Last week marked the public debut of Montreal-based apparel retailer Groupe Dynamite (TSX: GRD). The company, well-known for its Garage and Dynamite brands, issued a secondary share offering so that some current shareholders, particularly those connected to CEO Andrew Lutfy, could liquidate a portion of their investments.

The IPO made available subordinate voting shares to the public as part of a multiple voting share structure for existing shareholders. The multiple-voting shares are primarily held by Lutfy and related entities, to maintain his control over the company, and give holders 10 votes per share.

The shares were priced at $21 and within the expected range of $19 to $23. The IPO raised approximately $300 million, all of which went to existing shareholders. No new shares were issued, and the company raised no capital. The issue was one of the largest Canadian corporate listings in recent years.

The shares closed today at C$20.25, reflecting a slight decline of nearly 4% from the offering price. Analysts noted that the early trading performance may reflect broader market conditions rather than company-specific concerns.

Valuation at Top End of Retail Comps

Based on the IPO share price of $21 and a total of 107.6 million shares outstanding, the company’s market capitalization is approximately $2.26 billion. Including Net Debt of $440 million, the Enterprise Value (EV) is approximately $2.7 billion.

Based on the company’s last twelve months’ (LTM) financials (as of August 3, 2024), Groupe Dynamite’s EV to Revenue (EV/Rev) ratio is approximately 3.0x, and its EV to Adjusted EBITDA (EV/Adj. EBITDA) ratio is approximately 9.8x. Additionally, the company’s Price-to-Earnings (P/E) ratio is 17.7x, based on net earnings of $127.8 million.

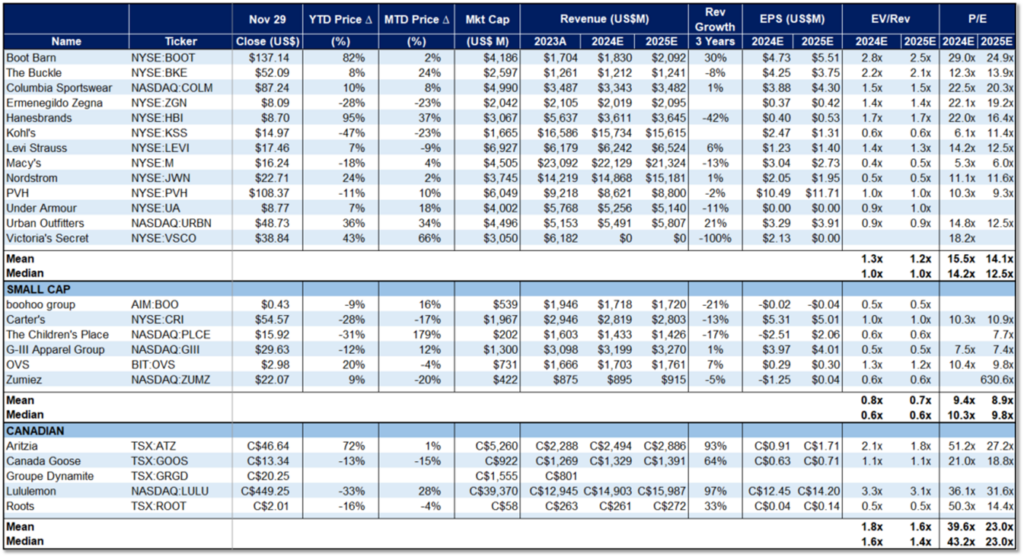

Looking at the 2024 retail comparables in Canada and the U.S. for 2024 estimates, EV/Rev ratios in this sector range from 0.45x to 5.0x, with an average of 1.5x and a median of 1.3x. Groupe Dynamite’s EV/Revenue ratio of 3.0x places it above the average, suggesting that the market is pricing the company at a premium relative to many of its peers. This may reflect expectations for higher growth or operational efficiency.

For P/E ratios, retail comparables range from 5.4x to 60.5x, with an average of 23.6x and a median of 16.5x. Groupe Dynamite’s P/E ratio of 17.6x aligns closely with the median, indicating that its stock price is within a reasonable range compared to peers based on earnings.

These valuation metrics suggest that the market may be optimistic about the company’s plans for U.S. and U.K. expansion, as well as its ability to sustain recent financial performance. However, the premium revenue valuation may also reflect expectations of maintaining or exceeding current growth trends, placing pressure on the company to deliver consistent results.

Arising After Creditor Protection During the Pandemic

Groupe Dynamite sought creditor protection under the Companies’ Creditors Arrangement Act (CCAA) in September 2020 and later filed for Chapter 15 in the U.S. These actions helped the company reorganize its business and finances during the difficulties brought on by the COVID-19 pandemic.

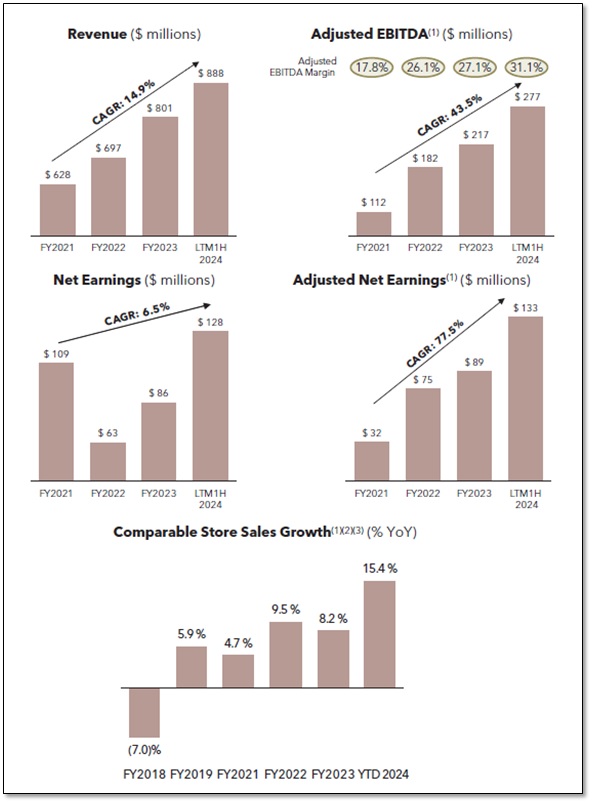

More recently, the company’s financials reflect its growth, driven by strategic restructuring and improved operational performance. Revenue has grown from $628 million in 2021 to $801 million in 2023. Although earnings have also slipped from $109.2 million in 2021 to $86 million in 2023.

Over the last 12 months (as of August 3, 2024), revenue has continued to increase and reached $888.4 million, a three-year compound annual growth rate (CAGR) of approximately 14.9%, with earnings growing to $127.8 million.

FIGURE 1: Financial Summary

Use of Free Cash Flow for Growth

Although Groupe Dynamite did not directly raise capital from the IPO, the company has outlined plans to use its free cash flow to support growth and focus on:

- U.S. Expansion: Building on its current footprint of approximately 300 stores and 6,000 employees across Canada and the U.S., Groupe Dynamite plans to expand further into the U.S. market.

- Entry into the United Kingdom: The retailer is preparing for its first move into the U.K., which represents a new opportunity for international growth.

These initiatives are part of the company’s strategy to adapt to changing consumer trends while maintaining its position in the competitive fashion retail market.

Leadership and Legacy

Andrew Lutfy, Groupe Dynamite’s CEO, has been a key figure in the company’s development. He started as a stockroom clerk at Garage and eventually transformed the business into a significant player in North American retail. Lutfy also leads Carbonleo, a real estate firm responsible for high-profile projects like Montreal’s Royalmount luxury development.

Lutfy’s connection to the fashion industry runs deep. His grandfather, Joseph Chamandy, founded Gildan Activewear (TSX: GIL), a global leader in apparel manufacturing. This legacy drives Lutfy’s vision for Groupe Dynamite, combining innovation with a focus on long-term growth.

Competitive Landscape and Challenges

The fashion retail industry remains competitive, with major players like Zara (owned by Industria de Diseño Textil (BME: ITX), H&M (OM: HM B), and American Eagle (NTSE: AEO) dominating the market. Groupe Dynamite competes by focusing on Generation Z and Millennial customers, offering fashion-forward designs marketed through bold and youthful branding.

The company’s ability to adapt to trends, such as the rise of e-commerce and demand for sustainability, will be critical to its success. Groupe Dynamite’s focuses on leveraging customer insights and operational efficiency to stay ahead of trends.

FIGURE 2: Groupe Dynamite Fashions

Final Thoughts

Groupe Dynamite’s IPO represents a significant milestone for the Montreal-based retailer. While the proceeds benefited existing shareholders, the listing establishes the company on the public market and sets the stage for future growth.

The company hopes to grow by expanding into the US and entering into the UK, but also needs to keep in tune with the changing fashion industry. Investors will be paying close attention to both factors.

FIGURE 3: Fashion Retail Comp Table (click to open the image)

Notes: All numbers in CAD unless otherwise stated. The author of this report, and employees, consultants, and family of eResearch may own stock positions in companies mentioned in this article and may have been paid by a company mentioned in the article or research report. eResearch offers no representations or warranties that any of the information contained in this article is accurate or complete. Articles on eresearch.com are provided for general informational purposes only and do not constitute financial, investment, tax, legal, or accounting advice nor does it constitute an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this information should consult with a financial advisor. The article may contain “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements are based on the opinions and assumptions of the Company’s management as of the date made. They are inherently susceptible to uncertainty and other factors that could cause actual events/results to differ materially from these forward-looking statements. Additional risks and uncertainties, including those that the Company does not know about now or that it currently deems immaterial, may also adversely affect the Company’s business or any investment therein. Any projections given are principally intended for use as objectives and are not intended, and should not be taken, as assurances that the projected results will be obtained by the Company. The assumptions used may not prove to be accurate and a potential decline in the Company’s financial condition or results of operations may negatively impact the value of its securities. Please read eResearch’s full disclaimer.