eResearch | Playtika Holding Corp. (NASDAQ: PLTK), a mobile game and interactive entertainment development, recently announced an agreement to acquire Innplay Labs, an Israel-based mobile gaming studio for an upfront payment of US$80 million, with the potential to reach up to US$300 million.

eResearch | Playtika Holding Corp. (NASDAQ: PLTK), a mobile game and interactive entertainment development, recently announced an agreement to acquire Innplay Labs, an Israel-based mobile gaming studio for an upfront payment of US$80 million, with the potential to reach up to US$300 million.

Robert Antokol, Playtika’s CEO, said the acquisition of Innplay Labs aligns with their strategic growth plans. He believes that Innplay Labs’ innovative growth franchise in the Luck Battle genre will be a valuable addition to their portfolio. Furthermore, he sees this as an opportunity to apply Playtika’s proprietary technology and LiveOps expertise to drive long-term growth. The synergy between the two companies is further underscored by their shared Israeli origins.

Established in 2019, Innplay Labs is a mobile gaming studio based in Israel. The company is committed to developing high-quality gaming experiences that cater to a global audience.

Over the past four years, Innplay Labs has produced games characterized by rich content and engagement. The integration into Playtika’s portfolio is anticipated to provide Innplay Labs with an opportunity for further growth and expansion.

Ore Gilron, CEO of Innplay Labs, is confident that joining Playtika’s portfolio will propel their company to greater success. Eitan Reisel, the founder of vgames and a significant investor in Innplay Labs, was positive about the acquisition and said, “I couldn’t ask for a better outcome.”

Playtika Leveraging Technology to Grow Market Share

Playtika Holding is known for its innovative approach to mobile gaming, leveraging its proprietary technology stack and Live Operations (LiveOps) expertise to optimize and scale games.

LiveOps is a style of game development and operations that provides ongoing feature updates, real-time analytics, and player communication in real-time.

Since its inception in 2010, Playtika has been at the forefront of introducing free-to-play social games on various platforms. The company’s headquarters is located in Herzliya, Israel, and it operates on a global scale with multiple international offices.

Second Acquisition this Quarter for Playtika

The acquisition of Innplay Labs is Playtika’s second significant transaction for the current quarter.

The acquisition of Innplay Labs is Playtika’s second significant transaction for the current quarter.

Recently, Playtika acquired the Youda Games portfolio from Azerion Group N.V. (ENXTAM: AZRN), one of Europe’s largest digital advertising and entertainment media platforms. This acquisition, which includes the social card-themed title Governor of Poker 3, aligns with Playtika’s strategic growth approach.

The initial cash consideration for the acquisition is EUR 81.3 million (US$89.1 million), with an earnout based on the performance of the acquired business potentially increasing the total consideration up to a maximum of EUR 150 million (US$164.4 million). The transaction is expected to close by the end of the third quarter of 2023.

This move by Playtika demonstrates its commitment to strengthening its market position and expanding its portfolio of games. By acquiring Youda Games, Playtika is gaining a popular title and further establishing itself as a major player in the mobile gaming industry.

Changing Mobile Gaming Environment Hits Q2 Earnings

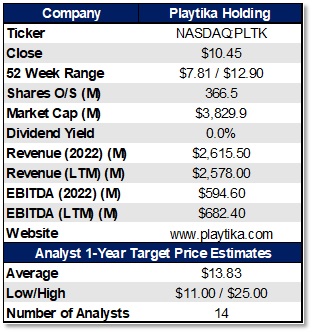

In the second quarter, Playtika reported revenue of US$642.8 million, a sequential decline of 2.0% and a year-over-year decrease of 2.5%. The Direct-to-Consumer (DTC) platforms generated revenue of $165.3 million, marking a 9.1% sequential growth and a 7.6% rise on a year-over-year basis.

The company’s Net Income hit $75.7 million, a 10.0% sequential drop but a year-over-year surge of 108.0% from the reduction of expenses. Its liquidity position remains strong, with cash and cash equivalents reported at $955.1 million as of June 30, 2023.

On the operational front, Playtika observed a decline in its Average Daily Paying Users to 307,000, a 5.8% sequential decrease and a 1.0% drop year over year. However, the Average Payer Conversion remained stable at 3.6% compared to the previous quarter and saw an improvement from 3.2% in the same period the previous year.

The company’s gaming portfolio showed mixed results. While some titles like Solitaire Grand Harvest reported a revenue growth year over year, others like Slotomania witnessed a decline both sequentially and year over year.

Guidance Shows Flat Revenue Growth

In terms of future projections, Playtika anticipates its annual revenue to align with the lower end of its previously forecasted range of $2.57 billion to $2.62 billion. The company also adjusted its capital expenditure expectations, now forecasting them to be between $100 and $105 million, a reduction from the earlier projection of $115 to $120 million.

Final Thoughts

Playtika is strategically expanding its portfolio, as evidenced by its acquisitions of Innplay Labs and the Youda Games portfolio. These acquisitions, particularly the Innplay Labs deal, align with Playtika’s growth trajectory, aiming to leverage synergies and capitalize on innovative game genres.

The acquisition of the popular title, Governor of Poker 3, from Youda Games solidifies Playtika’s commitment to enhancing its market presence.

However, the company’s Q2 financials paint a mixed picture as Playtika experienced a decline in revenue, both sequentially and year-over-year. While certain segments, such as the Direct-to-Consumer platforms, showed growth, others, like some gaming titles, witnessed a decline.

The company’s future revenue guidance also suggests cautious optimism, indicating a challenging mobile gaming environment.

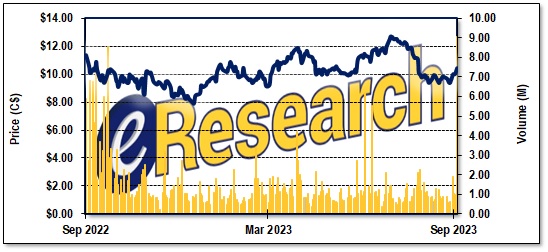

FIGURE 1: Playtika 1-Year Stock Chart

Notes: All numbers are in USD unless otherwise stated. The author of this report, and employees, consultants, and family of eResearch may own stock positions in companies mentioned in this article and may have been paid by a company mentioned in the article or research report. eResearch offers no representations or warranties that any of the information contained in this article is accurate or complete. Articles on eresearch.com are provided for general informational purposes only and do not constitute financial, investment, tax, legal, or accounting advice nor does it constitute an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this information should consult with a financial advisor. The article may contain “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements are based on the opinions and assumptions of the Company’s management as of the date made. They are inherently susceptible to uncertainty and other factors that could cause actual events/results to differ materially from these forward-looking statements. Additional risks and uncertainties, including those that the Company does not know about now or that it currently deems immaterial, may also adversely affect the Company’s business or any investment therein. Any projections given are principally intended for use as objectives and are not intended, and should not be taken, as assurances that the projected results will be obtained by the Company. The assumptions used may not prove to be accurate and a potential decline in the Company’s financial condition or results of operations may negatively impact the value of its securities. Please read eResearch’s full disclaimer.