eResearch | On August 20, 2019, to vertically integrate operations, Canopy Growth Corp. (NYSE: CGC; TSX: WEED; LSE: 0UO9; DB:11L1) announced that it had received an extraction license from Health Canada for its KeyLeaf Life Sciences facility in Saskatchewan, which is expected to have an extraction capacity of 5,000 kilograms (kg) per day.

Canopy announced the acquisition of KeyLeaf in November 2018, with a strategy to leverage KeyLeaf’s chemists, engineers, and operators who collectively have decades of extraction experience. Canopy now has three significant extraction assets to support anticipated demand once alternative cannabis products become legal within Canada in October 2019.

Canopy announced the acquisition of KeyLeaf in November 2018, with a strategy to leverage KeyLeaf’s chemists, engineers, and operators who collectively have decades of extraction experience. Canopy now has three significant extraction assets to support anticipated demand once alternative cannabis products become legal within Canada in October 2019.

“This licence will ensure we have the supply of extraction inputs for the medical, CBD, and recreational markets, especially the next generation of value-add, high margin cannabis products here in Canada,” Canopy stated in the press release.

According to Zion Market Research, the cannabis oils market generated sales of US$147 million in 2018 and is expected to reach US$2.4 billion by 2025 (CAGR of 49.5%). The new segment is attractive for cannabis companies due to its higher margins, diversity in product channels, and speed in product development.

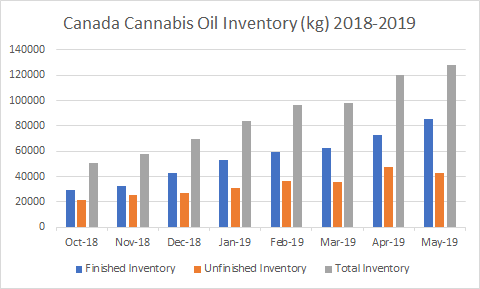

As of May 2019, total cannabis oil inventory held by Canadian cultivators, processors, distributors, and retailers was 263,928kg, a 152% increase from October 2018. The ramp up in production and storage is attributed to preparation for when oils can be transformed into cannabis derivative products.

As of May 2019, total cannabis oil inventory held by Canadian cultivators, processors, distributors, and retailers was 263,928kg, a 152% increase from October 2018. The ramp up in production and storage is attributed to preparation for when oils can be transformed into cannabis derivative products.

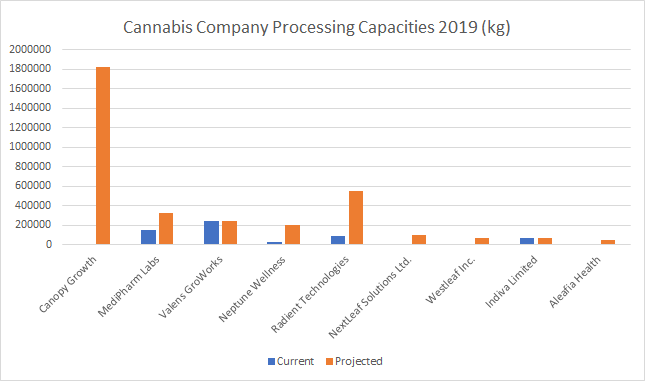

There are numerous public cannabis companies focusing on developing extraction facilities to build partnerships with licensed producers who don’t have capabilities to extract resin from cannabis.

Companies such as MediPharm Labs Corp. (TSXV: LABS; OTCQB: MEDIF, DB: MLZ) operates through a B2B model by extracting cannabis oils for white labelling under its own name or for processing other companies’ dried cannabis into oils at a fee-for-service basis.

Developing extraction capabilities is not easy, as companies must be able to (1) have the capital to purchase or lease extraction technology, (2) have the supply of enough dry cannabis to process and extract, and (3) have the ability to commend a high utilization rate in extracting a high percentage of resin from the biomass.

Though these cannabis companies are boasting large extraction capacities, it does not mean that they are currently extracting resin from the biomass at full capacity nor does it mean that they are extracting resin at a 100% utilization rate without any byproducts or waste.

Though these cannabis companies are boasting large extraction capacities, it does not mean that they are currently extracting resin from the biomass at full capacity nor does it mean that they are extracting resin at a 100% utilization rate without any byproducts or waste.

It will be interesting to see which companies are able to extract the full capacity that they are licensed to process and which companies are able procure enough biomass to fulfill their demand for extracts.

//

Canopy Growth Corp. (NYSE: CGC; TSX: WEED; LSE: 0UO9; DB:11L1)

- Headquartered in Ontario, Canada, Canopy Growth Corp. is the world’s largest cannabis company, based on market capitalization.

- Canopy was the first company to export cannabis to Germany, the first to make a partnership with a global beverage company, and the first to have an agreement to acquire a U.S.-based cannabis company.

- Canopy is currently trading at C$35.63 per share with a C$12.4 billion market capitalization.

MediPharm Labs Corp. (TSXV: LABS; OTCQB: MEDIF, DB: MLZ)

- Headquartered in Barrie, Canada, MediPharm is a medicinal cannabis company that produces pharmaceutical grade and GMP certified cannabis oil products, and supplies raw materials, formulations, processing, and packing for the creation of ready-to-sell derivative products.

- MediPharm is currently trading at C$5.49 per share with a market capitalization of C$712.6 million.

//