eResearch | For fiscal Q2, ending June 30, revenue for Tesla (NASDAQ: TSLA) was US$6.0 billion, up 1% quarter-over-quarter but down 5% year-over-year; however it beat the analysts’ consensus estimate of US$5.4 billion. Net Income was US$104 million and was the Company’s fourth consecutive profitable quarter.

eResearch | For fiscal Q2, ending June 30, revenue for Tesla (NASDAQ: TSLA) was US$6.0 billion, up 1% quarter-over-quarter but down 5% year-over-year; however it beat the analysts’ consensus estimate of US$5.4 billion. Net Income was US$104 million and was the Company’s fourth consecutive profitable quarter.

Investors focused on Tesla’s earnings as the Company has now met the requirements for inclusion in the S&P 500 index: being US based, with four consecutive quarters of profits, trading on the CBOE, NASDAQ or the NYSE, and having a market capitalization of over US$8 billion.

Telsa managed this revenue as Elon Musk said, “despite tremendous difficulties,” due to the Covid-19 pandemic and plant shutdown at both of its factories. For the first half of 2020, revenue in the automotive industry was down approximately 30% but Tesla’s revenue was down only 5%.

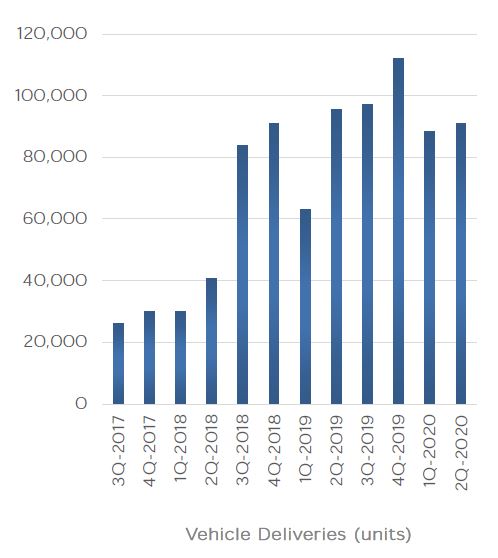

As reported in our July 6 article, Tesla Becomes Most Valuable Auto Company in the World after Impressive Deliveries, Tesla beat delivery expectations in Q2/2020 by 29%, reaching 90,650 deliveries compared with expectations of 70,300.

CHART 1: Tesla Quarterly Vehicle Deliveries

Revenue in the quarter was bolstered by US$428 million in regulatory credits, up 286% from US$111 a year ago and, for 2020, is expected to be roughly double that of 2019. Regulatory credits revenue is generated when Tesla sells its excess credits (that governments give to automakers for meeting emissions programs) to other car manufacturers so they can avoid penalties.

In the quarter, the cash balance reached US$8.6 billion, increasing US$535 million quarter-over-quarter, despite an increase in capital expenses associated with the Shanghai and Berlin factory construction.

Electric Vehicles

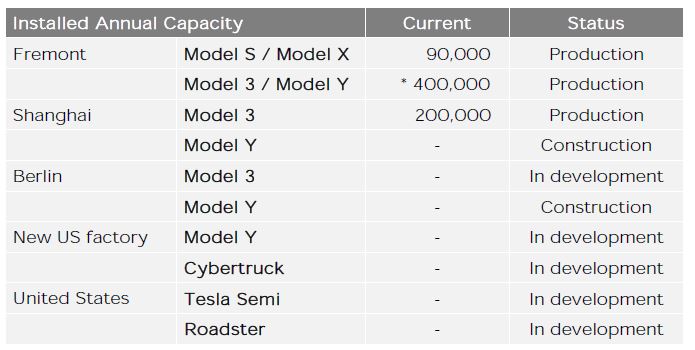

During the earnings’ conference call, Elon Musk announced that the next Tesla factory will be built near Austin, Texas. Tesla currently has vehicle production facilities in Freemont, California and Shanghai, China; a lithium-ion battery and electric vehicle subassembly factory near Reno, Nevada; and is currently building a vehicle factory near Berlin, Germany.

The Austin factory will produce the Cybertruck and the Tesla Semi, as well as the Model 3 and Model Y for the eastern half of North America. The California plant will produce the Tesla Roadster, the Model S and Model X for worldwide consumption, and the Model 3 and Model Y for the western half of North America.

Tesla reaffirmed that delivery of the Tesla Cybertruck and Tesla Semi by 2021.

Table 1: Tesla – Installed Annual Capacity

Self-Driving

Tesla continues to test their Full Self-Driving (“FSD”) software and is aiming for the FSD functionality to be complete by the end of 2020.

Elon Musk said, “I personally tested the latest alpha build of the Full Self-Driving software when I drive my car. And it is really, I think, profoundly better than people realize. So it’s almost getting to a point where I can go from my house to work with no interventions, despite going through construction and widely varying situations.”

Calling all Nickel Mining Companies

For Tesla’s longer range vehicles such as the Tesla Semi, the battery desired is a higher energy density Nickel-based cell. According to Elon Musk, the real limit on Tesla’s growth is battery cell production at an affordable price.

With that requirement, Elon Musk said, “any mining companies out there, please mine more nickel. Tesla will give you a giant contract for a long period of time if you mine nickel efficiently and in an environmentally sensitive way. So hopefully, this message goes out to all mining companies. Please get nickel.”

Solar and Power

Tesla continues to focus on all things electric and recently adjusted the pricing of its solar panels to US$1.49 per Watt, after U.S. Federal tax credits. Tesla believes their solar panels are the lowest cost solar in the United States and provides a “lowest cost” guarantee and a money-back guarantee on all sales.

Even though the solar installation business was impacted by permit office closures limiting installation volume, according to the Company’s Q2/2020 presentation, solar roof installations almost tripled in Q2/2020 compared to Q1/2020 and they continue to expand their installation team to increase the deployment rate.

Tesla is pairing their Solar Roof or solar panels with the Tesla Powerwall, a home energy storage system for time-of-use load shifting, backup power or off-the-grid solutions.

Tesla Insurance

Tesla continues to move forward with its insurance program, currently available in California, and are filing “in a handful” of other states “very shortly”. Tesla’s goal is to become a major insurance company and even asked for “high energy actuaries” to apply to Tesla.

Tesla Insurance uses the data that is captured in the car to build a driving profile of the driver, to be able to assess a monthly premium for that customer. If a person drives more aggressively, then, in that case, the driver would pay a higher insurance rate.

In addition, there is feedback on the repair and Tesla hopes to learn about the cost of repairs and feed it back into the car design process to create a lower cost of ownership.

Tesla closed the week at US$1,417 down 5.5%.

CHART 1: Tesla (up 229%) vs S&P500 (down 1.3%) vs NASDAQ 100 (up 13.9%)