Mattr (TSX: MATR) announced the acquisition of AmerCable Inc. from Nexans S.A. (ENXTPA: NEX), in a transaction valued at US$280 million (C$390 million).

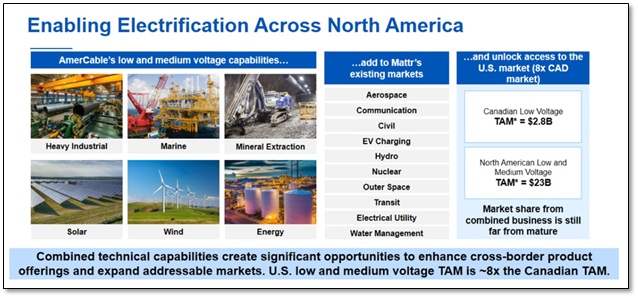

AmerCable is a U.S.-based producer of highly engineered wire and cable solutions. Mattr believes this acquisition aligns well with its previously disclosed M&A criteria and offers a platform to expand its U.S. wire and cable footprint, particularly in the medium voltage space. This segment is benefiting from electrification tailwinds and longer-term macro trends.

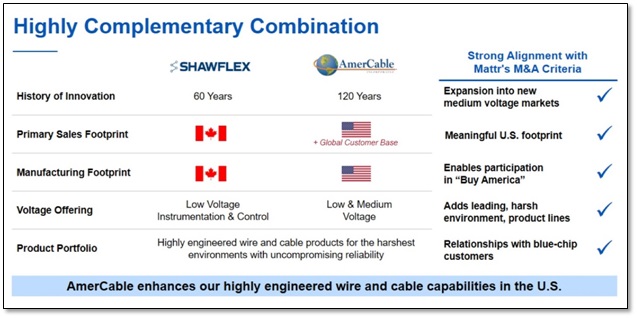

The company views AmerCable’s core competencies as complementary to its existing, mostly Canadian-focused Shawflex wire and cable business. Both organizations specialize in designing and manufacturing highly engineered wire and cable solutions for challenging operating environments, such as the mining and oil & gas sectors, where performance reliability is critical.

Mattr anticipates that combining these two entities will create one of North America’s premier custom-engineered cable manufacturers. “We look forward to welcoming the AmerCable family to Mattr,” said Michael E. Reeves, President, CEO, and Director of Mattr.

Strategic and Financial Benefits

Mattr outlined several reasons why the acquisition of AmerCable is strategically and financially advantageous:

- Enhanced Market Presence: The transaction is expected to expand Mattr’s geographic and end-market presence, providing greater access to key U.S. markets.

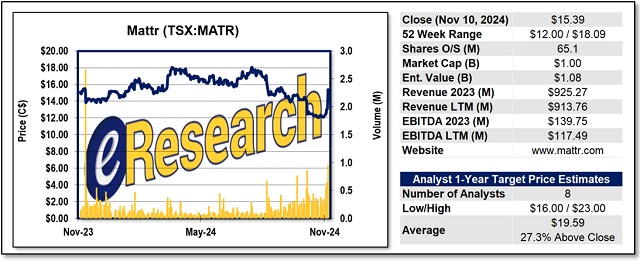

- Financial Gains: The purchase price represents approximately 5x AmerCable’s trailing 12-month adjusted EBITDA, and is projected to deliver immediate and meaningful accretion to Mattr’s earnings per share. Additionally, the acquisition is expected to reduce earnings cyclicality and improve revenue predictability.

AmerCable Business Overview

AmerCable brings a robust portfolio of engineered wire and cable solutions, supporting critical operations in the industrial, energy, and mineral extraction sectors.

Its product offerings include low- and medium-voltage solutions and globally recognized brands that emphasize bespoke, high-margin products designed to address complex challenges. The company also offers in-house design and engineering capabilities, serving a blue-chip customer base.

FIGURE 1: Shawflex and AmerCable – Highly Complementary Combination

Operational and Manufacturing Strengths

AmerCable operates from a 600,000-square-foot manufacturing facility in El Dorado, Arkansas, and a 57,000-square-foot assembly facility in Katy, Texas. These facilities are staffed by approximately 300 employees, a significant advantage given the current constraints in the U.S. labor market.

Mattr plans to integrate these operations with its new modernized low-voltage facility in Vaughan, Ontario, to establish a distributed and efficient manufacturing footprint. The strategic locations and scalable facilities will enable Mattr to meet rising customer demand while supporting future growth through incremental investments.

Growth and Cross-Selling Opportunities

The acquisition positions Mattr to accelerate growth in several ways:

- Organic and Inorganic Expansion: The scaled U.S. footprint offers opportunities for further acquisitions and organic growth.

- Cross-Selling Potential: Mattr aims to leverage AmerCable’s strengths in medium voltage and low smoke, zero halogen solutions to complement Shawflex’s premium low-voltage offerings.

- Increased Market Access: The combined portfolio allows Mattr to target new customers across North America and explore additional international opportunities.

FIGURE 2: Segment Benefiting from Electrification Tailwinds

Financial Details and Implications

The transaction is subject to customary closing conditions, including U.S. antitrust review, and is expected to close by year-end.

Post-acquisition, AmerCable is anticipated to contribute over C$75 million of trailing 12-month adjusted EBITDA to Mattr’s financials. Pro forma, the Connection Technologies segment will account for more than 50% of Mattr’s trailing 12-month revenue, balancing the company’s overall portfolio.

Mattr plans to fund the transaction through a mix of cash and existing credit facilities while maintaining its net debt to Adjusted EBITDA ratio near 2x.

Strategic Alignment and Future Outlook

Since 2021, Mattr has been executing a strategic transformation focused on high-margin, low-volatility businesses that support infrastructure expansion. The company believes the AmerCable acquisition is a critical step in its wire and cable growth strategy, enhancing its capabilities in both low- and medium-voltage solutions.

“This acquisition positions Mattr as a premier provider in the North American custom-engineered wire and cable market and accelerates the achievement of our long-term growth, profitability, and cash flow targets,” said Reeves.

FIGURE 3: 1-Year Stock Chart

Notes: All numbers in USD unless otherwise stated. The author of this report, and employees, consultants, and family of eResearch may own stock positions in companies mentioned in this article and may have been paid by a company mentioned in the article or research report. eResearch offers no representations or warranties that any of the information contained in this article is accurate or complete. Articles on eresearch.com are provided for general informational purposes only and do not constitute financial, investment, tax, legal, or accounting advice nor does it constitute an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this information should consult with a financial advisor. The article may contain “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements are based on the opinions and assumptions of the Company’s management as of the date made. They are inherently susceptible to uncertainty and other factors that could cause actual events/results to differ materially from these forward-looking statements. Additional risks and uncertainties, including those that the Company does not know about now or that it currently deems immaterial, may also adversely affect the Company’s business or any investment therein. Any projections given are principally intended for use as objectives and are not intended, and should not be taken, as assurances that the projected results will be obtained by the Company. The assumptions used may not prove to be accurate and a potential decline in the Company’s financial condition or results of operations may negatively impact the value of its securities. Please read eResearch’s full disclaimer.