eResearch | On June 18, 2019, Facebook (NASDAQ:FB) officially unveiled their white paper for Libra, a new global cryptocurrency (a form of electronic cash) managed by the newly formed, non-for-profit collaborative called the Libra Association. In addition to Libra, Facebook is creating a separate subsidiary called Calibra for the development of a digital wallet that holds and manages transactions for Libra. The Libra blockchain and Calibra digital wallet are currently under development by Facebook and affiliated Libra Association members, and is expected to come live in 2020.

Bitcoin, the first decentralized cryptocurrency, was created in 2009. It is a digital currency without a central bank or single administrator and can be sent from user-to-user on the peer-to-peer bitcoin network, utilizing blockchain technology, without the need for intermediaries. Bitcoins are generated by computational “miners” and the total number of bitcoins will never exceed 21 million.

Libra will be a digital cryptocurrency on a blockchain ledger and considered a “stable coin” as its value will be pegged to a basket of fiat currencies, bank deposits and short-term government securities. The vision of Libra is to create a global digital currency that is easily accessible and affordable to those who do not have access to traditional financial institutions. The World Bank estimates that 31% of the global adult population (1.7 billion people) remains unbanked without access to an account at a financial institution or to mobile money.

Libra addresses key issues that limited bitcoin’s applicable use, which include price volatility, insurance of assets, accessibility to market goods and services, and governance. The network of businesses and vendors in the Libra Association, in addition to Facebook’s internal business network, enables Libra to be widely accessible for goods and services.

Libra addresses key issues that limited bitcoin’s applicable use, which include price volatility, insurance of assets, accessibility to market goods and services, and governance. The network of businesses and vendors in the Libra Association, in addition to Facebook’s internal business network, enables Libra to be widely accessible for goods and services.

Located in Geneva, the Libra Association currently consists of 28 organizations, including payments companies Mastercard (NYSE:MA) and Visa (NYSE:V), technology companies eBay (NASDAQ:EBAY), Lyft (NASDAQ:LYFT) and Uber (NYSE:UBER), telecommunications companies Iliad (ENXTPA:ILD) and Vodafone (LSE:VOD), blockchain companies Anchorage and Coinbase, and Venture Capital companies Andreesen Horowitz and Thrive Capital. (For the full list of members, see Figure 2.)

Each member of the Libra Association has equal voting rights, invested a minimum of $10 million into the Libra Reserve, and will supply a network transaction node. Libra’s blockchain ledger is expected to handle up to 1,000 transactions per second, more than 10 times faster than the typical bitcoin transaction speed.

The Libra Association does not plan to monetize their business model through targeted ads, transaction fees, or app fees. After Libra’s adoption and validation from the market, other opportunities could emerge in the Libra ecosystem, including the introduction of financial products and services.

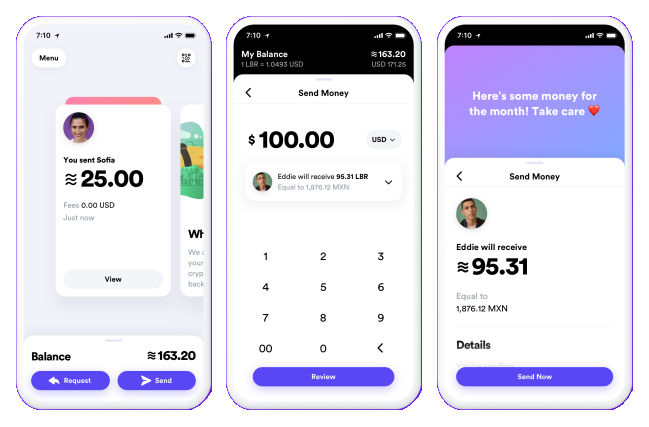

In addition to Libra, Facebook is creating a separate subsidiary called Calibra for the development of a digital wallet that holds and manages transactions for Libra but does not act as an exchange. Calibra will let the user send Libra to almost anyone with a smartphone, similar to the speed and ease as sending a text message and at a low cost.

Calibra will be its own stand alone application and will be able to easily integrate with third-party applications such as Whatsapp and Facebook Messenger. Individuals, businesses, and vendors can create their own digital wallet to easily buy, sell, accept, and send Libra using a smartphone. Eventually, Calibra plans to offer in-store payments with integration to different point-of-sale systems within merchant stores.

Through Calibra, Facebook may form partnerships with Visa and MasterCard, who can drive merchant acceptance of Libra across millions of businesses around the world, and offer additional financial services such as credit and investment services (U.S. credit card fee revenue in 2018 amounted to $100B.)

Figure 1: Calibra Digital Wallet

Source: Facebook.com

Facebook (NASDAQ:FB)

After the Libra announcement, Facebook climbed more than 1% in the morning trading session but quickly ended the day down 0.3% at US$188.47 a share.

Western Union (NYSE: WU)

Western Union was one of the worst performing stocks on the S&P 500, falling 2.4% to close at US$19.57 a share on Tuesday after announcement of the Libra, as Peer-to-Peer (P2P) cash transactions make up 80% of total revenue for Western Union.

Square (NYSE:SQ)

Square, a company that acts as a merchant aggregator and simple point of sale system for retail shops, has a complete financial services portfolio including debit cards, P2P transactions management, small to medium sized loans, and cash management. To scale Libra and its ability to make real life transactions on the spot with merchants, Facebook needs an efficient point of sale system and Square may be an option as they already have a P2P app that facilitates cryptocurrency transactions.

Bitcoin (BTC)

Since the Libra announcement, Bitcoin has quickly moved past US$11,000, a level not seen since February 2018, and well above its 52-week low of US$3,168 that was hit in December 2018.

//

Figure 2: Libra Member Organizations

Sources: Libra.org; eResearch Corp.

//