The International Energy Agency (IEA) “Global EV Outlook 2024” provides a comprehensive analysis of the electric vehicle (EV) industry, detailing significant trends and future projections across various segments including personal and commercial EVs, EV batteries, and charging infrastructure.

Notably, the report highlights that EV sales neared 14 million in 2023, marking a 35% growth from the previous year, underscoring the continued expansion of the market, despite news suggesting otherwise.

It also highlights the significant increase in the installation of fast-charging stations, essential for supporting long-distance EV travel and facilitating the sector’s growth.

The EV market is currently driven by technological advancements, regulatory policies, and shifts in consumer preferences, with challenges and opportunities in the global supply chain. Sustainability practices and innovation could play a critical role in meeting the increasing demand for electric mobility solutions.

Electric Vehicle Sales Grew 35%

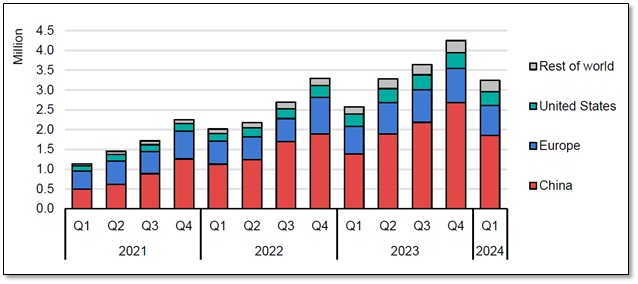

In 2023, EV sales approached 14 million units globally, representing 18% share of all cars sold, indicating strong growth and a 35% increase from 2022. The report forecasts that EV sales could reach around 17 million units in 2024, accounting for more than one in five cars sold globally.

China, Europe, and the United States accounted for 95% of global EV sales, demonstrating a significant market concentration. Notably, China maintained its lead with about 60% of global sales, while Europe and the U.S. had 25% and 10%, respectively. By 2024, the market share of EVS is expected to reach up to 45% in China, 25% in Europe, and over 11% in the United States.

According to the IEA, by 2030, approximately one in three cars on the roads in China is expected to be electric, and, in the United States and the European Union, about one in five cars is projected to be electric by the same year. Extending this trend to 2035, the scenario anticipates that every other car sold globally will be an EV.

The IEA report emphasizes the role of affordability and government incentives in boosting electric vehicle (EV) adoption. For instance, in the U.S., revised tax credits under the Inflation Reduction Act (IRA) have facilitated continued growth in EV sales, despite stringent domestic content requirements. In Europe, however, the phase-out of purchase incentives has somewhat reduced sales momentum.

In the Chinese market, EVs are becoming increasingly competitive with conventional vehicles due to aggressive pricing strategies and strong policy support. This has helped propel China as a major player in the global EV market, influencing global sales dynamics and market strategies.

Sales are also rising in emerging markets, such as India and Thailand, due to favorable policies and an influx of affordable models from Chinese manufacturers. This trend is set to enhance the geographical diversity of the EV market and potentially stabilize global sales distribution over the coming years.

In 2023, EVs accounted for 15% of all cars sold in Vietnam and 10% in Thailand. Meanwhile, other emerging economies like India, Brazil, Indonesia, and Malaysia saw lower adoption rates, with EV market shares hovering from 2% to 3%.

According to the report, continued technological advancements and cost reductions in battery production are important for sustaining the growth trajectory of the EV market. This will help in maintaining competitive pricing and also meeting the increasing global demand for electric vehicles.

FIGURE 1: Quarterly EV Sales (2021-2024)

Light-duty and Heavy-duty EVs Find Traction

Supportive regulatory frameworks and technological advancements in batteries and charging infrastructure are important factors driving the uptake of electric vehicles across Light- and Heavy-duty EVs.

The report suggests that as battery costs continue to decline and charging technology improves, the market for Light- and Heavy-duty EVs is expected to expand, contributing to a more substantial shift away from fossil fuel-dependent vehicles.

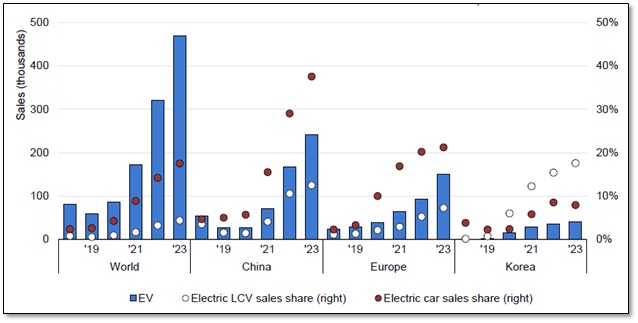

Light-duty EVs include electric two- and three-wheelers, and light commercial vehicles. The sales of electric two-wheelers and three-wheelers have shown considerable growth, particularly in Asia where these vehicles are a primary mode of transport due to their cost efficiency and lower energy requirements.

