Written by: Bob Weir, CFA

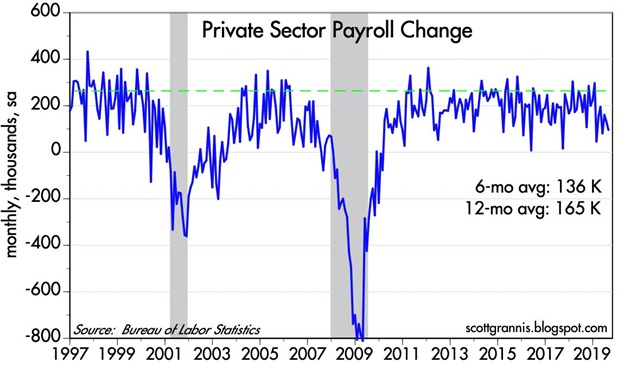

In his latest article, Scott Grannis, the Calafia Beach Pundit, notes that private–sector jobs growth is decelerating, as evidenced by the announced 96,000 private-sector jobs created in August, with the most notable gains coming in health-care and financial activities, and net job losses in mining. The expected increase in the private sector was for 150,000 new jobs.

Mr. Grannis believes that the lower job creation is no cause for concern and that it could easily reflect an increased difficulty in finding workers. The labour force participation rate was 63.2% in August, which level it has hovered around for all of 2019. In August, the number of unemployed persons was essentially unchanged at 6.0 million, and the unemployment rate remained at 3.7%.

Total non-farm payroll employment rose by 130,000 in August, which is below the year’s average monthly rate of 156,000, and compared to 223,000 in 2018.

Mr. Grannis claims that monthly statistics can be quite volatile and, therefore, cannot give an accurate picture of the true job creation mechanism. Instead, he considers the 6-month and 12-month rate-of-change in private-sector jobs to be much more meaningful in determining whether jobs growth is increasing or decreasing.

The next chart shows that jobs growth is currently trending around 1.3%-1.6% annually, which is definitely down from 2018’s experience around 2.0%.

Offsetting the slower rate of jobs growth has been a pick-up in labour productivity. Less workers are providing greater output. That is not a sign of a deteriorating economy.

To add impetus to his theory that companies are having some difficulty finding the workers that they want, Mr. Grannis provides a chart showing the difference between job offerings and the number of persons actively looking for work. The chart shows that, beginning in early 2018, there have been more job openings available than there have been persons looking for employment.

There has been increasing concern that the U.S. economy is slowing and that the possibility of an economic recession is increasing. Monitoring job growth is one key factor in this economic watch. Mr. Grannis is convinced that the recent spate of slowing jobs growth in the private sector is not a sign of a slowing economy overall, but reflects an increasing difficulty to find workers because of a shortage of people who are actually willing to work.

You can read the entire Calafia Beach Pundit article by clicking:

http://scottgrannis.blogspot.com/2019/09/jobs-growth-continues-to-slow-but-its.html

//