eResearch is pleased to publish an Update Report on Canadian North Resources Inc. (TSXV: CNRI | OTCQX: CNRSF | FSE: EO0).

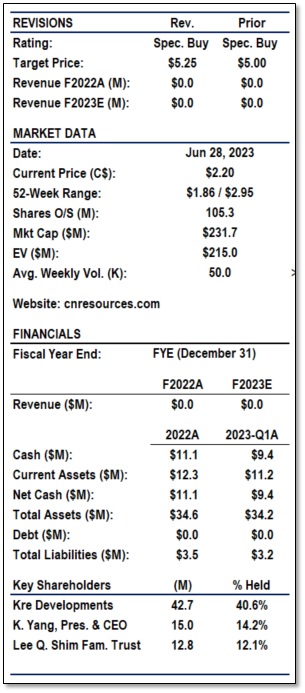

We are maintaining a Speculative Buy rating and increasing the one-year price target to $5.25 from $5.00.

You can download our 43-page Equity Research Update Report by clicking on the following link: eR-CdnNorthRes-CNRI-2023-06-28_FINAL

Company Description:

Canadian North Resources Inc. (“CNRI” or “the Company”) is a Canadian-based mineral exploration and development company that explores for minerals in Nunavut, Canada. The Company has acquired a 100% interest in the Ferguson Lake Project, which comprises an area of 253.8 km2 (over 62,715 acres). The project hosts a recently updated NI 43-101 mineral resource containing an Indicated Mineral Resource of 455 million pounds (Mlb) copper (Cu) at 0.85%, 321 Mlb nickel (Ni) at 0.60%, 37.5 Mlb cobalt (Co) at 0.07%, 1.08 million ounces (Moz) palladium (Pd) at 1.38 grams per tonne (g/t), and 0.18 Moz platinum (Pt) at 0.23 g/t; and an Inferred Mineral Resource containing 947 Mlb Cu at 0.91%, 551.5 Mlb Ni at 0.53%, 62.4 Mlb Co at 0.06%, 2.12 Moz Pd at 1.4 g/t, and 0.38 Moz Pt at 0.25 g/t.

Investment Thesis:

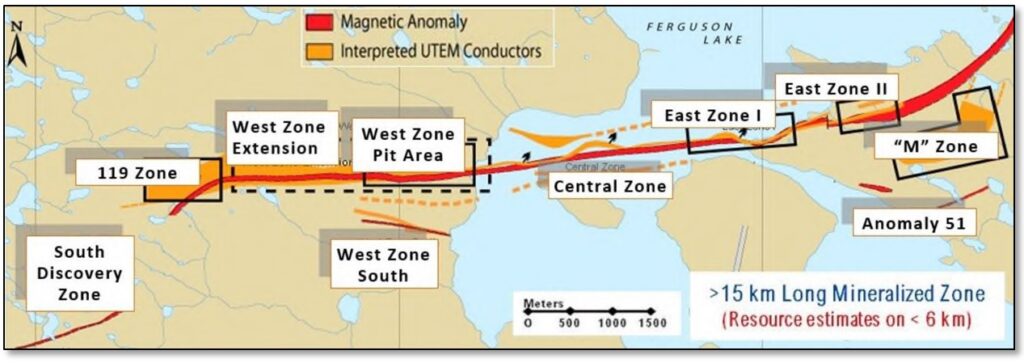

District-scale Exploration Opportunity: The Ferguson Lake Project is 8 km2 (over 62,715 acres) and rich in Platinum Group Metals (PGMs), including Pd, Pt, and rhodium (Rh); Base Metals, including Cu, Ni, and Co; and occurrences of gold (Au) and silver (Ag).

District-scale Exploration Opportunity: The Ferguson Lake Project is 8 km2 (over 62,715 acres) and rich in Platinum Group Metals (PGMs), including Pd, Pt, and rhodium (Rh); Base Metals, including Cu, Ni, and Co; and occurrences of gold (Au) and silver (Ag).- Expecting Updated NI 43-101 Resource by Year-end: We expect an updated NI 43-101 mineral resource estimate in 2023, which should show a significant positive increase from the 2021 to 2023 drilling.

- Resource Potential Upside: Only 5 of 10 mineralized zones were part of the 2022 mineral resource, with the potential to grow the resource at Ferguson Lake as well as from new discoveries at the regional prospects.

- Lithium Potential: In March 2023, CNRI announced the discovery of granitic pegmatites that potentially contain lithium-bearing minerals. The Company is planning to explore the lithium potential this summer.

