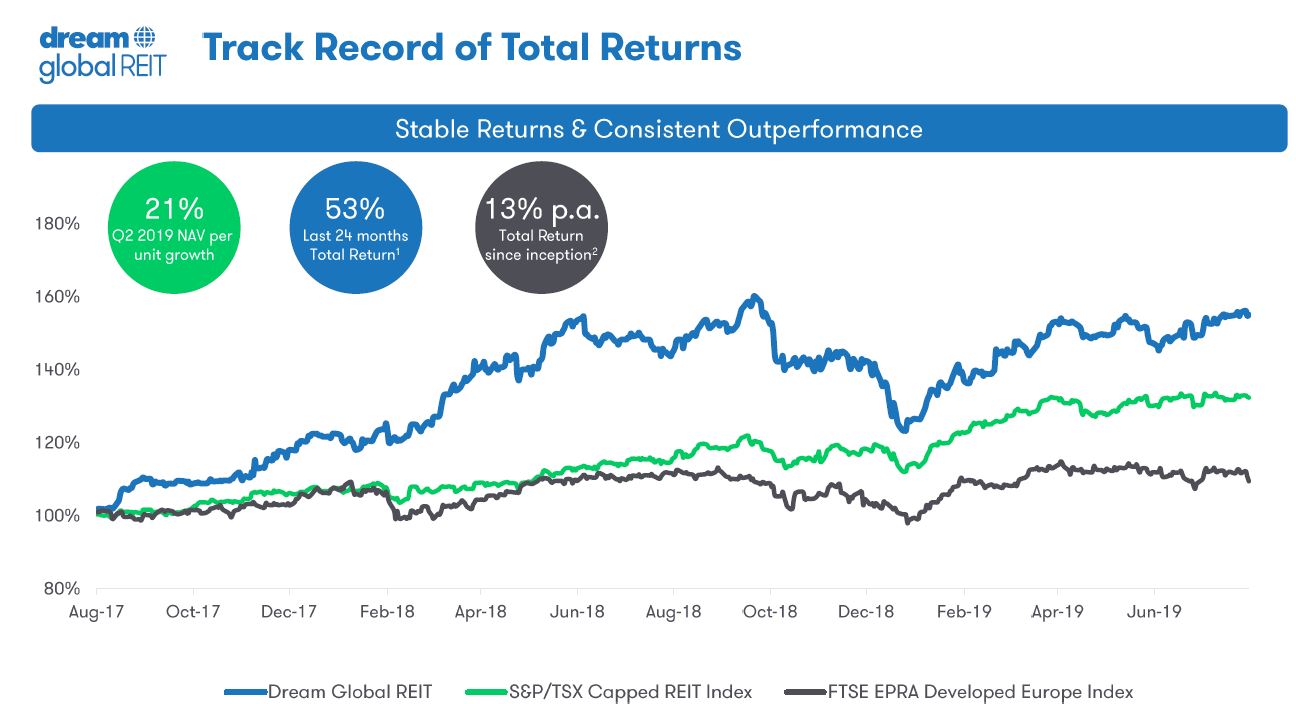

Dream Global REIT Market Performance 2017-19

Source: Q2/2019– Dream Global REIT Investor Presentation

Interest rates are falling everywhere as the Federal Reserve is expected to cut interest rates again tomorrow after having already lowered rates in July 2019. Emerging market policymakers are following suit with 37 developing countries showing net 14 rate cuts last month as recession fears build up.

As interest rates trend lower and lower, REITs are getting more and more popular. Countries in Europe with negative interest rates such as Sweden have been a highlight for its property market, as the central bank of Sweden has been aggressively cutting interest rates since 2008 resulting in residential properties rising in price by about 50% in the past 7 years.

There is evidence of the market expecting interest rates to stay low as asset managers such as BlackRock are trying to capture appreciation in property prices which is supported by an increase in demand from home buyers who have greater avenues for financing with low interest rates.

Long-term investors looking for safe, predictable cash flows from bonds are experiencing sub-par performance as yields are pressured downwards with growing global uncertainties and debt levels. Risk adverse investors searching for returns greater than bond yields should take a look at a diversification of REITs across different countries.

//

BlackRock, Inc. (NYSE: BLK; LSE: BRFI)

- Headquartered in New York City, U.S., BlackRock is the world’s largest asset manager with US$6.8 trillion in assets under management and global operations including 70 offices across 30 countries.

- BlackRock is currently trading at US$438.80 per share with a market capitalization of US$67.8 billion.

//