Paladin Energy Ltd. (ASX: PDN | OTCQX: PALAF), the Australian miner, announced a deal with Fission Uranium Corp. (TSX: FCU | OTCQX: FCUUF) in June for C$1.14 billion and thought it was on the cusp of a major uranium sector shakeup. But a key shareholder, CGN Mining Company Ltd., a Chinese state-backed entity, has voiced its opposition to the deal.

Deal Structure and Mounting Challenges

Paladin offered Fission shareholders 0.1076 Paladin shares for every Fission share. The deal valued Fission’s stock at C$1.30 per share, a 26% premium over where Fission shares traded before the announcement.

CGN Mining, which holds 11.26% of Fission’s stock, decided to oppose the deal in court. It’s unclear what their exact motivations are, but China’s long-standing interest in controlling uranium resources is a factor worth considering. It isn’t just about the dollars, it’s about power, influence, and control over a crucial natural resource.

Uranium is Essential for a Green Future

China’s global push for energy security is no secret. Uranium is essential to its nuclear energy strategy, and Fission’s Patterson Lake South (PLS) project in Canada is a good asset. It’s one of the world’s most significant high-grade uranium finds.

CGN’s opposition could be a tactical move to ensure a greater degree of control or influence over the project, preventing it from slipping out of reach. It might also reflect concerns about foreign ownership of a critical resource that could feed into China’s growing energy needs.

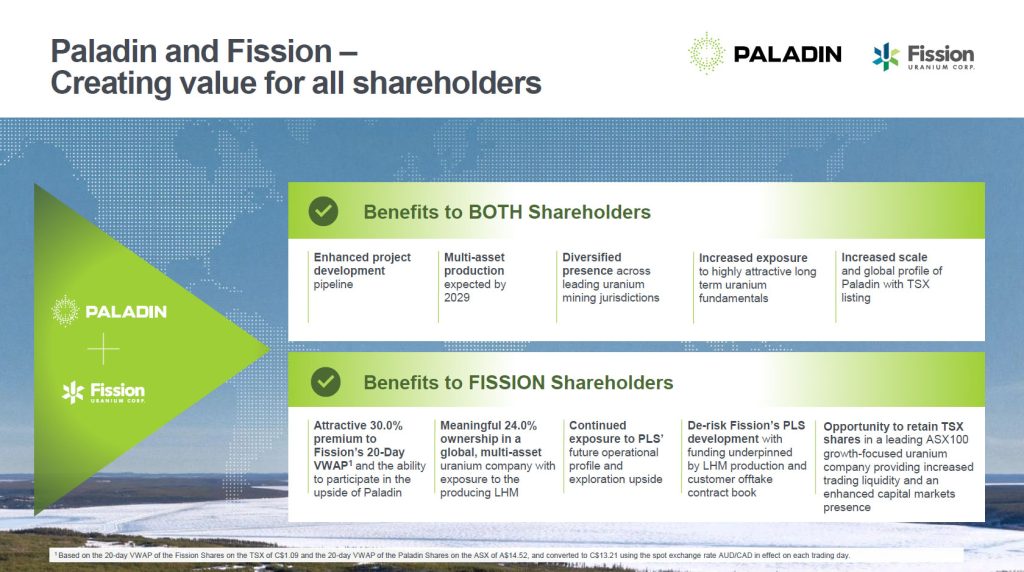

If Paladin manages to pull this deal off, though, it’s a big win. They’ll be adding Fission’s top-tier uranium project to a portfolio that already includes the Langer Heinrich Mine (LHM) in Namibia, which just got back online earlier this year.

The combined assets would give Paladin a foothold across Namibia, Australia, and Canada. That’s a diverse global portfolio and near a key market, the U.S., making the Patterson Lake South project even more strategic for Paladin. CEO Ian Purdy knows this deal is essential to Paladin’s growth. It would bring medium-term development opportunities and help the company solidify its place in the global uranium market.

FIGURE 1: Acquisition Benefits Slide

Shareholders: Not Everyone’s Convinced

At first glance, this deal seems like a good one for Fission shareholders. A 26% premium is attractive, and the combined company would have a market capitalization of about US$3.5 billion. Fission shareholders would own approximately 24% of the new entity.

Despite the attractive premium, some investors argue that Fission’s assets, particularly PLS, aren’t being fully valued in the deal. They think the long-term potential of the project could deliver even higher returns, and they’re not sure this acquisition is the best route.

At the recent special meeting on September 9, 67.9% of shareholders voted in favor but nearly a third weren’t on board. And with CGN Mining’s 11.26% stake, their opposition adds even more complexity to the situation.

A New Uranium Giant in the Making

If this deal gets done, the combined company could control 10% of the global uranium supply. And a good part of the market, especially as the world scrambles to secure long-term uranium contracts. Nuclear energy is making a comeback, driven by the shift to cleaner energy sources, and companies like Paladin are positioning themselves to meet that growing demand.

For Paladin, this acquisition is part of a broader strategy to diversify. With uranium mining banned in Western Australia and Queensland, the company has been looking for growth opportunities abroad. PLS, in a politically stable region like Canada and close to major markets, is a natural fit. It could be just the thing Paladin needs to take its production and market reach to the next level, especially as the company works to bring its LHM mine back to full capacity.

