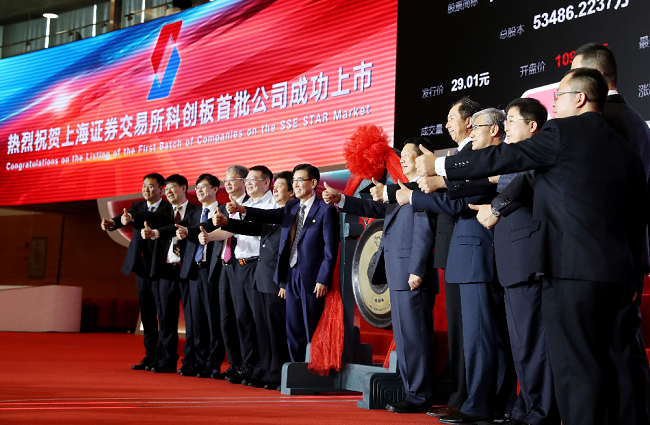

eResearch |On July 22, 2019, China launched a new stock exchange for Chinese technology companies called the Science and Technology Innovation Board, or STAR Market, which will be run by the Shanghai Stock Exchange (SSE). The exchange focuses on new science and technology equities, in which the Chinese government hopes will be able to compete against the NASDAQ, encouraging Chinese companies and investors to list and invest domestically.

Only 25 of the 140 companies that applied were approved to list on the exchange, which collectively raised US$5.3 billion, and the listed stocks rose on average by 140%. Anji Technology Co Ltd (TPE: 6477), a Chinese chipmaker company, was a highlight on the exchange as it recorded as much as a 520% stock price increase, before settling down with the largest stock price gain on the day at 400%. At market close, 4 companies’ stock prices closed above 200% higher and 16 companies’ stock prices closed above 100% higher.

The STAR Market plans to raise a total of US$18.7 billion from more than 140 different technology and science companies within six emerging sectors: information technology, smart manufacturing, aerospace, new materials, renewable energy, and biotech.

The new exchange allows dual-class shares that preserve founders’ control and allows short-selling of stocks, an option that is illegal in all other Chinese stock exchanges. Other benefits that attracted companies to the exchange include letting non-profitable companies list on the exchange, a first for Chinese markets, and allowing companies to choose the date and price for their Initial Public Offering (IPO). In addition, to support new start-ups in raising funds on the exchange, a streamlined application process was created in which the SSE directly vets the IPOs instead of the China Securities Regulatory Commission (CSRC).

To be eligible to trade on the exchange, an investor must have US$73,000 worth of financial assets within their account, with at least two years of stock trading history.

High volatility in stock prices is new in China, as the government historically restricted large stock price movements, in which the Shanghai and Shenzhen exchanges only allowed stock prices to move up 44% on the first day, and then only 10% afterwards. Companies listed on the STAR Market have five days of trading unrestricted to price movements, before a 20% cap is implemented.

According to Chinese market data provider, Wind, STAR-listed companies on average closed trading at 120 times earnings yesterday. Margaret Yang, a market analyst with CMC Markets Singapore, warned that there is no guarantee the market will prosper long-term and investors will have to see if the companies’ fundamentals start to consolidate the stock prices back to multiples typical for these type of tech companies, such as on the NASDAQ and Shenzhen stock exchanges which have similar tech companies trading closer to 24 times earnings.

//