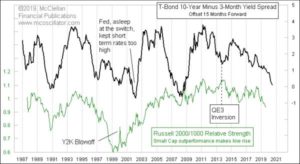

There is an ongoing debate in the media as to whether the various inverted yield curves, which historically have signaled an impending recession, will be realized this time around. The author, Tom McClellan, points out that there is a very reliable effect associated with yield curve fluctuations.

The first chart shows the Relative Strength between the Russell 2000 Index (R2) versus the Russell 1000 Index (R1), as well as the Spread between 10-year Treasury notes and 3-month Treasury bills. This Spread is currently “inverted”, meaning the 10-year note is yielding less than the 3-month bill. McClellan has shifted forward the 10-year/3-month Spread by 15 months in order to show how the R2/R1 Relative Strength ratio tends to follow the yield Spread in the same way after that lag time.

Since the R2/R1 Relative Strength line has been moving lower (i.e., small-caps are under-performing large caps), it is likely that the small-cap stocks are also likely to continue moving lower … perhaps for as much as the next 15 months.

What could throw the relationship off track is what the Fed does with its policy of restricting interest rates.

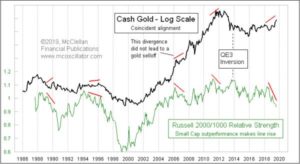

McClellan goes on to point out that there is another relationship that R2 and R1 have, and that is with gold, as shown in the second chart.

The chart above shows there is a strong longer-term correlation between R2/R1 and the price of gold. However, there have been short-term aberrations, as currently exists. While R2/R1 has been declining, the price of gold has been climbing.

The fact that Gold is rising is in contrast to what is occurring with the R2/R1 Relative Strength metric and the 10-year/3-month Spread.

You can read the entire report HERE