eResearch is pleased to publish an Initiation Equity Research Report on Renforth Resources Inc. (CSE:RFR | OTC:RFHRF | FSE:9RR).

eResearch is pleased to publish an Initiation Equity Research Report on Renforth Resources Inc. (CSE:RFR | OTC:RFHRF | FSE:9RR).

You can download the full 29-page report by clicking here: eR-Renforth-RFR-IR-2021-04-28_FINAL

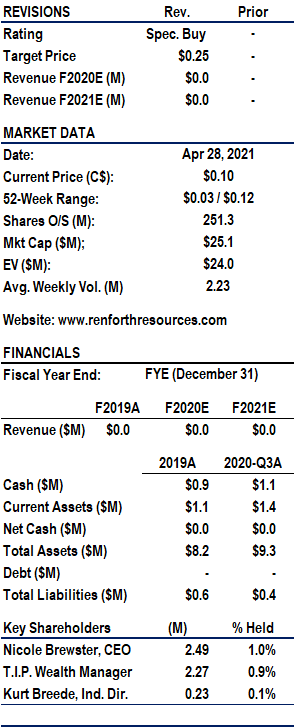

We are Initiating Coverage on Renforth with a Speculative Buy rating and a one-year price target of C$0.25/share.

COMPANY DESCRIPTION

Renforth Resources Inc. is a Canadian-focused mineral exploration company with a portfolio of four gold and battery metal projects within the Abitibi Greenstone Belt, a world-class mining region, with three projects in Quebec (Parbec, Surimeau, and Malartic West), and the Nixon-Bartleman property in Ontario.

Investment Thesis and Upcoming Catalysts:

Four Exploration Projects in the Abitibi Driving Value:

Four Exploration Projects in the Abitibi Driving Value:- Parbec Gold Project: Current near-surface, NI 43-101 resource of 282,800 gold ounces at 1.77 g/t, located on Cadillac Break, near Malartic, Quebec.

- Surimeau Battery Metals Project: District-scale project with seven mineralized targets and Volcanogenic Massive Sulphide (VMS) potential, near Malartic, Quebec.

- Malartic West Copper-Silver Project: District-scale project adjacent to the western border of the Canadian Malartic Mine (CMM).

- Nixon-Bartleman Gold Project: Gold on the surface over a strike length of 500m and sitting on the Destor-Porcupine Fault, near Timmins, Ontario.

- Strong Management Team: Management has extensive experience and geological knowledge of the region.

- Fully Funded for 2021: With the recent financing and asset sale, Renforth has $6.3 million in cash and securities and no debt.

- Upcoming Catalysts:

- Parbec: Drill results from the completed 15,569-metre drill program with planned resource restatement in Q2/2021.

- Surimeau: Results from a 15-hole (3,600 metres) drill program planned in the spring of 2021.

- Malartic West: Results from early-stage exploration work in 2021.

- Nixon-Bartleman: Exploration results from the planned Q2/2021 fieldwork program.

FINANCIAL ANALYSIS & VALUATION:

- We value Renforth based on a sum-of-parts model at $78.9 million or $0.25/share based on the fully diluted share count of 321.1 million.

We are Initiating Coverage with a Speculative Buy rating and a one-year price target of $0.25.

You can download the full 29-page report by clicking here: eR-Renforth-RFR-IR-2021-04-28_FINAL

Notes: All numbers in CAD unless otherwise stated. The author of this report, and employees, consultants, and family of eResearch may own stock positions in companies mentioned in this article and may have been paid by a company mentioned in the article or research report. eResearch offers no representations or warranties that any of the information contained in this article is accurate or complete. Articles on eresearch.com are provided for general informational purposes only and do not constitute financial, investment, tax, legal, or accounting advice nor does it constitute an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this information should consult with a financial advisor. The article may contain “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements are based on the opinions and assumptions of the Company’s management as of the date made. They are inherently susceptible to uncertainty and other factors that could cause actual events/results to differ materially from these forward-looking statements. Additional risks and uncertainties, including those that the Company does not know about now or that it currently deems immaterial, may also adversely affect the Company’s business or any investment therein. Any projections given are principally intended for use as objectives and are not intended, and should not be taken, as assurances that the projected results will be obtained by the Company. The assumptions used may not prove to be accurate and a potential decline in the Company’s financial condition or results of operations may negatively impact the value of its securities. Please read eResearch’s full disclaimer.

Four Exploration Projects in the Abitibi Driving Value:

Four Exploration Projects in the Abitibi Driving Value: