2019 will be a very different kind of year. The near-decade of ‘recovery’ following the Great Financial Crisis enjoyed a stability and tranquility that suddenly evaporated at the end of 2018. Here, in 2019, instability reigns.

The world’s central banks are absolutely panicking. After last year’s bursting of the Everything Bubble, their coordinated plans for Quantitative Tightening have been summarily thrown out the window. Suddenly, no chairman can prove himself too dovish. Jerome Powell, the supposed hardliner among them, completely capitulated in the wake of the recent -15% tantrum in stocks.

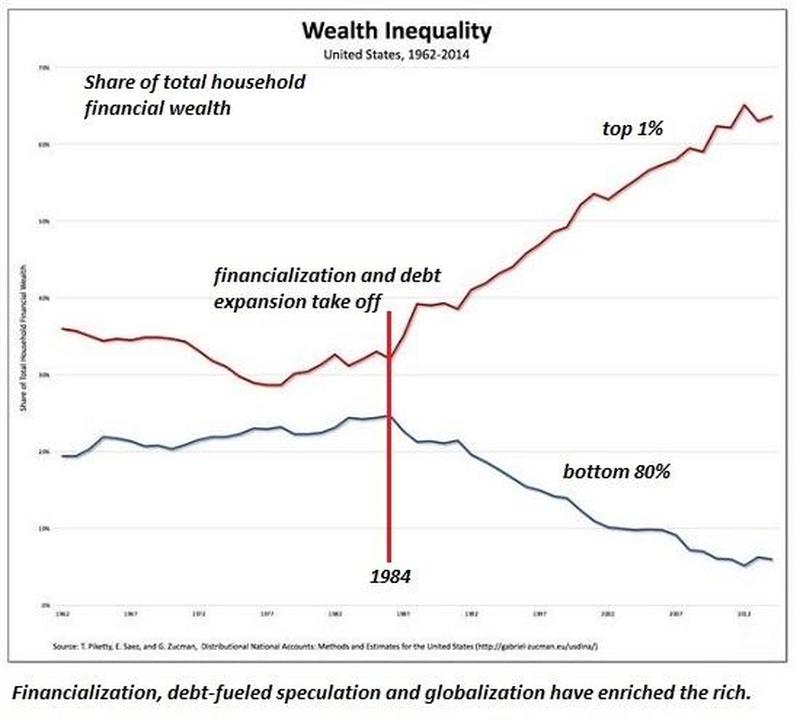

The global tsunami of liquidity (i.e. thin-air money printing) released by the central banking cartel has been the defining trend of the past decade. It has driven, directly or indirectly, more world events than any other factor. One of its more notorious legacies is the massive disparity and wealth and income resulting from its favoring of the top 0.1% over everyone else. The mega-rich have seen their assets skyrocket in value, while the masses have been mercilessly squeezed between similarly rising costs of living and stagnant wages.

You can access this week’s entire extensive commentary HERE