eResearch | No change for Canada. It is on an official eResearch Count-Down to a possible Economic Recession occurring in Canada between November 2020 and April 2021.

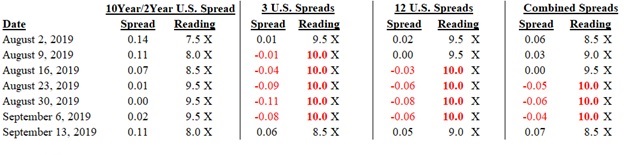

In the US, yields for maturities one year and out all rose dramatically last week. With short-term rates under one year remaining fairly stable, Spreads for maturities from 5-year/2-year and lower did not move that much. But Spreads for 10-year and higher all rose appreciably. Thus, the Recession Barometer readings for all four of our yield curve ratio metrics pulled back from the brink of initiating our Count-Down to a possible Economic Recession in the US.

Our most important yield curve metric is the 10-year/2-year Spread, which has now widened out after briefly flirting with Inversion at the end of August. Our “3 Spreads” metric, comprising 20-year/10-year, 10-year/3-month, and 5-year/2-year, were negative, or “inverted”, for five straight weeks before going decidedly positive this past week. Our “12 Spreads” reading also were negative/inverted until this past week. As shown in the table, there has been a dramatic increase in interest rates at maturities from one-year out to 30-years, while short-term rates have stayed fairly stable over the past fortnight. After three negative/inverted weeks, the Combined Spread has gone positive. All four of the metrics must be inverted in order to initiate the Count-Down. We came very close at the end of August. Last week we came back from the brink, and decidedly so.

You can read our entire 11-page report by clicking the following link: RB_091319