Light commercial EVs are also gaining traction, driven by increasing demand for delivery services and a growing recognition of their lower operational costs compared to internal combustion engine (ICE) vehicles.

Heavy-duty EVs, such as buses and trucks are benefiting from the deployment of electric buses, particularly in urban settings where municipalities are pushing for reductions in urban air pollution.

The adoption rates of heavy-duty electric trucks are rising, albeit from a low base, stimulated by both regulatory measures and the economic benefits of lower fuel and maintenance costs.

The report cites that while the initial purchase price of heavy electric vehicles remains high, total cost of ownership comparisons increasingly favor electric models, especially when considering the longer operational life typical of these vehicles.

Investment in charging infrastructure tailored to heavy-duty applications is highlighted as a critical factor for broader adoption, requiring significant capital outlays and strategic planning to meet the charging needs of these larger vehicles.

This sector benefits significantly from regulatory support in key markets which incentivizes fleet electrification as part of broader emissions reduction strategies.

FIGURE 2: Light Commercial EV Sales and Sales Shares (2018-2023)

EV Charging Infrastructure and Vehicle-to-Grid Technologies

The EV charging infrastructure plays an important role in supporting the global transition towards electric mobility. The report suggests that governments’ policies need to encourage the deployment of EV charging stations and foster continued technological advancement in charging equipment.

The expansion and improvement of the EV charging infrastructure are reported as essential to sustaining the momentum of the global shift towards electric vehicles, ensuring accessibility and practicality for an increasing number of EV users.

The EV charging infrastructure has witnessed a rapid expansion of both public and private charging stations, especially a significant increase in fast-charging stations. These stations are crucial for reducing charging time and enhancing the convenience of EVs, particularly for drivers who undertake long-distance travel.

Additionally, the integration of smart charging technologies is gaining traction, enabling more efficient energy management by aligning charging patterns with grid demand and electricity pricing.

The report highlights that the future landscape of the EV charging infrastructure requires substantial investment and strategic planning to keep pace with the expected rise in EV adoption.

The report predicts a robust expansion in global charging infrastructure, driven by both policy initiatives and private sector investment. It stresses the importance of a diverse charging infrastructure capable of supporting various EV markets, including urban areas where space constraints may favor fast public charging stations and rural areas where home charging prevails.

The outlook highlights the critical role of innovations, such as vehicle-to-grid (V2G) technologies, which enable EVs to interact with the power grid, providing potential energy storage solutions and helping to stabilize grid operations during peak demand.

The development of ultra-fast charging technology is also identified as a pivotal factor that could alleviate range anxiety and boost consumer confidence in EV technology.

Battery Manufacturing Capacity Currently Exceeds Demand

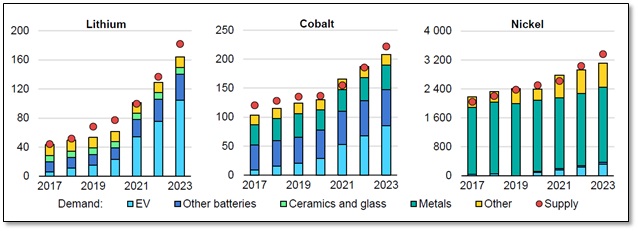

The global EV battery manufacturing sector has successfully reached sufficient capacity to meet the commitments made by automakers and governments worldwide. Over the past five years, substantial investments have allowed the manufacturing capacity to significantly surpass the demand in 2023.

Looking forward, demand is projected to increase dramatically, potentially growing sevenfold to ninefold by 2035 under various emission reduction scenarios and twelvefold under the Net Zero Emissions by 2050 scenario.

Despite this rapid increase in demand, the existing and committed battery manufacturing capacities are expected to meet the requirements of a net zero pathway by 2030.

However, the current surplus in manufacturing capacity is impacting profit margins and could drive further consolidation within the market. This environment presents significant opportunities for battery and mining companies, particularly in emerging markets outside of China.