- Fully Funded for the Short Term and Government Support: As of March 31, 2023, CNRI had $9.35 million in cash on its Balance Sheet, excluding a recent $250,000 grant from the Government of Nunavut.

Upcoming Catalysts

- Results from the current 2023 diamond drilling exploration program.

- An updated NI 43-101 mineral resource estimate in 2023, which incorporates the drilling conducted in 2021, 2022, and 2023.

- Advancing the project to the Preliminary Economic Assessment (PEA) and Feasibility stages.

- Additional metallurgical tests and updated processing results.

Figure 1: Ferguson Lake Project’s Mineralized Zones

Financial Analysis and Valuation:

Since the Initiation Report was released in July 2022, CNRI has completed additional exploration and drilling at the Ferguson Lake Project, identified five new near-surface targets for Ni, Cu, Co, Pd, and Pt mineralization in the exploration claims surrounding the mining leases, and raised additional capital.

We are maintaining a Speculative Buy Rating on CNRI and increasing our one-year Price Target to $5.25 from $5.00.

We have slightly adjusted these valuation factors from the last report:

- Updated commodity price estimates in 2025 for the various commodities based on data from S&P Capital IQ;

- An updated share count that includes the equity financing in December 2022, and accounts for any outstanding options and warrants using the Treasury Method;

- Assuming Net Cash is currently $8 million.

We have maintained these valuation factors:

- An adjusted mineral resource calculated by the following formula: 75% credit for the M&I resources and 50% credit for the Inferred resources;

- We are still assigning only a 5% value to the resources “in the ground” since the project is still in the Resource Definition Stage.

For a more in-depth explanation of the valuation estimation, see “Section 6 – Detailed Valuation Calculation” in the Update Report.

You can download our 43-page Equity Research Update Report by clicking on the following link: eR-CdnNorthRes-CNRI-2023-06-28_FINAL

Other CNRI Research Reports:

- CNRI INITIATION REPORT (July 25, 2022): Canadian North Resources – Advanced-Stage Canadian PGM & Base Metal Resource Ready for the North American Clean Tech Industry

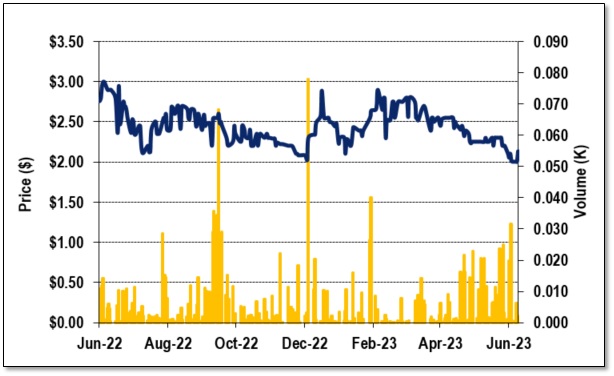

FIGURE 2: One-Year Stock Chart

Notes: All numbers are in CAD unless otherwise stated. The author of this report, and employees, consultants, and family of eResearch may own stock positions in companies mentioned in this article and may have been paid by a company mentioned in the article or research report. eResearch offers no representations or warranties that any of the information contained in this article is accurate or complete. Articles on eresearch.com are provided for general informational purposes only and do not constitute financial, investment, tax, legal, or accounting advice nor does it constitute an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this information should consult with a financial advisor. The article may contain “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements are based on the opinions and assumptions of the Company’s management as of the date made. They are inherently susceptible to uncertainty and other factors that could cause actual events/results to differ materially from these forward-looking statements. Additional risks and uncertainties, including those that the Company does not know about now or that it currently deems immaterial, may also adversely affect the Company’s business or any investment therein. Any projections given are principally intended for use as objectives and are not intended, and should not be taken, as assurances that the projected results will be obtained by the Company. The assumptions used may not prove to be accurate and a potential decline in the Company’s financial condition or results of operations may negatively impact the value of its securities. Please read eResearch’s full disclaimer.

District-scale Exploration Opportunity: The Ferguson Lake Project is 8 km2 (over 62,715 acres) and rich in Platinum Group Metals (PGMs), including Pd, Pt, and rhodium (Rh); Base Metals, including Cu, Ni, and Co; and occurrences of gold (Au) and silver (Ag).

District-scale Exploration Opportunity: The Ferguson Lake Project is 8 km2 (over 62,715 acres) and rich in Platinum Group Metals (PGMs), including Pd, Pt, and rhodium (Rh); Base Metals, including Cu, Ni, and Co; and occurrences of gold (Au) and silver (Ag).