The Court Battle: Eyes on September 26

This deal isn’t done yet. After initial hearings on September 13, the Supreme Court of British Columbia will reconvene on September 26 to decide if this acquisition will move forward. Paladin needs the court’s approval to finalize things, but CGN’s opposition complicates the outcome.

If the court rules in Paladin’s favor and the remaining regulatory approvals come through, the acquisition could close by the end of the third quarter. But if there’s one thing we’ve learned from this saga, it’s that nothing is certain when international mining deals are at stake.

What’s at Stake?

For investors, the million-dollar question is whether this acquisition will transform Paladin into a uranium juggernaut or whether it’ll stall in the courts. The global demand for uranium is on the rise, and this deal could position Paladin as a key player for decades to come. But CGN’s opposition and broader geopolitical tensions could mean there’s a lot more in play here than just financials.

We’ll have to wait and see how it all plays out. The court’s ruling on September 26 will give us a better sense of what comes next for both Paladin and Fission.

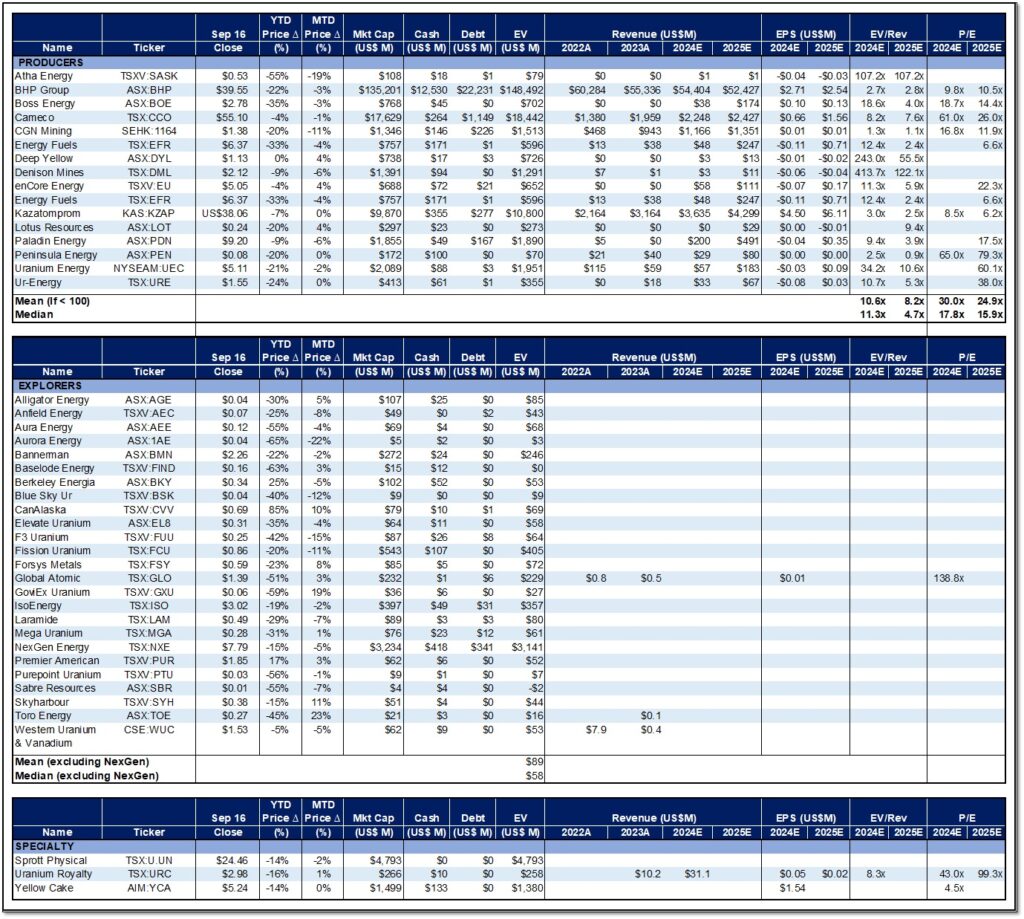

FIGURE 2: Uranium Mining and Specialty Companies

Notes: All numbers in CAD unless otherwise stated. The author of this report, and employees, consultants, and family of eResearch may own stock positions in companies mentioned in this article and may have been paid by a company mentioned in the article or research report. eResearch offers no representations or warranties that any of the information contained in this article is accurate or complete. Articles on eresearch.com are provided for general informational purposes only and do not constitute financial, investment, tax, legal, or accounting advice nor does it constitute an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this information should consult with a financial advisor. The article may contain “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements are based on the opinions and assumptions of the Company’s management as of the date made. They are inherently susceptible to uncertainty and other factors that could cause actual events/results to differ materially from these forward-looking statements. Additional risks and uncertainties, including those that the Company does not know about now or that it currently deems immaterial, may also adversely affect the Company’s business or any investment therein. Any projections given are principally intended for use as objectives and are not intended, and should not be taken, as assurances that the projected results will be obtained by the Company. The assumptions used may not prove to be accurate and a potential decline in the Company’s financial condition or results of operations may negatively impact the value of its securities. Please read eResearch’s full disclaimer.