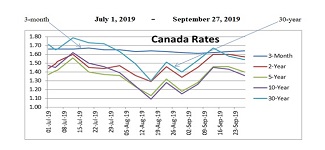

eResearch monitors a myriad of yield curve ratios for both Canada and the USA in order to assess whether either economy might be heading towards a recession.

On August 8, our Recession Barometer for Canada officially signaled an Inversion had occurred, which put Canada on a Count-Down to a possible Economic Recession. Historically, an Economic Recession occurs, on average, 15 to 20 months after an Inversion has occurred. That would mean an Economic Recession in Canada could occur between November 2020 and April 2021.

In the USA, our key Inversion metric, the 10-year/2-year yield curve ratio has not yet inverted (except intra-day) but it sits at a Spread of just 0.01x as of Friday. If the “game” between the White House and the Federal Reserve continues, that might just be enough to tip the scales, and this could happen sooner than later.

Our report this week looks at Interest Rates and Spreads for the 10-year/2-year and the 10-year/3-month yield curve ratios. We also provide a table that shows, unbelievably, that the Overnight Bank Funding Rate sports a higher yield than the Treasury bills or Treasury notes of ANY maturity, right out to 30 years!!!

You can access this week’s Recession Barometer report here: … RB_082319