FIGURE 3: Supply and Demand of Battery Metals by Sector (2017-2023) (kTonnes)

EV Battery Technologies Continue to Evolve

The report still projects a significant increase in global battery demand, driven by both the proliferation of EVs and the need for stationary energy storage solutions.

Current trends in EV battery technology focus on advancements in battery chemistry, improvements in energy density, and cost reductions. The report suggests that ongoing efforts to enhance battery safety and longevity are critical in consumer acceptance and market growth.

The report highlights the shift towards lithium-ion batteries with higher nickel content, which offer greater energy density and efficiency, facilitating longer driving ranges without significant increases in battery size or weight.

Additionally, research and development continues on solid-state batteries, promising even greater improvements in performance and safety.

Battery technology innovation plays a critical role in supporting the scaling of the EV market and meeting the energy requirements of a broader range of automotive and stationary applications. The advancements in battery design, improved manufacturing processes, and increased investment in recycling infrastructure are essential to meet future demand sustainably.

Demand for raw materials, such as lithium, cobalt, and nickel, highlights potential challenges in supply chain sustainability and the importance of recycling initiatives to mitigate environmental impacts and supply risks.

Final Thoughts

The “Global EV Outlook 2024” report offers an extensive evaluation of the electric vehicle industry, emphasizing the interplay between technological innovation, regulatory frameworks, and market dynamics.

As the report outlines, the EV sector continues to experience rapid growth, fueled by advancements in vehicle and battery technologies, alongside an expanding global charging infrastructure.

The continued growth in electric car sales, the strategic development of charging networks, and the ongoing evolution of battery technologies are essential for the industry’s future.

The report also discusses the challenges in scaling the supply chain sustainably, underscoring the necessity for continued innovation and regulatory support to foster the widespread adoption of electric mobility solutions, ensuring a sustainable transition in the global transportation landscape.

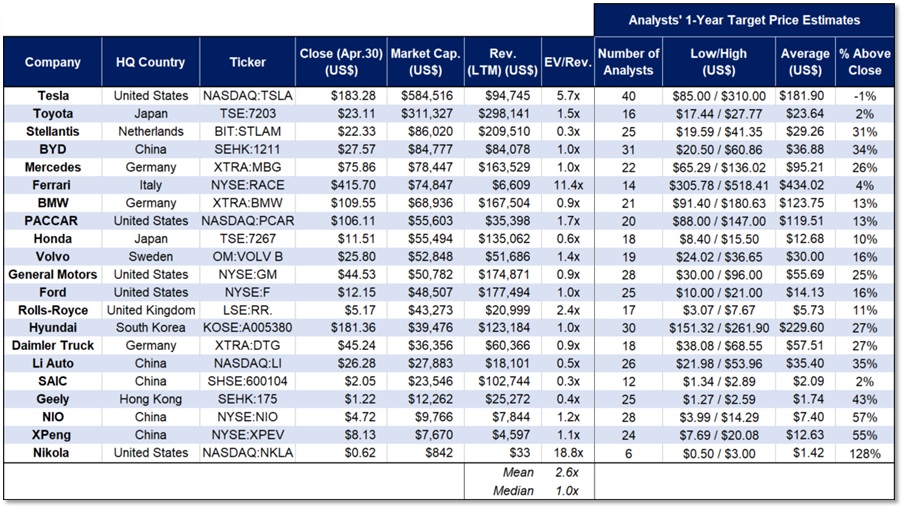

Figure 1: EV Comp Table

Notes: All numbers in CAD unless otherwise stated. The author of this report, and employees, consultants, and family of eResearch may own stock positions in companies mentioned in this article and may have been paid by a company mentioned in the article or research report. eResearch offers no representations or warranties that any of the information contained in this article is accurate or complete. Articles on eresearch.com are provided for general informational purposes only and do not constitute financial, investment, tax, legal, or accounting advice nor does it constitute an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this information should consult with a financial advisor. The article may contain “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements are based on the opinions and assumptions of the Company’s management as of the date made. They are inherently susceptible to uncertainty and other factors that could cause actual events/results to differ materially from these forward-looking statements. Additional risks and uncertainties, including those that the Company does not know about now or that it currently deems immaterial, may also adversely affect the Company’s business or any investment therein. Any projections given are principally intended for use as objectives and are not intended, and should not be taken, as assurances that the projected results will be obtained by the Company. The assumptions used may not prove to be accurate and a potential decline in the Company’s financial condition or results of operations may negatively impact the value of its securities. Please read eResearch’s full disclaimer.